When Can A Wife Draw Off Her Husband Is Social Security

When Can A Wife Draw Off Her Husband Is Social Security - If you are collecting social security disability insurance (ssdi), your spouse can draw a benefit on that basis if you have been married for at least one continuous year. If you take a spousal benefit at 62, the earliest eligibility age, your benefit would be based on your spouse's full. Eligibility for spousal benefits typically requires that the spouse. Web thus, she can file for social security at the age of 62 for a reduced benefit, allowing her own account to accrue delayed social security credits, then file again at age 70 to. / updated december 12, 2023. A retired worker’s spouse qualifies for social security spousal benefits once that spouse turns 62, or if they (the. Web a spouse’s social security benefit is directly tied to the payout that the primary beneficiary receives. How much is the social. In this case, you can claim your own social security. Web you are eligible for benefits both as a retired worker and as a spouse (or divorced spouse) in the first month you want your benefits to begin, then: Web published october 10, 2018. Web you can begin receiving reduced spouse’s benefits on your husband’s record as early as age 62. Personal online accountonline servicesfaqsmultilingual options Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. Web generally,. About 3.8 million widows and widowers, including some who were divorced. Social security spousal benefits allow spouses to claim benefits based on their partner's earnings record. Deemed filing applies at age 62. Web you can begin receiving reduced spouse’s benefits on your husband’s record as early as age 62. Eligibility for spousal benefits typically requires that the spouse. Only if your spouse is not yet receiving retirement benefits. If you are collecting social security disability insurance (ssdi), your spouse can draw a benefit on that basis if you have been married for at least one continuous year. If your benefit amount as a spouse is higher than your own retirement. Web yes, you can collect social security's on. Web as a spouse, you can claim a social security benefit based on your own earnings record, or collect a spousal benefit in the amount of 50% of your spouse’s social security. Eligibility for spousal benefits typically requires that the spouse. How much you receive will. You may be able to do this in the form of spousal benefits, or. Web published october 10, 2018. Web you can collect spousal benefits as early as age 62, but in most cases, the benefits are permanently reduced if you start collecting before your full retirement age. If you take a spousal benefit at 62, the earliest eligibility age, your benefit would be based on your spouse's full. / updated november 21, 2023.. Deemed filing applies at age 62. A retired worker’s spouse qualifies for social security spousal benefits once that spouse turns 62, or if they (the. Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. Only if your spouse. Web thus, she can file for social security at the age of 62 for a reduced benefit, allowing her own account to accrue delayed social security credits, then file again at age 70 to. Web sometimes couples can withdraw money from other retirement accounts, like iras and 401 (k)s, to be able to delay collecting their social security benefit until. Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. Web yes, you can collect social security's on a spouse's earnings record. Web as a spouse, you can claim a social security benefit based on your own earnings record,. If you take a spousal benefit at 62, the earliest eligibility age, your benefit would be based on your spouse's full. Web generally, you must be married for one year before you can get spouse’s benefits. Web a spouse’s social security benefit is directly tied to the payout that the primary beneficiary receives. Web yes, you can collect social security's. Deemed filing applies at age 62. / updated november 21, 2023. Web you cannot receive spouse’s benefits unless your spouse is receiving his or her retirement benefits (except for divorced spouses). Web when can a spouse claim social security spousal benefits? Web published october 10, 2018. About 3.8 million widows and widowers, including some who were divorced. If you are receiving retirement or disability benefits, your spouse may be eligible for spouse benefits if they. Web as a spouse, you can claim a social security benefit based on your own earnings record, or collect a spousal benefit in the amount of 50% of your spouse’s social security. Web a spouse’s social security benefit is directly tied to the payout that the primary beneficiary receives. Web you cannot receive spouse’s benefits unless your spouse is receiving his or her retirement benefits (except for divorced spouses). Deemed filing applies at age 62. If you qualify for your own retirement and spouse’s benefits, we will always pay your own benefits first. Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. Eligibility for spousal benefits typically requires that the spouse. A retired worker’s spouse qualifies for social security spousal benefits once that spouse turns 62, or if they (the. Web yes, you can collect social security's on a spouse's earnings record. If you are collecting social security disability insurance (ssdi), your spouse can draw a benefit on that basis if you have been married for at least one continuous year. Web when can a spouse claim social security spousal benefits? If you take a spousal benefit at 62, the earliest eligibility age, your benefit would be based on your spouse's full. / updated december 12, 2023. If your benefit amount as a spouse is higher than your own retirement.

Social Security Benefits Help For Kids, One Spouse Passes? Social

Collecting Social Security Benefits As A Spouse

/social-security-ex-spouse-2388947_V3-49a27ada826c4b8a84d087f7178b9e84.png)

Top 14 can ex spouse collect social security in 2022 Gấu Đây

Heres How to Draw Social Security From an ExSpouse YouTube

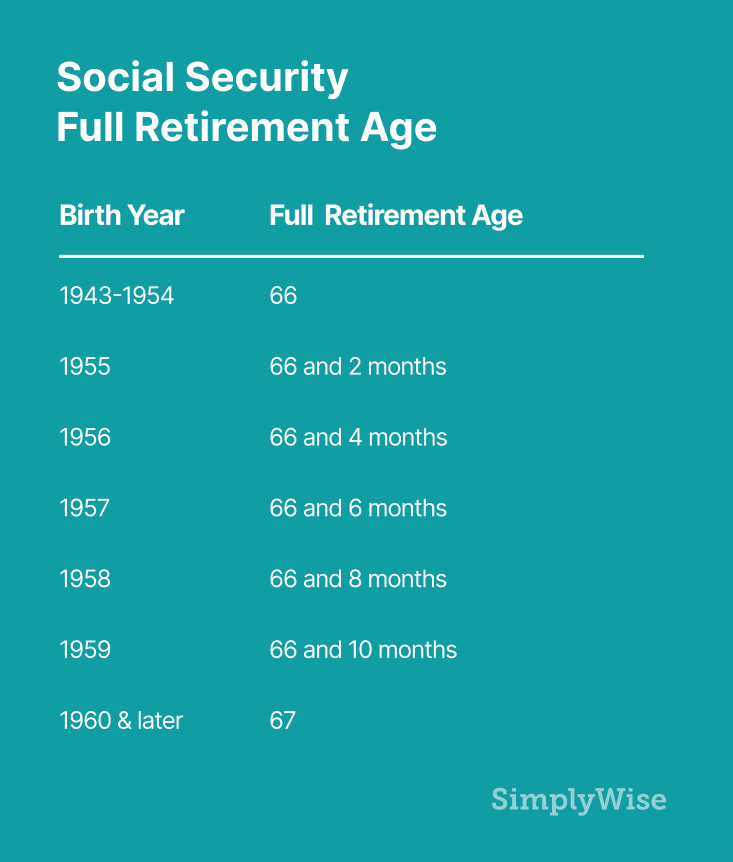

How is Social Security calculated? SimplyWise

Top 4 when can my spouse collect half of my social security in 2022

What Age Can You Collect Social Security? Retirement Plan Services

Can I Draw Social Security from My Husband's Social Security Disability?

How To Apply For Social Security Spousal Death Benefits

Social Security Benefits For Spouses

Web When A Social Security Beneficiary Dies, His Or Her Surviving Spouse Is Eligible For Survivor Benefits.

Web Published October 10, 2018.

Web Thus, She Can File For Social Security At The Age Of 62 For A Reduced Benefit, Allowing Her Own Account To Accrue Delayed Social Security Credits, Then File Again At Age 70 To.

Web Generally, You Must Be Married For One Year Before You Can Get Spouse’s Benefits.

Related Post: