When Can You Draw From Your Ira

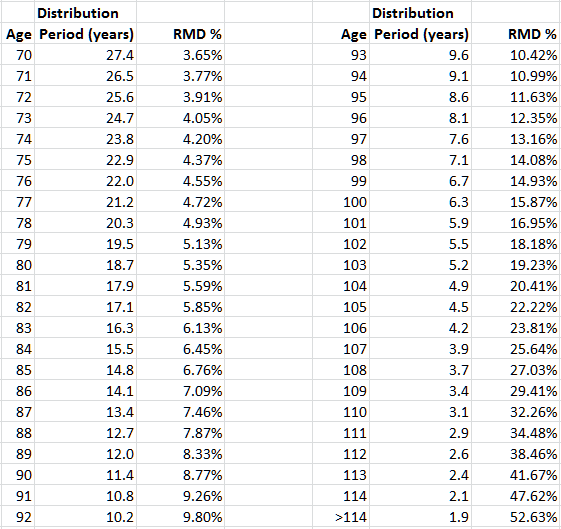

When Can You Draw From Your Ira - Web there are a few rules for taking money out of your 401 (k) or ira account before you reach retirement age. Web withdrawing from an ira. While tapping your ira might get you into a. But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning. Web how much you will pay in taxes when you withdraw money from an individual retirement account (ira) depends on the type of ira, your age, and even the. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; For a traditional ira, you’ll need to take out your first rmd by april 1 of the year following the year you. You can state a trust beneficiary of your ira and dictate how the assets are. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs treats your withdrawal. When you set up your roth ira account you will be asked to select investments you want to buy with your contributions. Web ira beneficiaries don’t have to take an rmd this year. Web ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web what if you want to withdraw money from a traditional ira before age. 45+ years experienceserving all 50 stateseasy setuppersonalized service Ira rules for rmds & other withdrawals. If you withdraw roth ira earnings before age 59½, a 10%. Web ira beneficiaries don’t have to take an rmd this year. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. Web you must take your distribution by april 1 of the year following the calendar year in which you turn 70½. Retirement income · annuities · estate planning · 401(k) and ira Web if you want to make ira withdrawals before age 59 1/2, you'll pay penalties unless you qualify for an exception. Web what if i withdraw money from. Web ira beneficiaries don’t have to take an rmd this year. You can do it, but you'll pay a fairly high penalty. Web ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web choosing your investments. Fund comparison toolretirement planningretirement calculatormarket insights Web you can withdraw your roth ira contributions at any time without penalty. Web the annual deadline for your first required ira withdrawal. Web you're only permitted to withdraw the earnings from your contributions after you reach age 59½, according to the irs, and if you've held the account for at least five. Web if you’re buying or building your. Web withdrawing from an ira. Web if you’re buying or building your first home, you can withdraw up to $10,000 from your ira to contribute toward costs. But here’s why maybe they should. Other rules apply when you're ready to retire and. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5. Retirement income · annuities · estate planning · 401(k) and ira Web ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web you're only permitted to withdraw the earnings from your contributions after you reach age 59½, according to the irs, and if you've held the account for at least five. Web how much you will pay. You can state a trust beneficiary of your ira and dictate how the assets are. Web you must take your distribution by april 1 of the year following the calendar year in which you turn 70½. Your ira savings is always yours when you need it—whether for retirement or emergency funds. The rmd rules require individuals to take withdrawals from. You can state a trust beneficiary of your ira and dictate how the assets are. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Ira rules for rmds & other withdrawals. Withdrawals for special purposes, such as up to. Web there are a few rules for taking money out of your 401 (k) or. Withdrawals for special purposes, such as up to. Web you can withdraw money from your ira at any time. Web you can withdraw your roth ira contributions at any time without penalty. Any early ira withdrawal is subject to a 10% penalty. But after that, you can wait until december 31 of each year. 45+ years experienceserving all 50 stateseasy setuppersonalized service Fund comparison toolretirement planningretirement calculatormarket insights Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before. Web you can withdraw money from your ira at any time. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs treats your withdrawal. While tapping your ira might get you into a. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Web withdrawing from an ira. Web how much you will pay in taxes when you withdraw money from an individual retirement account (ira) depends on the type of ira, your age, and even the. You can withdraw roth individual retirement account (ira) contributions at any time. If you’re married, your spouse can. Other rules apply when you're ready to retire and.Ira Types Chart

When do you have to draw from your IRA? YouTube

3 steps to help you get the most out of your IRA

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

Can I Borrow From My IRA Account? (2024 Rules)

What is an IRA? Practical Credit

Give From Your IRA the University of Pittsburgh

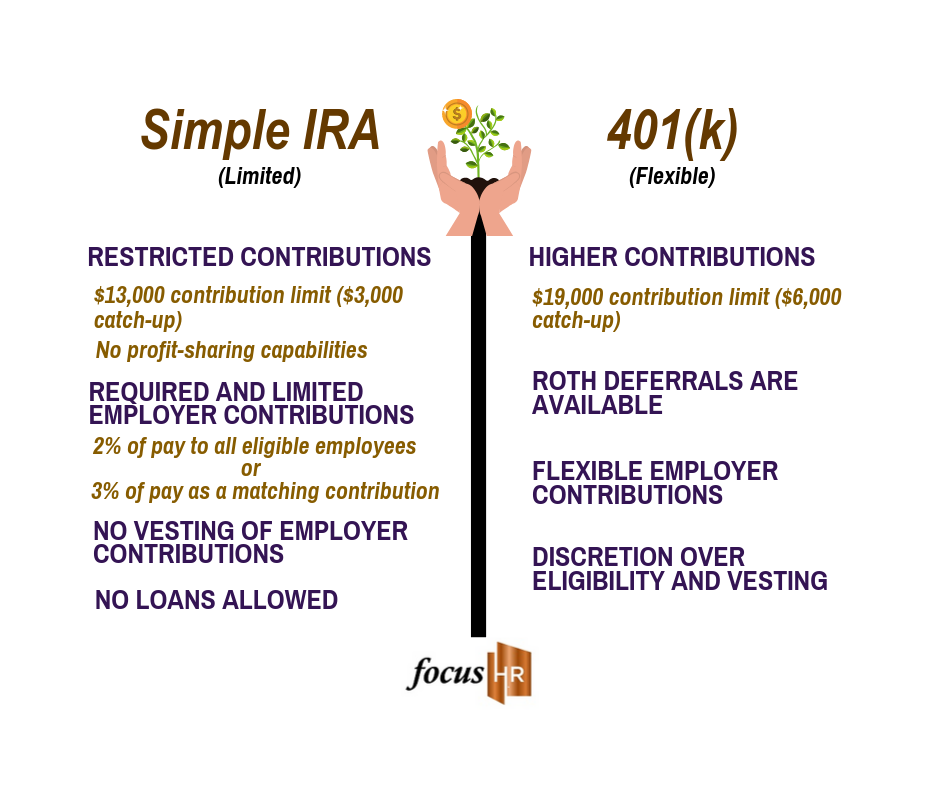

Retirement Plan Comparison Simple IRA vs. 401(k) Focus HR Inc.

Drawing Down Your IRA What You Can Expect Seeking Alpha

Roth IRA Withdrawal Rules and Penalties First Finance News

Any Early Ira Withdrawal Is Subject To A 10% Penalty.

But After That, You Can Wait Until December 31 Of Each Year.

If You Withdraw Roth Ira Earnings Before Age 59½, A 10%.

There Is No Need To Show A Hardship To Take A Distribution.

Related Post: