Are Owner Draws Taxable

Are Owner Draws Taxable - Web taxes are withheld from salary payments but not from an owner’s draw. Web how are owner’s draws taxed? How much should you pay yourself? Learn how to calculate, record, and pay. Web draws are not personal income, however, which means they’re not taxed as such. As the owner of your business, how exactly do you pay yourself? If you are looking to boost your tax deductions ,. On the other hand, owners of corporations or s. If you run a limited liability company, you’d. Web an owner's draw is when a business owner takes funds out of their business for personal use. You don’t report an owner’s draw on your. Web an owner's draw is when a business owner takes funds out of their business for personal use. Web 23 november 2020 20 min read. It is not taxable on the business's income, but it is taxable as. How do business owners pay themselves? Web draws are not personal income, however, which means they’re not taxed as such. Draws are a distribution of cash that will be allocated to the business owner. By taking an owner’s draw. How do i pay myself from my llc? Pros and cons of a salary. If you run a limited liability company, you’d. Learn how to calculate, record, and pay. Web to sum it up, in most cases, no, owner’s draws are not taxable. The first thing you need to know is that there are two main ways you can pay yourself: Draws are a distribution of cash that will be allocated to the business. Web taxes are withheld from salary payments but not from an owner’s draw. Learn how to calculate, record, and pay. How do business owners get paid? If you are looking to boost your tax deductions ,. Web an owner's draw is when a business owner takes funds out of their business for personal use. Web to sum it up, in most cases, no, owner’s draws are not taxable. Learn how to calculate, record, and pay. By taking an owner’s draw. Learn all about owner's draws: Web so, the money you take as an owner’s draw will be taxed. You don’t report an owner’s draw on your. Web so, the money you take as an owner’s draw will be taxed. Web how are owner’s draws taxed? How do business owners pay themselves? You just don’t have to report it twice. You don’t report an owner’s draw on your. If you run a limited liability company, you’d. The first thing you need to know is that there are two main ways you can pay yourself: By taking an owner’s draw. You just don’t have to report it twice. On the other hand, owners of corporations or s. Web draws are not personal income, however, which means they’re not taxed as such. The first thing you need to know is that there are two main ways you can pay yourself: Web an owner's draw is when a business owner takes funds out of their business for personal use. If. Web draws are not personal income, however, which means they’re not taxed as such. Web similarly, these draws do not affect the net income of the company, as they are a reduction of the company’s capital and not an expense for tax accounting. By taking an owner’s draw. Web an owner’s draw is simply a distribution of profits from the. In this article, you will learn: As the owner of your business, how exactly do you pay yourself? How do i pay myself from my llc? Web 23 november 2020 20 min read. How do business owners pay themselves? On the other hand, owners of corporations or s. Web an owner's draw is when a business owner takes funds out of their business for personal use. The company typically makes the distribution in cash, and it is not subject to. You just don’t have to report it twice. Pros and cons of a salary. How do business owners get paid? As the owner of your business, how exactly do you pay yourself? Web an owner’s draw is simply a distribution of profits from the s corporation to its owners. Making the correct choice for you and your business will help. How do i pay myself from my llc? In this article, you will learn: It is not taxable on the business's income, but it is taxable as. You don’t report an owner’s draw on your. Web there is another option to be taxed like a corporation, and if that’s the case, you won’t be able to take an owner’s draw. Web an owner's draw is a way for business owners to withdraw from their share of the business's value, but it's not taxable. The first thing you need to know is that there are two main ways you can pay yourself:

What is an Owners Draw vs Payroll When I Pay Myself As A Business Owner

Small Business Financial Skills Is Owner's Draw Taxable? YouTube

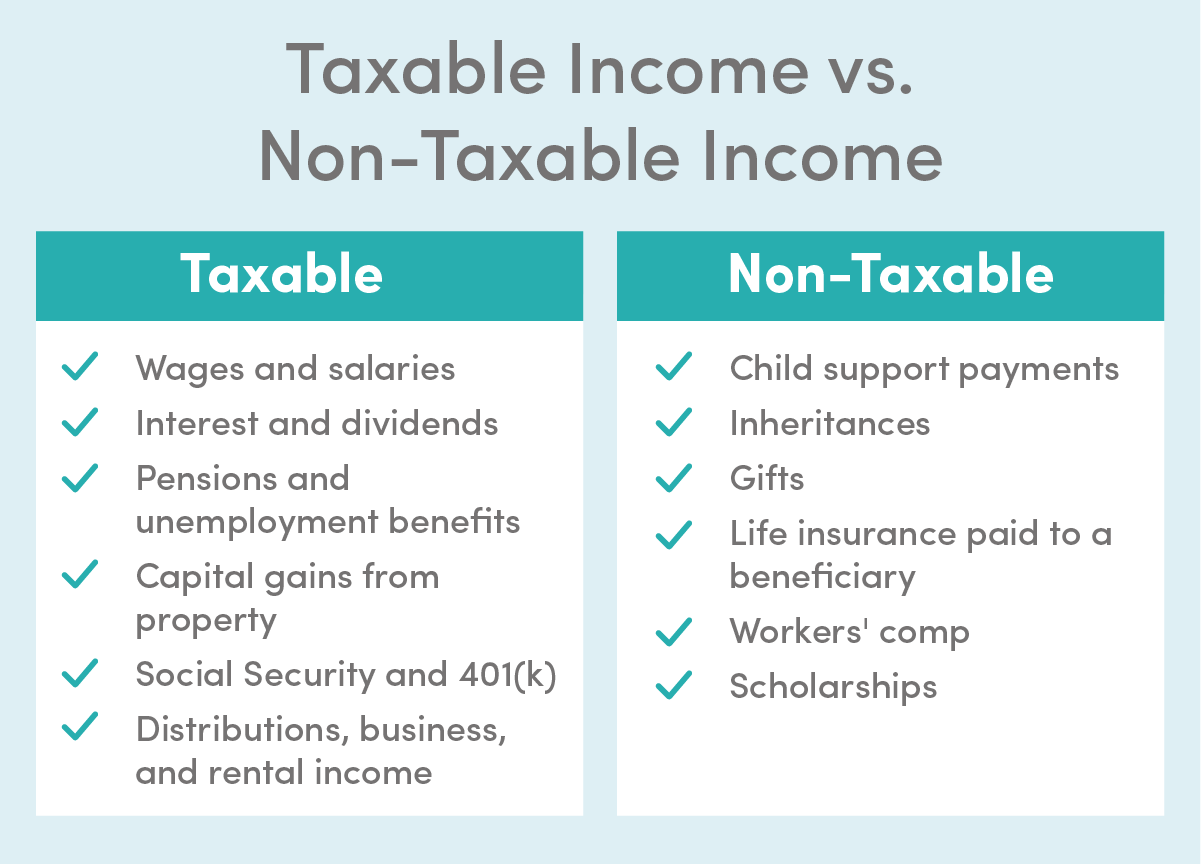

What is Taxable Explanation, Importance, Calculation Bizness

owner's drawing account definition and Business Accounting

Taxable Formula financepal

Owners Draw

Owners draw balances

Small Business Taxes Are Owner Draws Taxable? YouTube

Paying yourself as an owner How to Calculate Owner’s Draw (without

How to record an Owner's Draw The YarnyBookkeeper

Web 23 November 2020 20 Min Read.

Learn How To Calculate, Record, And Pay.

Web To Sum It Up, In Most Cases, No, Owner’s Draws Are Not Taxable.

Web Owner’s Draws Should Not Be Declared On Your Business’s Schedule C Tax Form, As They Are Not Tax Deductible.

Related Post: