What Are Special Drawing Rights

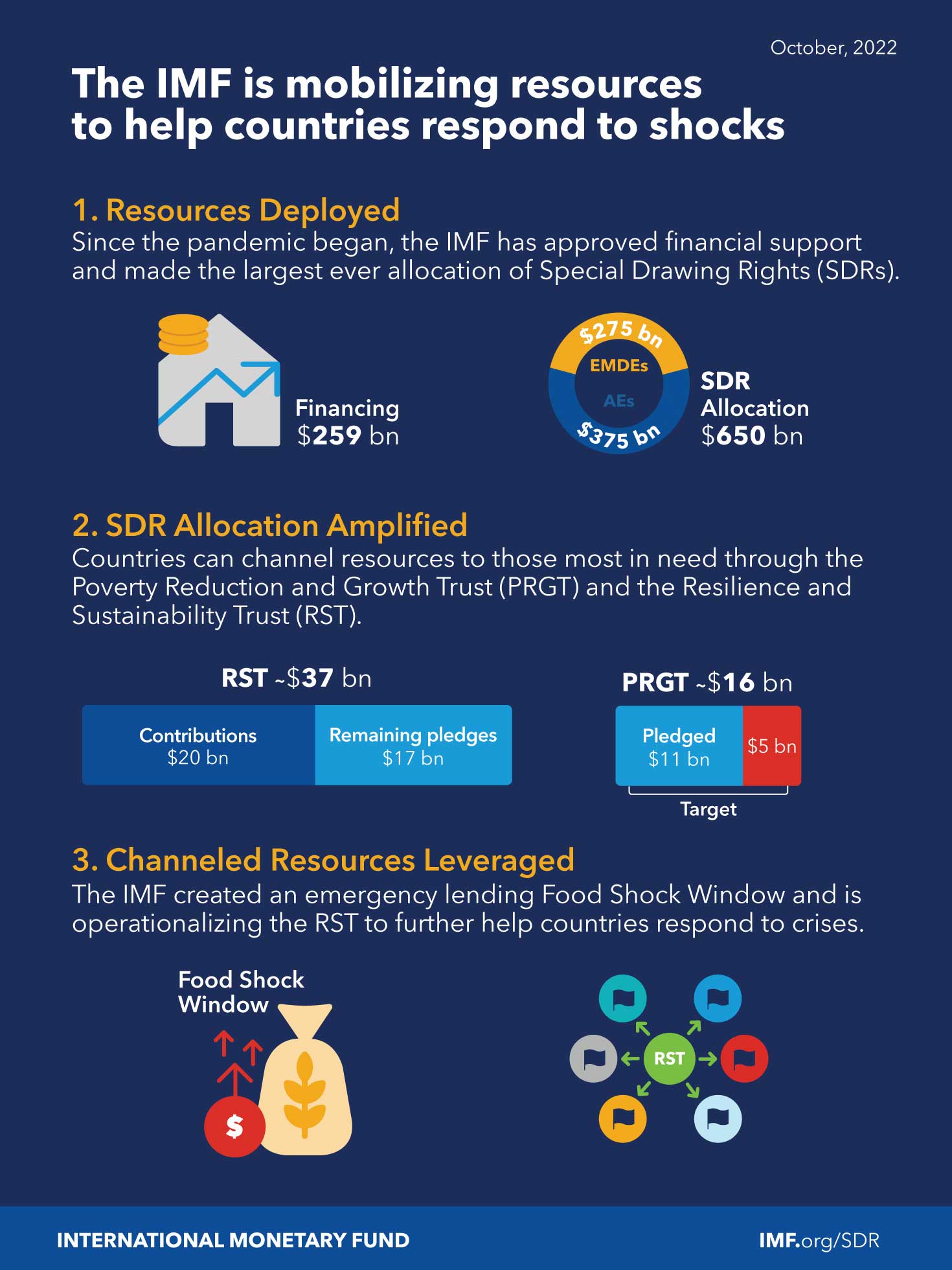

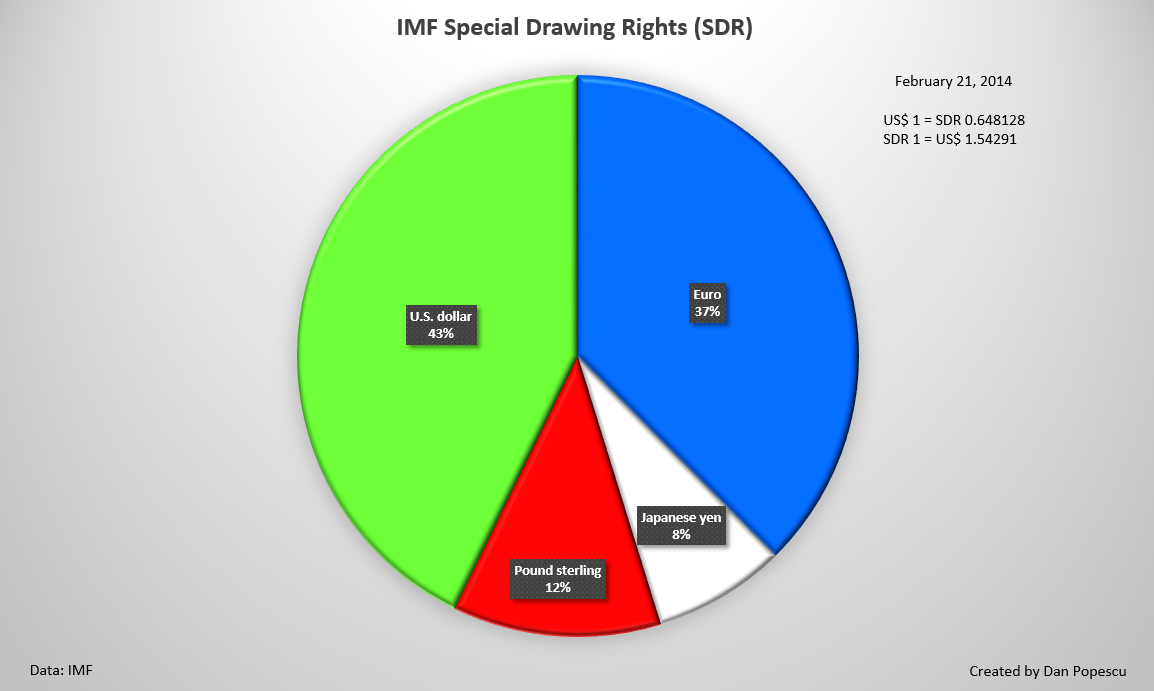

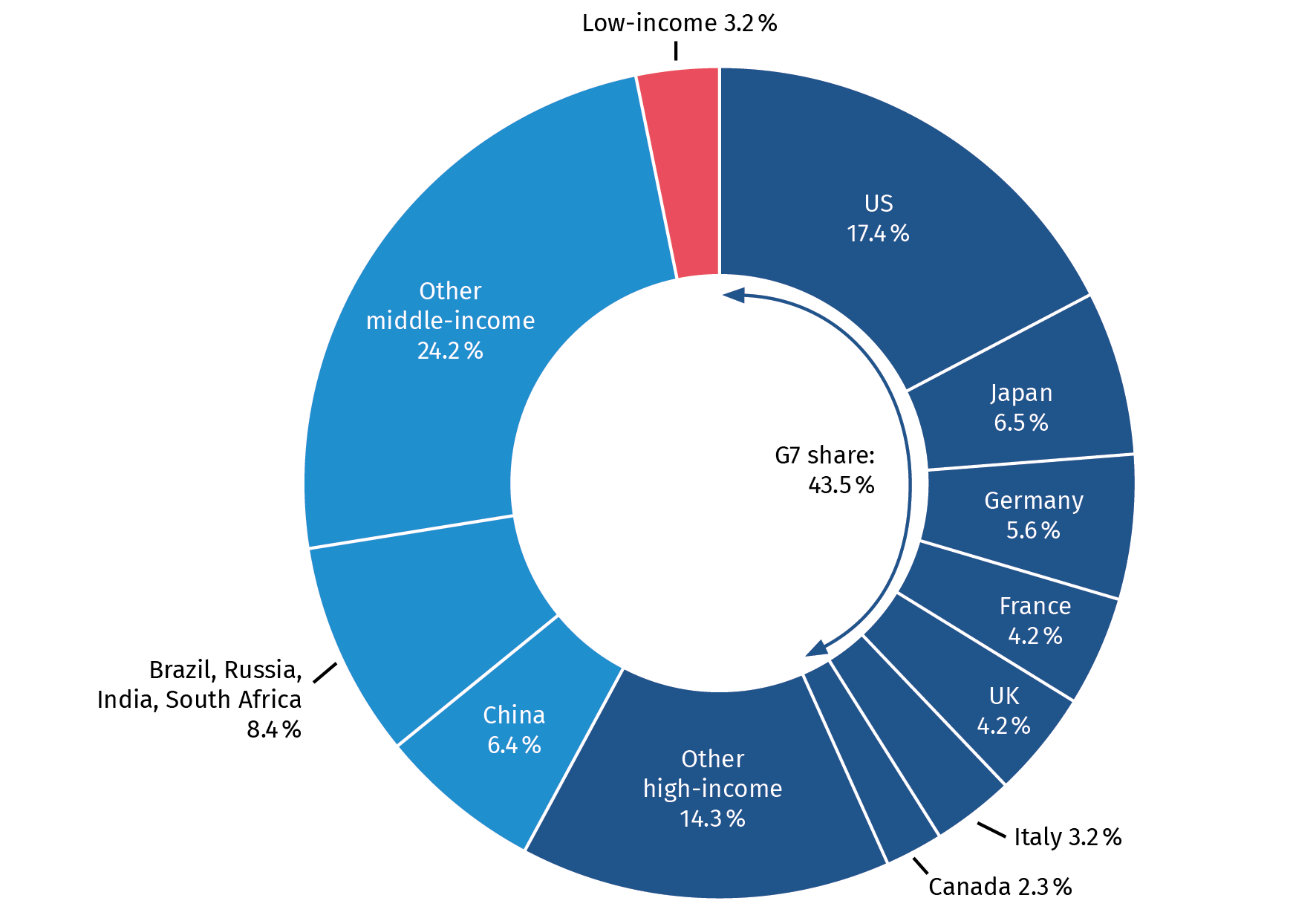

What Are Special Drawing Rights - Special drawing rights are a world reserve asset whose value is based on a basket of four major international currencies. In addition, some countries peg their currencies to the sdr or to a basket of currencies including the sdr. Web an allocation of imf special drawing rights (sdrs) would help build reserve buffers, smooth adjustments, and mitigate the risks of economic stagnation in global growth. They serve as a supplement to existing member countries’ money reserves, enhancing international liquidity. Special drawing right, established and created by the imf in 1969, is a supplement reserve of foreign exchange assets comprising leading currencies across the globe for settling international transactions. Web special drawing rights (sdrs) are an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. Sdrs are units of account for the imf, and not a currency per se. Web supplementary foreign exchange reserves are defined and maintained by the international monetary fund (imf) and are known as special drawing rights. The sdr is based on a basket of currencies and comes with the currency code, xdr, which it may also be referred to by. The sdr is an international reserve asset. The sdr is an international reserve asset created by the imf to supplement the official reserves of its member countries. Web special drawing rights (sdrs) are an international monetary reserve currency created by the international monetary fund (imf) in 1969. Web what is a special drawing right? Web special drawing rights (sdrs) are an international reserve asset, created by the. The sdr is an international reserve asset created by the imf to supplement the official reserves of its member countries. Web the currency value of the sdr is determined by summing the values in u.s. Dollars, based on market exchange rates, of a basket of major currencies (the u.s. Web special drawing rights (sdrs, code xdr) are supplementary foreign exchange. Web special drawing rights: They represent a claim to currency held by imf member countries for which they may be exchanged. Web special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf). Dollar, euro, japanese yen, pound sterling and the chinese renminbi). It is a potential claim on the. As such, sdrs can provide a country with liquidity. In addition, some countries peg their currencies to the sdr or to a basket of currencies including the sdr. Web special drawing rights (sdr): Sdrs are units of account for the imf, and not a currency per se. Sdrs are used by the imf to make emergency loans and are. This article gives a brief understanding of special drawing rights, including the procedure used for determining its value and the list of international organisations that uses it for its. Web what is a special drawing right? Web a general allocation of special drawing rights (sdrs) equivalent to about us$650 billion became effective on august 23, 2021. Web an allocation of. Rather, it is a potential claim on the freely usable currencies of imf members. Web special drawing rights (sdr) english. The sdr currency value is calculated daily except on imf holidays, or whenever the imf is closed for business, or. They represent a claim to currency held by imf member countries for which they may be exchanged. Sdrs can be. The sdr is based on a basket of currencies and comes with the currency code, xdr, which it may also be referred to by. The right tool to use to respond to the pandemic and other challenges. This article gives a brief understanding of special drawing rights, including the procedure used for determining its value and the list of international. They serve as a supplement to existing member countries’ money reserves, enhancing international liquidity. The sdr is based on a basket of currencies and comes with the currency code, xdr, which it may also be referred to by. Web special drawing rights: The right tool to use to respond to the pandemic and other challenges. Rather than a currency, it. Sdrs can be exchanged for these currencies. Web special drawing rights (sdrs) are an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. They serve as a supplement to existing member countries’ money reserves, enhancing international liquidity. Rather, it is a potential claim on the freely usable currencies of imf members. Web what. The sdr is not a currency. The sdr is not a currency, but its value is based on a basket of five currencies—the us dollar, the euro, the chinese renminbi, the japanese yen, and the british pound sterling. Dollar, euro, japanese yen, pound sterling and the chinese renminbi). Dollars, based on market exchange rates, of a basket of major currencies. Sdrs are used by the imf to make emergency loans and are. Web what are special drawing rights (sdrs)? Web what are special drawing rights? Web the currency value of the sdr is determined by summing the values in u.s. To serve its purpose as a reserve asset, the sdr must be fully convertible into foreign currency. Dollar, japanese yen, euro, pound sterling and chinese renminbi. Rather, it is a potential claim on the freely usable currencies of imf members. In addition, some countries peg their currencies to the sdr or to a basket of currencies including the sdr. Web special drawing rights (sdrs) are an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. Web special drawing rights (sdr) english. Web an allocation of imf special drawing rights (sdrs) would help build reserve buffers, smooth adjustments, and mitigate the risks of economic stagnation in global growth. Special drawing rights (sdr) refer to an international type of monetary reserve currency created by the international monetary fund (imf) in 1969. Web special drawing rights (sdr): The sdr is an international reserve asset created by the imf to supplement the official reserves of its member countries. What is the purpose of the sdr? The sdr is an international reserve asset.

Special Drawing rights IMF YouTube

Free of Charge Creative Commons special drawing rights Image Financial 3

Special Drawing Rights (SDR) Challenges, Uses, Significance

Special Drawing Rights

What You Should Know About Special Drawing Rights (SDRs) The Daily

Gold And The Special Drawing Rights (SDR) 1969Present

Special Drawing Rights can help developing countries to build back greener

PPT International business environment PowerPoint Presentation, free

Special Contribution 1.5 IMF Special Drawing Rights a historic

Special Drawing Rights (SDR)

Dollars, Based On Market Exchange Rates, Of A Basket Of Major Currencies (The U.s.

It Is A Potential Claim On The Freely Usable Currencies Of Imf Members.

Web The Bottom Line.

Web Special Drawing Rights (Sdrs) Are An International Monetary Reserve Currency Created By The International Monetary Fund (Imf) In 1969.

Related Post: