When Can You Draw On Your 401K

When Can You Draw On Your 401K - If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web first, let’s recap: Web you can withdraw money penalty free from your 401(k) at age 59½, or even earlier for some qualifying purposes. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and. Check with your employer to see whether you're allowed to withdraw from your 401(k) while working. Some reasons for taking an early 401. There are exceptions, as some plans allow 401 (k) loans or hardship withdrawals. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. You must check with your plan administrator to see if they allow these options. You must check with your plan administrator to see if they allow these options. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income. There are exceptions, as some plans allow 401 (k) loans or hardship withdrawals. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. You’re age 55 to 59 ½. You must check with your plan administrator to see if they allow these options. That's the limit set. Some reasons for taking an early 401. Check with your employer to see whether you're allowed to withdraw from your 401(k) while working. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and. With the rule of 55, those who leave a job in the year they turn 55 or later can. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web for a 401 (k) offered by your current employer, usually, you can’t take withdrawals while still working there. A 401 (k) early withdrawal is any money you take. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Check with. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k).. Web you can withdraw money penalty free from your 401(k) at age 59½, or even earlier for some qualifying purposes. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. Web for a 401 (k) offered by your current employer, usually, you can’t take withdrawals while. There are exceptions, as some plans allow 401 (k) loans or hardship withdrawals. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. That's the limit set by federal law, but keep in mind that your situation could be. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Taking an early. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. If you are under age 59½, in most cases you will incur a. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. You’re age 55 to 59 ½. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web for a 401 (k) offered by your current employer, usually, you can’t take withdrawals while still working there. With the rule of 55, those who leave a job in the year they turn 55 or later can remove funds from that employer’s 401 (k) or 403 (b) without having. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and. You must check with your plan administrator to see if they allow these options. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Web you can withdraw money penalty free from your 401(k) at age 59½, or even earlier for some qualifying purposes. Some reasons for taking an early 401. There are exceptions, as some plans allow 401 (k) loans or hardship withdrawals. Web april 13, 2022, at 5:34 p.m.:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

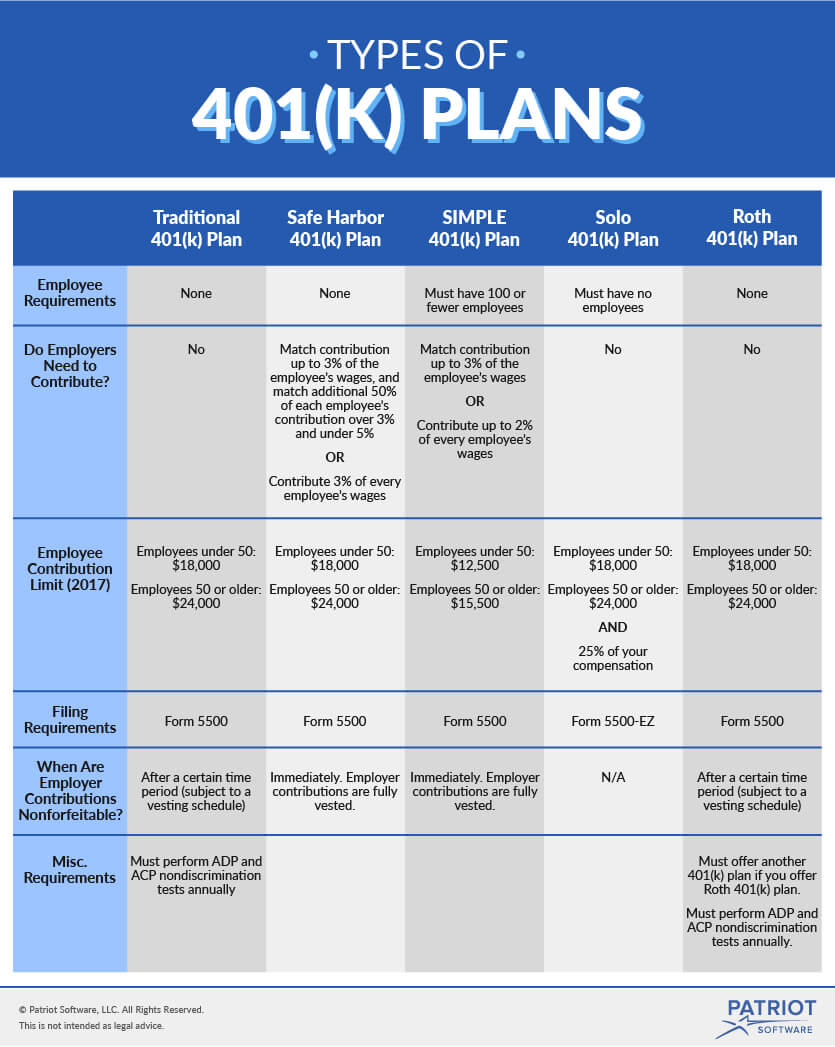

types of 401k plans visual

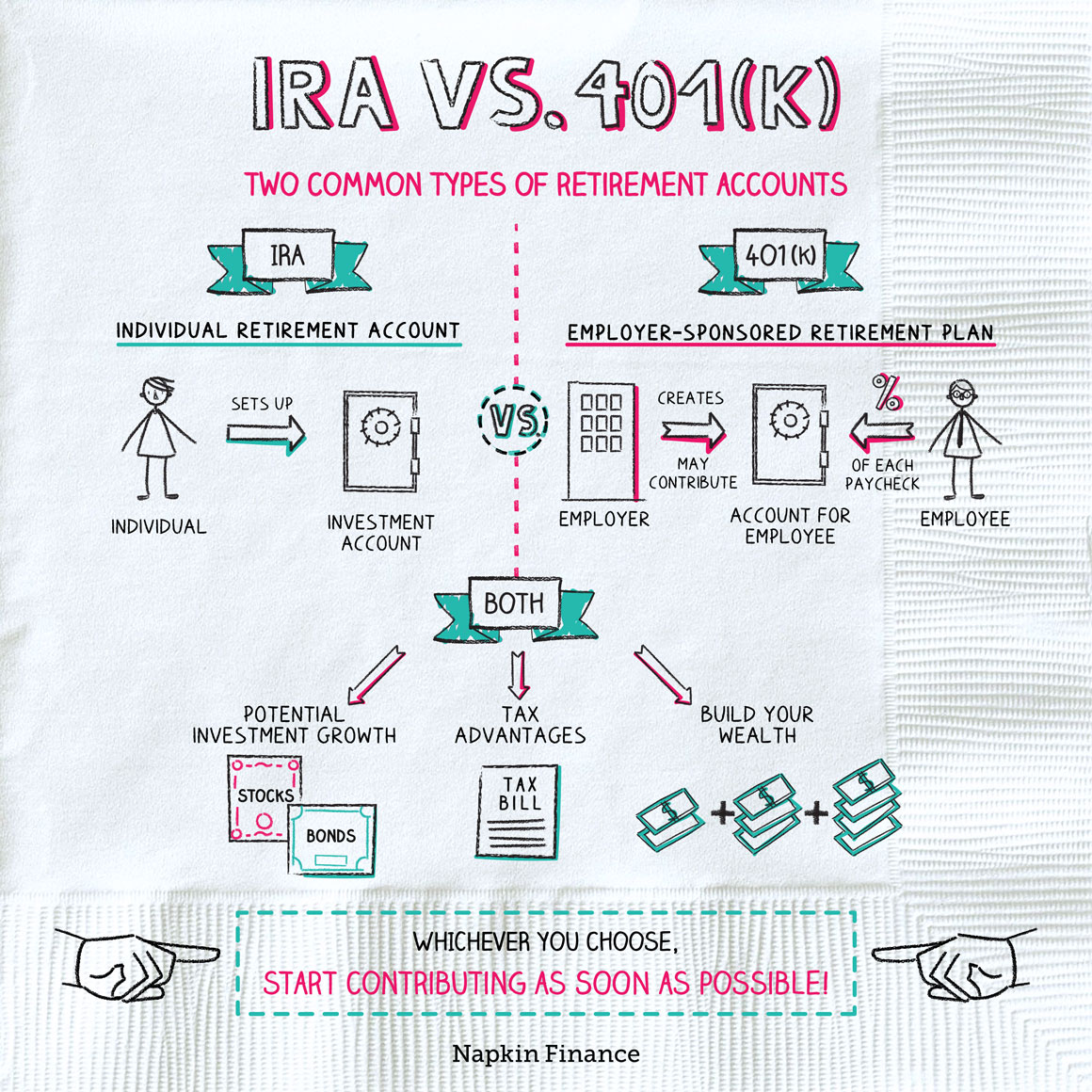

What is 401K? IRA vs 401K Retirement Answers from Napkin Finance

.jpg)

What Is a 401(k)? Everything You Need to Know (2022)

When Can I Draw From My 401k Men's Complete Life

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

The Maximum 401(k) Contribution Limit For 2021

Your HowTo Guide on 401k Rollovers

When Can I Draw From My 401k Men's Complete Life

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is a 401(k) and How Does It Work?

A 401 (K) Early Withdrawal Is Any Money You Take Out From Your Retirement Account Before You’ve Reached Federal Retirement Age, Which Is Currently 59 ½.

If You Tap Into It Beforehand, You May Face A 10% Penalty Tax On The Withdrawal In Addition To Income Tax That You’d Owe On Any Type Of Withdrawal From A Traditional 401 (K).

Check With Your Employer To See Whether You're Allowed To Withdraw From Your 401(K) While Working.

Web First, Let’s Recap:

Related Post: