When Can You Draw From Roth Ira

When Can You Draw From Roth Ira - You cannot contribute an amount greater than the amount. But, your income could also make you ineligible to contribute to a roth ira. Web roth ira withdrawal guidelines. Web you can make contributions to your roth ira after you reach age 70 ½. You can withdraw your contributions at any time and owe no taxes or penalties. Web you'd only have to wait until jan. 1 of the year you do the conversion. But you can only withdraw the account’s earnings. Web the internal revenue service (irs) requires a waiting period of 5 years before withdrawing balances converted from a traditional ira to a roth ira, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion. The same combined contribution limit applies to all of your roth and traditional iras. Are you under age 59 ½ and want to take an ira withdrawal? You can leave amounts in your roth ira as long as you live. The same combined contribution limit applies to all of your roth and traditional iras. But, your income could also make you ineligible to contribute to a roth ira. Web your ira savings is always. The account or annuity must be designated as a roth ira when it is set up. Web you can make contributions to your roth ira after you reach age 70 ½. Web when can you withdraw from a roth ira? Web when can you withdraw from a roth ira? The same combined contribution limit applies to all of your roth. Withdrawals must be taken after age 59½. Web when can you withdraw from a roth ira? The same combined contribution limit applies to all of your roth and traditional iras. You can withdraw your contributions at any time and owe no taxes or penalties. Web the internal revenue service (irs) requires a waiting period of 5 years before withdrawing balances. Web you can make contributions to your roth ira after you reach age 70 ½. So if you convert $5,000 from a traditional ira to a roth ira on sept. Are you under age 59 ½ and want to take an ira withdrawal? You can withdraw your contributions at any time and owe no taxes or penalties. Web the internal. Web your ira savings is always yours when you need it—whether for retirement or emergency funds. You can withdraw your roth ira contributions at any time without penalty. You can withdraw your contributions at any time and owe no taxes or penalties. Web when can you withdraw from a roth ira? Web you can make contributions to your roth ira. So if you convert $5,000 from a traditional ira to a roth ira on sept. Web roth ira withdrawal guidelines. The account or annuity must be designated as a roth ira when it is set up. Withdrawals must be taken after age 59½. Web when can you withdraw from a roth ira? You can leave amounts in your roth ira as long as you live. So if you convert $5,000 from a traditional ira to a roth ira on sept. Web roth ira withdrawal guidelines. Limits on roth ira contributions based on modified. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Web you'd only have to wait until jan. You can leave amounts in your roth ira as long as you live. The same combined contribution limit applies to all of your roth and traditional iras. You can withdraw your contributions at any time and owe no taxes or penalties. Web you can make contributions to your roth ira after you. Web the internal revenue service (irs) requires a waiting period of 5 years before withdrawing balances converted from a traditional ira to a roth ira, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion. Limits on roth ira contributions based on. You can withdraw your contributions at any time and owe no taxes or penalties. Web your ira savings is always yours when you need it—whether for retirement or emergency funds. Web roth ira withdrawal guidelines. But, your income could also make you ineligible to contribute to a roth ira. Limits on roth ira contributions based on modified. Web the internal revenue service (irs) requires a waiting period of 5 years before withdrawing balances converted from a traditional ira to a roth ira, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion. So if you convert $5,000 from a traditional ira to a roth ira on sept. Before making a roth ira withdrawal, keep in mind the following rules to avoid a potential 10% early withdrawal penalty: Web you'd only have to wait until jan. The same combined contribution limit applies to all of your roth and traditional iras. But you can only withdraw the account’s earnings. Limits on roth ira contributions based on modified. You can withdraw your contributions at any time and owe no taxes or penalties. Are you under age 59 ½ and want to take an ira withdrawal? You cannot contribute an amount greater than the amount. The account or annuity must be designated as a roth ira when it is set up. But, your income could also make you ineligible to contribute to a roth ira. But you can only pull the earnings out of a roth ira. Web when can you withdraw from a roth ira? 1, 2024, your countdown begins jan. Web you can make contributions to your roth ira after you reach age 70 ½.

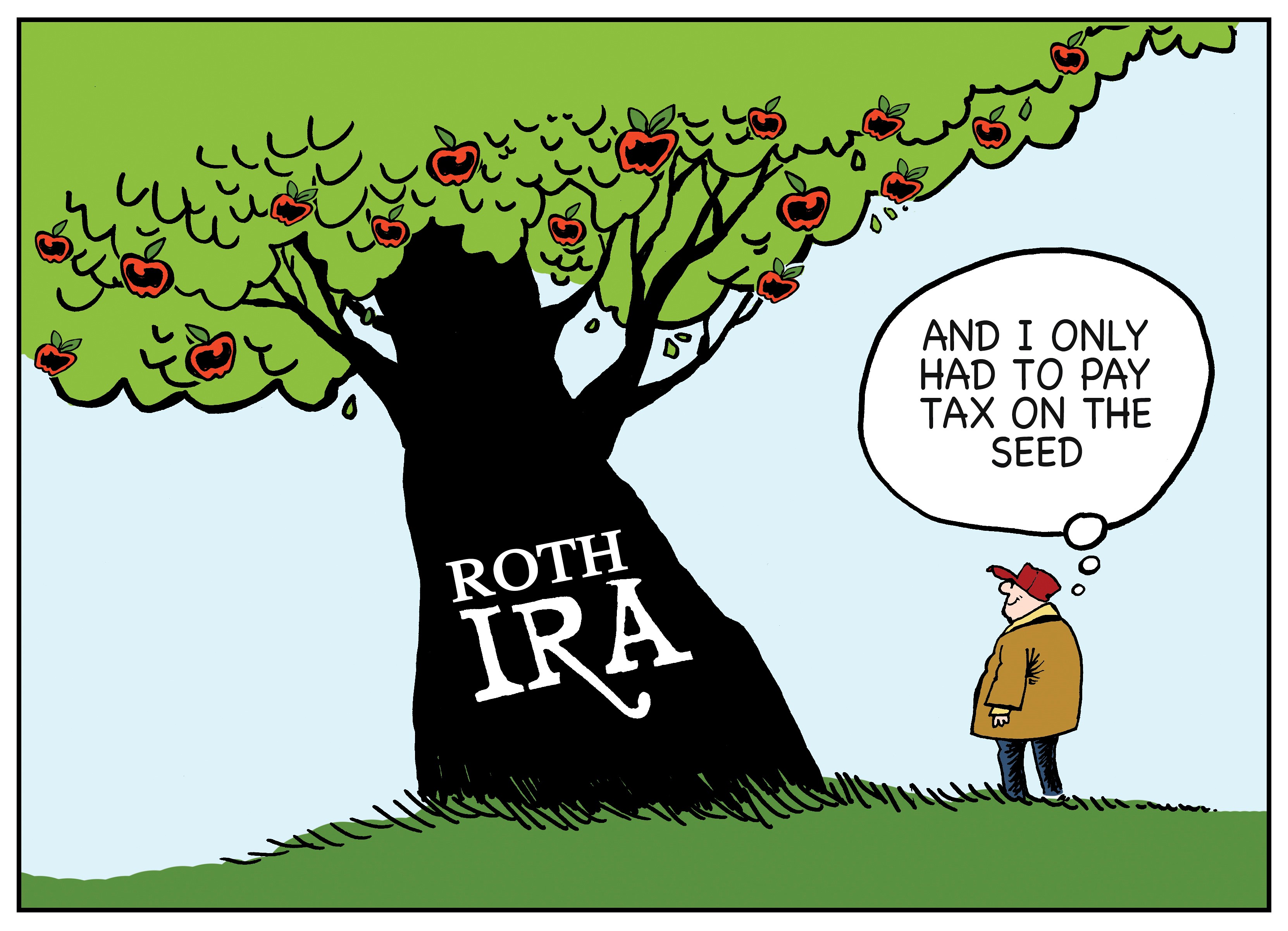

Now Is The Best Time In History To Do A Roth IRA Conversion The

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)

Roth IRA What It Is and How to Open One

Roth IRA Explained A simple explanation of the Roth IRA. YouTube

Roth vs Traditional IRAs A Complete Reference Guide Gone on FIRE

What is a Roth IRA? The Fancy Accountant

Roth IRA Withdrawal Rules and Penalties First Finance News

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

How Does A Roth IRA Work? Roth IRA Explained. YouTube

Roth IRA Withdrawal Rules and Penalties First Finance News

Roth IRAs 8 Essential Rules and Strategies to Know

Web Your Ira Savings Is Always Yours When You Need It—Whether For Retirement Or Emergency Funds.

Web Roth Ira Withdrawal Guidelines.

You Can Leave Amounts In Your Roth Ira As Long As You Live.

Web When Can You Withdraw From A Roth Ira?

Related Post: