When Can I Draw Social Security From My Deceased Husband

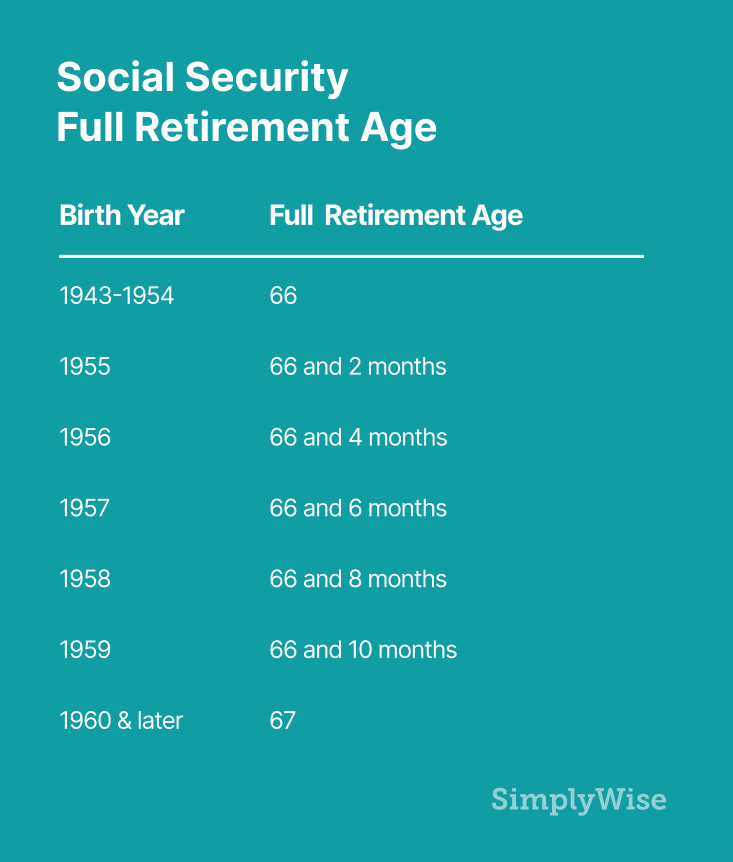

When Can I Draw Social Security From My Deceased Husband - Anyone who was married to a social security beneficiary can potentially receive survivor benefits on the death of that person. How the age you claim affects your monthly benefit. There are multiple exceptions to the 9 month requirement. How taxes affect your social security payments. If your spouse had not yet reached full retirement age, social security bases the survivor benefit on the deceased’s primary insurance amount — 100 percent of the benefit he or she would have been entitled to, based on lifetime earnings. March 28, 2024, at 2:35 p.m. Web you are at least age 60, unless you have a disability that started before or within seven years of your spouse’s death (in this case the minimum age is 50) or you are caring for a child of the deceased who is under 16 or has a disability (no age minimum). If the deceased did not reach full retirement age, the surviving spouse can receive 100% of the retirement benefit. Web claiming at 70 could limit your overall income. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. We break down everything you need to know about survivors benefits. There are multiple exceptions to the 9 month requirement. Web if you remarry after age 60 — you may still become entitled to benefits on your prior deceased spouse’s social security earnings record. Widows or widowers benefits based on age can start any time between age 60 and full. You may receive survivors benefits when a family member dies. Survivors must apply for this payment. If your spouse had not yet reached full retirement age, social security bases the survivor benefit on the deceased’s primary insurance amount — 100 percent of the benefit he or she would have been entitled to, based on lifetime earnings. Web published april 07,. The social security program includes provisions for surviving family members to ensure they are not left without any financial assistance. / updated december 06, 2023. Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. How taxes affect your. 7, 2023, at 8:42 a.m. Web if you are already receiving a spousal benefit when your husband or wife dies, social security will in most cases convert it automatically to a survivor benefit once the death is reported. Web published october 10, 2018. Web you are at least age 60, unless you have a disability that started before or within. Web if the deceased was already receiving social security benefits, the surviving spouse is eligible to collect 100% of the benefits as long as they are at least 60 and they were married to the deceased for at least nine months. Navigating social security widows benefits after the death of a loved one can feel even more complicated. Anyone who. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. Web when a social security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. Social security is already confusing. Surviving spouses, of any age, caring for the deceased’s child aged. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. March 28, 2024, at 2:35 p.m. Survivors must apply for this payment. Web the earliest a widow or widower can start receiving social security survivors benefits based on age will remain at age. Web published october 10, 2018. Your spouse, children, and parents could be eligible for benefits based on your earnings. You may receive survivors benefits when a family member dies. Web if you remarry after age 60 (age 50 if you have a disability), you may continue to be eligible for survivors benefits on your deceased spouse’s social security record. Web. Web if you remarry after age 60 (age 50 if you have a disability), you may continue to be eligible for survivors benefits on your deceased spouse’s social security record. Anyone who was married to a social security beneficiary can potentially receive survivor benefits on the death of that person. March 28, 2024, at 2:35 p.m. Benefit amount may depend. March 28, 2024, at 2:35 p.m. Web claiming at 70 could limit your overall income. Web a surviving spouse, surviving divorced spouse, unmarried child, or dependent parent may be eligible for monthly survivor benefits based on the deceased worker’s earnings. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months.. For more information on survivors benefits, visit. Benefit amount may depend on the age at which you file for benefits. The social security program includes provisions for surviving family members to ensure they are not left without any financial assistance. How the age you claim affects your monthly benefit. Web your surviving spouse can get reduced benefits as early as age 60. Anyone who was married to a social security beneficiary can potentially receive survivor benefits on the death of that person. Waiting until 70 to claim benefits allows you to maximize your monthly payments, but there’s a chance you may not live long enough to see it. Web additionally, a court order that awards a survivor annuity to a former spouse also awards a corresponding share of the bedb unless the order expressly states otherwise.) in addition, your spouse may also be eligible for social security survivor benefits if you are covered under social security at the time of your death. But you don’t have to navigate your finances and benefits alone. If my spouse dies, can i collect their social security benefits? A representative at your local social security office can provide estimates of the benefit you can receive as a divorced spouse, based on your former wife’s or husband’s earnings record. Web if you are already receiving a spousal benefit when your husband or wife dies, social security will in most cases convert it automatically to a survivor benefit once the death is reported. Web if you remarry after age 60 (age 50 if you have a disability), you may continue to be eligible for survivors benefits on your deceased spouse’s social security record. About 3.8 million widows and widowers, including some who were divorced from late beneficiaries, were receiving survivor benefits as of december 2023. Web if you are working and paying into social security, some of those taxes you pay are for survivors benefits. Web published april 07, 2022.

How does Social Security work when your spouse dies? ISC Financial

How is Social Security calculated? SimplyWise

Can I Collect My Deceased Spouse's Social Security And My Own At The

When Can I Draw Social Security From My Deceased Husband? Retire Gen Z

If My Spouse Dies Can I Collect Their Social Security Benefits?

When Can I Draw Social Security From My Deceased Husband? Retire Gen Z

What To Do When Spouse Dies Social Security Can A Divorced Person

How Old Can You Be to Draw Social Security Joseph Voinieuse

When Can I Draw Social Security From My Deceased Husband? Retire Gen Z

Can I Collect My Exspouse's or Deceased Spouse's Social Security? 🤔

/ Updated December 06, 2023.

Web If You Remarry After Age 60 — You May Still Become Entitled To Benefits On Your Prior Deceased Spouse’s Social Security Earnings Record.

Social Security Is Already Confusing.

Survivors Must Apply For This Payment.

Related Post: