When Can You Draw From A Roth Ira

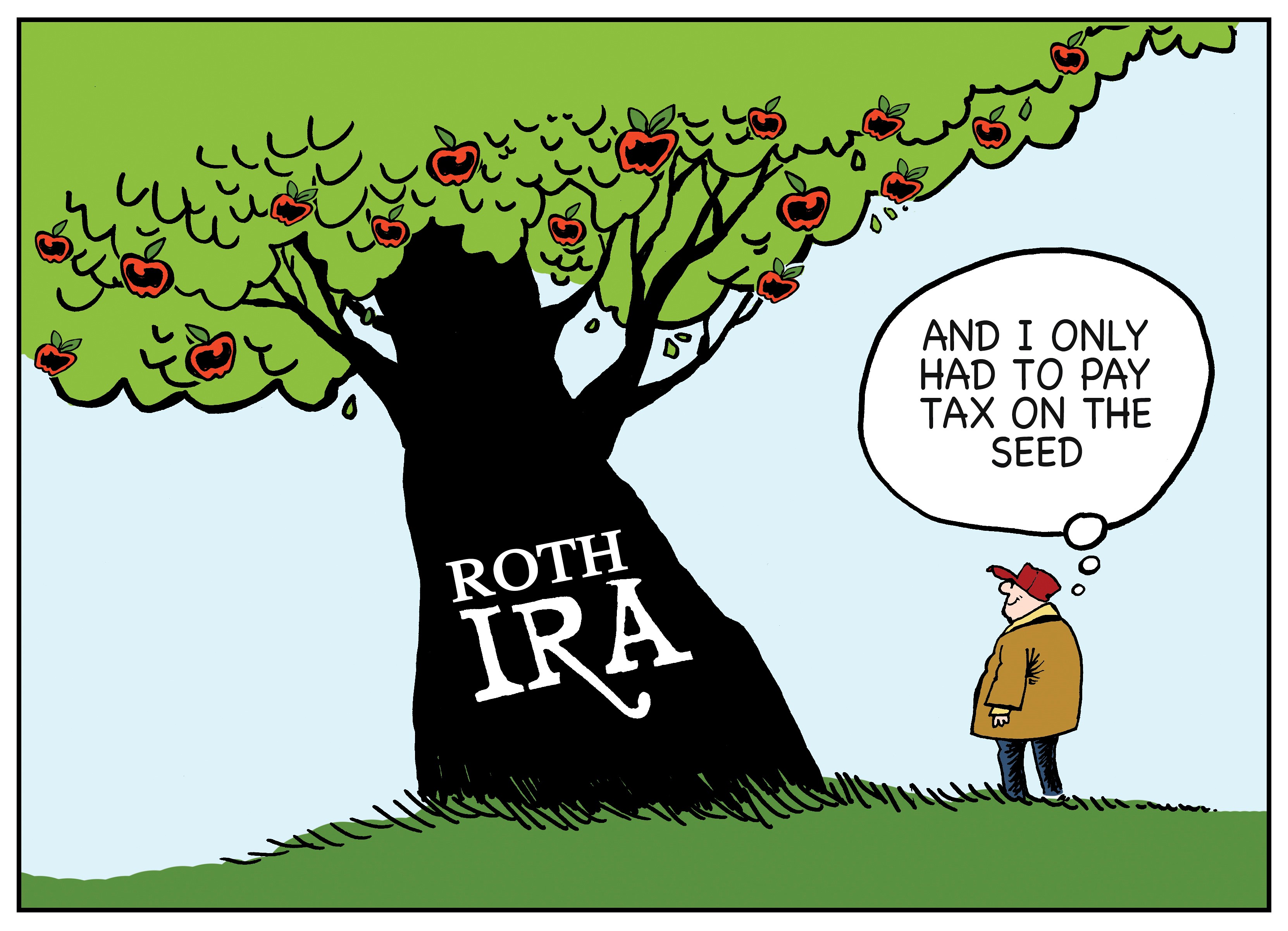

When Can You Draw From A Roth Ira - Web the internal revenue service (irs) requires a waiting period of 5 years before withdrawing balances converted from a traditional ira to a roth ira, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion. The same combined contribution limit applies to all of your roth and traditional iras. Web updated april 1, 2024. Web once you contribute money to a roth ira, you can withdraw your original contributions at any time without paying any sort of tax or penalty. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. One exception to this rule is funding a home down payment. Web for example, you can park up to $7,000 or $8,000 in an ira, you can add some or all of that $25,000 to your regular, taxable brokerage account, you can send some or all of it to one or more mutual. Roth iras work in almost the exact opposite fashion of traditional iras in terms of the tax and penalty rules surrounding account withdrawals. Web not understanding roth ira rules. The account or annuity must be designated as a roth ira when it is set up. However, you may have to pay taxes and penalties on earnings in your roth ira. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. You can withdraw your contributions at any time and owe no taxes or penalties. Web updated april 1, 2024. Web for example, you can. Web when can you withdraw from a roth ira? Roth ira earnings can incur early withdrawal taxes and penalties, depending on your age and the account's. 1 of the tax year when the first contribution was made. For each subsequent year, you must take your rmd by december 31. The irs notes that you can make a full contribution with. Traditional ira · private equity · forex trading · resources For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. Web but you can only save $7,000 in a roth ira or $8,000 if you're 50 or older. Early withdrawal of earnings can lead to. Web when can you withdraw from a roth ira? Traditional ira · private equity · forex trading · resources Web you can make contributions to your roth ira after you reach age 70 ½. Web when can you withdraw from a roth ira? The account or annuity must be designated as a roth ira when it is set up. Web age 59 ½ and under. Roth ira contributions and earnings. Limits on roth ira contributions based on modified. For example, if your roth 401(k) balance is 90% contributions and 10% earnings and you withdraw $10,000, $1,000 of. 1 of the year you do the conversion. The account or annuity must be designated as a roth ira when it is set up. Web roth ira contributions can be withdrawn at any time without tax or penalty. Web you need have had the account open for at least five years, and be at least age 59 ½, to withdraw your investment earnings without paying taxes on them.. You can leave amounts in your roth ira as long as you live. Money is contributed to a. Web not understanding roth ira rules. 1 of the year you do the conversion. Web roth ira contributions can be withdrawn at any time without tax or penalty. Web age 59 ½ and under. Traditional, rollover, or sep ira. For each subsequent year, you must take your rmd by december 31. Unlike traditional iras, roth iras don't require you to withdraw a certain amount each year once you reach a certain age. Traditional ira · private equity · forex trading · resources Traditional, rollover, or sep ira. But, your income could also make you ineligible to contribute to a roth ira. (to recharacterize, the individual must have eligible compensation. This means there’s almost no reason not to. However, you may have to pay taxes and penalties on earnings in your roth ira. You can leave amounts in your roth ira as long as you live. Roth iras work in almost the exact opposite fashion of traditional iras in terms of the tax and penalty rules surrounding account withdrawals. But you can only pull the earnings out of a roth ira. Web age 59 ½ and under. One exception to this rule is. Web for example, you can park up to $7,000 or $8,000 in an ira, you can add some or all of that $25,000 to your regular, taxable brokerage account, you can send some or all of it to one or more mutual. This means there’s almost no reason not to. But you can only withdraw the account’s earnings according. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. The same combined contribution limit applies to all of your roth and traditional iras. Unlike traditional iras, roth iras don't require you to withdraw a certain amount each year once you reach a certain age. You can also choose between a traditional ira account or a roth ira account. However, you may have to pay taxes and penalties on earnings in your roth ira. Web the internal revenue service (irs) requires a waiting period of 5 years before withdrawing balances converted from a traditional ira to a roth ira, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion. Web roth ira contributions can be withdrawn at any time without tax or penalty. Web not understanding roth ira rules. Limits on roth ira contributions based on modified. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. Web when can you withdraw from a roth ira? The account or annuity must be designated as a roth ira when it is set up. Roth iras work in almost the exact opposite fashion of traditional iras in terms of the tax and penalty rules surrounding account withdrawals.

Roth IRA Explained A simple explanation of the Roth IRA. YouTube

Roth vs Traditional IRAs A Complete Reference Guide Gone on FIRE

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

Roth IRA Withdrawal Rules and Penalties First Finance News

Now Is The Best Time In History To Do A Roth IRA Conversion The

Roth IRA Withdrawal Rules and Penalties First Finance News

How Does A Roth IRA Work? Roth IRA Explained. YouTube

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)

Roth IRA What It Is and How to Open One

Roth IRAs 8 Essential Rules and Strategies to Know

How to Start a Roth IRA in 2020 Roth IRA Guide to Save for Retirement

Web Choosing Your Investments.

This Gives You More Control Over Your Savings In Retirement.

Traditional Ira · Private Equity · Forex Trading · Resources

The Irs Notes That You Can Make A Full Contribution With An Magi Below $146,000 Or A Partial One With An Magi Of $138,000 To $153,000 In 2024.

Related Post: