When Can I Draw Money From My 401K

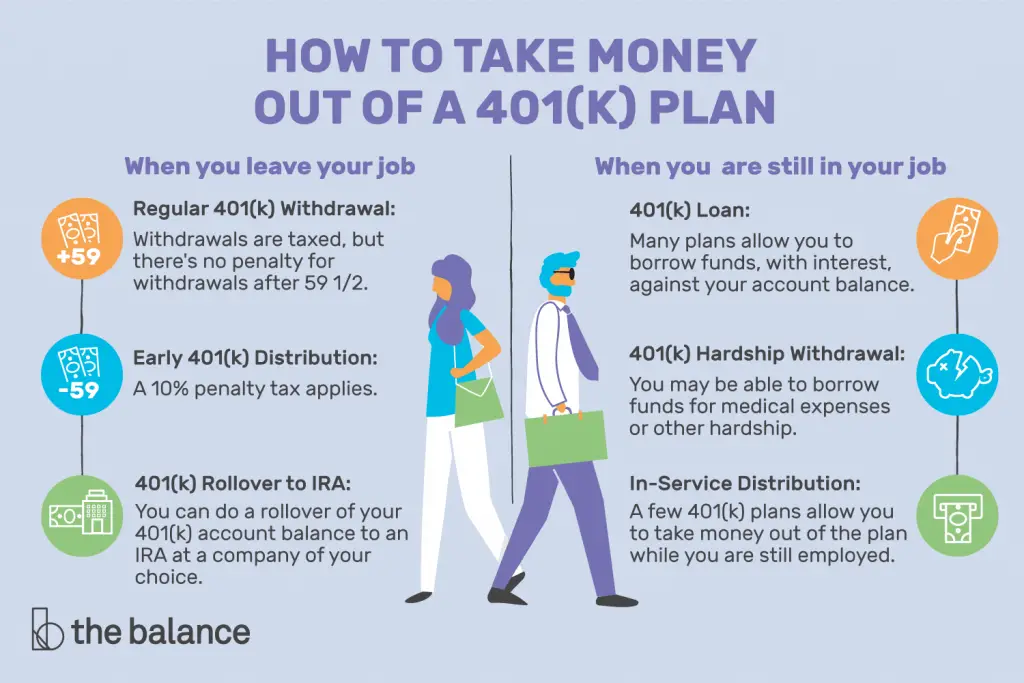

When Can I Draw Money From My 401K - Taking an early withdrawal from your 401 (k) should only be done as a last resort. There are many different ways to access funds in your 401 (k) plan. Web it expects to report to congress with recommendations by the end of 2025, ms. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. Web first, let’s recap: A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Advice & guidanceaccess to advisors Web you can withdraw money penalty free from your 401(k) at age 59½, or even earlier for some qualifying purposes. But you must pay taxes on the amount. The internal revenue service (irs) has set the standard retirement. Written by javier simon, cepf®. Web remember that, except with roth accounts, you must start making required minimum withdrawals at age 72. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Fact checked by jiwon ma. This minimum distribution calculator will show you the right amount. Learn finance easily.free animation videos.learn more.learn at no cost. Taking an early withdrawal from your 401 (k) should only be done as a last resort. There are many different ways to access funds in your 401 (k) plan. Knowledgeable teama+ ratings with bbbover 24 yrs of experience Web understanding early withdrawals. With traditional 401 (k) plans, employers can make contributions to all participants, match employee contributions, or both. Accessing your 401 (k) funds before retirement age can turn costly due to taxes and penalties. Web it expects to report to congress with recommendations by the end of 2025, ms. Written by javier simon, cepf®. The internal revenue service (irs) has set. Web you can withdraw money penalty free from your 401(k) at age 59½, or even earlier for some qualifying purposes. Don’t forget about social security payments. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. With traditional 401 (k) plans, employers can make contributions to all participants, match employee contributions, or both. You. Web updated on february 15, 2024. You’ll simply need to contact your plan administrator or log into your account online and request a. You can withdraw money when you retire, take out a 401 (k) loan, make a hardship withdrawal, or roll over. Web traditional 401 (k) plans: Most plans allow participants to withdraw funds from their 401 (k) at. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your. Contributions and earnings in a roth 401 (k) can be withdrawn. Web first, let’s recap: Web understanding early withdrawals. Unemployed individuals can make withdrawals from their 401 (k) plans without facing penalties. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of. However, early withdrawals often come with hefty penalties and tax consequences. Advice & guidanceaccess to advisors Web yes, you can withdraw money from your 401 (k) before age 59½. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. Fact checked by jiwon ma. Web michael j boyle. Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. Learn finance easily.free animation videos.learn more.learn at no cost. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Understanding the rules about roth 401 (k) accounts can keep. Learn finance easily.free animation videos.learn more.learn at no cost. But if you make a withdrawal from your retirement account before age 59½, you’re also subject to a 10% early withdrawal penalty, unless you meet one of the exceptions provided by the irs. Web many employers offer 401(k) matching contributions. But you must pay taxes on the amount. Some withdrawals might. However, early withdrawals often come with hefty penalties and tax consequences. Unemployed individuals can make withdrawals from their 401 (k) plans without facing penalties. Check with your employer to see whether you're allowed to withdraw from your 401(k) while working. Web ordinarily, you can’t withdraw money from these plans before age 59½ without facing a 10% early withdrawal penalty. Web updated on february 15, 2024. With traditional 401 (k) plans, employers can make contributions to all participants, match employee contributions, or both. This rule is only waived when certain exceptions apply and the rule. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. After you've maxed out your match, you should think about. Accessing your 401 (k) funds before retirement age can turn costly due to taxes and penalties. April 13, 2022, at 5:34 p.m. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. Unlike a 401 (k) loan, the funds need not be repaid. Yes, it’s possible to make an early withdrawal from a 401 (k) plan at any time and for any reason. There are many different ways to access funds in your 401 (k) plan. Written by javier simon, cepf®.

Should I Cash Out My 401k to Pay Off Debt? Personal Finance Library

How To Draw Money From 401k LIESSE

Taking Money From a 401K

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

How Can I Get My Money From 401k

How To Easy Money Drawing? FACTOFIT

When Can I Draw From My 401k Men's Complete Life

When Can I Draw From My 401k Men's Complete Life

How To Pull Money From My 401k

When Can I Draw From My 401k Men's Complete Life

Some Withdrawals Might Qualify As Hardship.

Web You Can Withdraw Money Penalty Free From Your 401(K) At Age 59½, Or Even Earlier For Some Qualifying Purposes.

Taking An Early Withdrawal From Your 401 (K) Should Only Be Done As A Last Resort.

A Hardship Withdrawal From A 401 (K) Retirement Account Is For Large, Unexpected Expenses.

Related Post: