When Can You Draw From A 401K

When Can You Draw From A 401K - However, early withdrawals often come with hefty penalties and tax consequences. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. This is where the rule of 55 comes in. Yes, you can withdraw money from your 401 (k) before age 59½. If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. While you’ve deferred taxes until now, these distributions are now taxed as regular income. Some withdrawals might qualify as hardship. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. (they may be able to. Yes, you can withdraw money from your 401 (k) before age 59½. In most, but not all, circumstances, this triggers an early withdrawal penalty of. This is known as the. There are plenty of best practices for growing your money in a 401 (k), but what about withdrawing it? Web first, let’s recap: You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. A 401(k) account alone may not help you save as much as. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. A hardship withdrawal from a 401 (k) retirement account is for large, unexpected expenses. Web drawbacks of 401(k) accounts: That means you will pay the regular income tax rates on your distributions. The good news. You can't take loans from old 401(k) accounts. Some withdrawals might qualify as hardship. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Written by javier simon, cepf®. You’ll simply need to contact your plan administrator or log into your account online and request. Some withdrawals might qualify as hardship. Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. Web updated on february 15, 2024. However, early withdrawals often come with hefty penalties and tax consequences. Web you generally must start taking withdrawals from your 401 (k) by age 73. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. There are plenty of best practices for growing your money in a 401 (k), but what about withdrawing it? Web a withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes. You’ll simply need to contact your plan administrator or log into your account online and request a withdrawal. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. For 2024, you can stash away up to $23,000 in your. Your plan administrator will let you know whether. While you’ve deferred taxes until now, these distributions are now taxed as regular income. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. That means you will pay the regular income tax rates on your distributions. If you tap into. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. That means you will pay the regular income tax rates on your distributions. Web by age 59.5 (and in some cases, age 55), you will be eligible. Web essentially, a 401 (k) is a retirement savings plan that lets you funnel part of your paycheck into the account before taxes are taken out. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. Web updated on february 15,. A hardship withdrawal from a 401 (k) retirement account is for large, unexpected expenses. (they may be able to. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. While you’ve deferred taxes until now, these distributions are now taxed as regular income. You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. But you must pay taxes on the. This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a. Web can you withdraw money from a 401 (k) early? Taking an early withdrawal from your 401 (k) should only be done as a last resort. Web the rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401 (k)s without incurring the customary 10% penalty for early withdrawals made before. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. For 2024, you can stash away up to $23,000 in your. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Edited by jeff white, cepf®. Web essentially, a 401 (k) is a retirement savings plan that lets you funnel part of your paycheck into the account before taxes are taken out.:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

When Can I Draw From My 401k Men's Complete Life

what reasons can you withdraw from 401k without penalty covid

When Can I Draw From My 401k Men's Complete Life

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

3 Ways to Withdraw from Your 401K wikiHow

When Can I Draw From My 401k Men's Complete Life

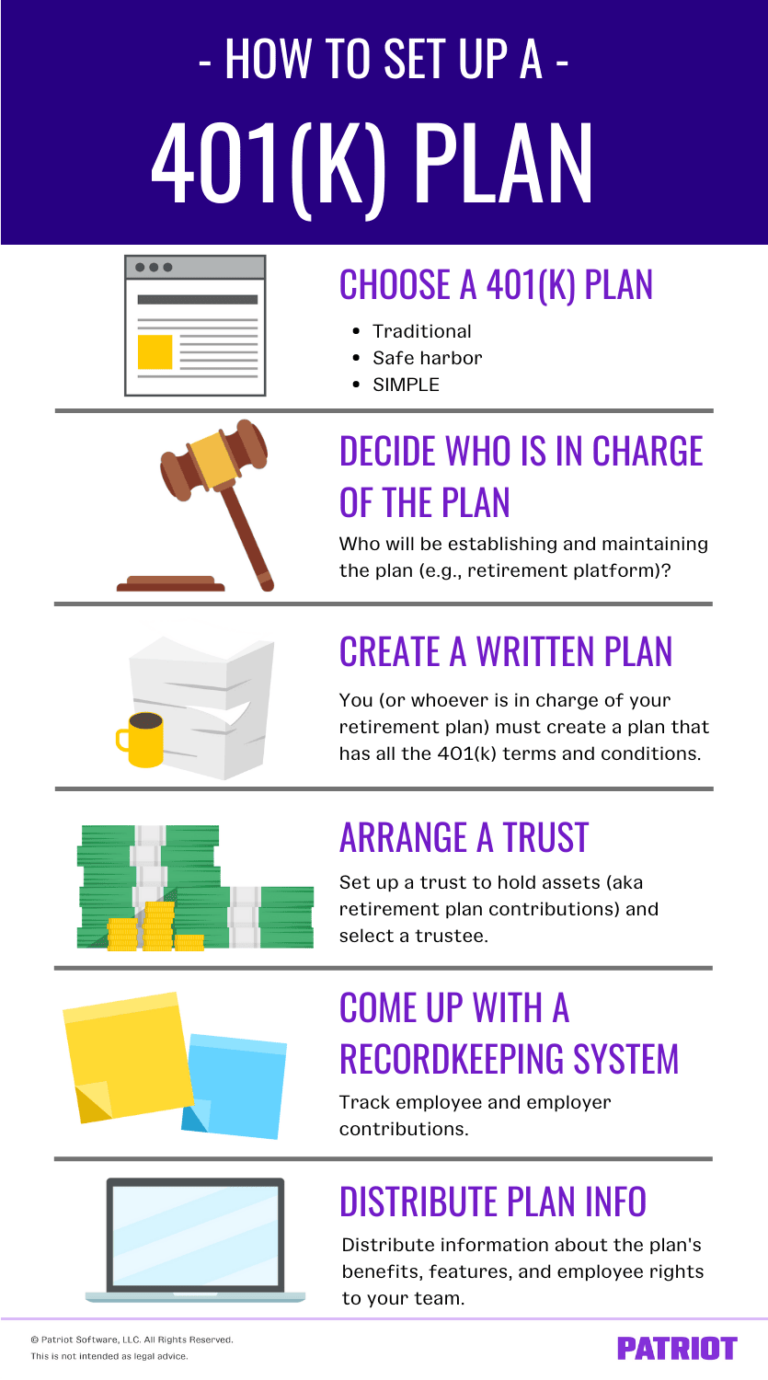

How to Set up a 401(k) Plan for Small Business Steps & More

.jpg)

What Is a 401(k)? Everything You Need to Know (2022)

New 401(k) factors to consider in 2022.

You’ll Need To Speak With Someone At Your Company’s Human Resources Department To See If This Option Is Available And How The Process.

Yes, You Can Withdraw Money From Your 401 (K) Before Age 59½.

Since Both Accounts Have Annual Contribution Limits And Potentially Different Tax Benefits.

If You Find Yourself Needing To Tap Into Your Retirement Funds Early, Here Are Rules To Be Aware Of And Options To Consider.

Related Post: