What Age To Draw From 401K

What Age To Draw From 401K - Web yes, you can withdraw money from your 401 (k) before age 59½. Web what is the safe withdrawal rate method? A safe withdrawal rate represents the maximum percentage of retirement funds a retiree may take from an investment portfolio on an annual basis without. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. You can withdraw money from your 401(k). However, early withdrawals often come with hefty penalties and tax consequences. Edited by jeff white, cepf®. Web you reach age 59½ or experience a financial hardship. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Some reasons for taking an early 401 (k). Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. A penalty tax usually applies to any withdrawals taken before age 59 ½. 401 (k) withdrawals before age 59½. You’ll simply need to contact your plan administrator or log into your. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Fact checked by kirsten rohrs schmitt. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Depending on the terms of. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income. Web generally, if you are age 73, you've reached the age where the irs mandates you start taking withdrawals from most qualified retirement accounts, such as iras and 401 (k)s (but not roth iras). A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½.. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web be at least age 55 or older. Web to receive the full benefit you're entitled to based on your work history, you'll need to file. Web with both a 401 (k) and a traditional ira, you will be required to take minimum distributions starting at age 73 or 75, depending on the year you were born. Web what is the safe withdrawal rate method? Web age 59½ is the earliest you can withdraw funds from an ira account and pay no penalty. A safe withdrawal. Depending on the terms of the plan, distributions may be: Generally, april 1 following the later of the calendar year in which you: Taking that route is not always advisable,. The best idea for 401(k) accounts from a previous employer is to roll them over when you leave a job. Web whether you can take regular withdrawals from your 401. Web how old will you be at the end of this year? Web with both a 401 (k) and a traditional ira, you will be required to take minimum distributions starting at age 73 or 75, depending on the year you were born. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. 1 if you will turn 72 after jan. People shy of retirement age by a few years may be able to avoid the penalty as well, thanks to. You’re not age 55 yet. Every employer's plan has different rules for 401 (k) withdrawals. A safe withdrawal rate represents the maximum percentage of retirement funds a retiree may take from an investment portfolio on an annual basis without. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. Web updated on february 15, 2024. Workers are covered by an employer retirement plan at any given time,. The best idea for 401(k). Web what is the safe withdrawal rate method? This age varies by birth year, but it's 67 years old for everyone. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at age 73. Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. People shy of retirement age by a few years may be able to avoid the penalty as well, thanks to. Web to receive the full benefit you're entitled to based on your work history, you'll need to file at your full retirement age (fra). Edited by jeff white, cepf®. You’re not age 55 yet. You can access funds from an old 401(k) plan after you reach age 59½ even if you haven't yet retired. Web updated on february 15, 2024. Explore all your options for getting cash before tapping your 401 (k) savings. 401 (k) withdrawals before age 59½. Written by javier simon, cepf®. Generally, april 1 following the later of the calendar year in which you: Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows.:max_bytes(150000):strip_icc()/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

At What Age Can I Withdraw Funds From My 401(k) Plan?

at what age do you have to take minimum distribution from a 401k Hoag

Important ages for retirement savings, benefits and withdrawals 401k

Why The Median 401(k) Retirement Balance By Age Is So Low

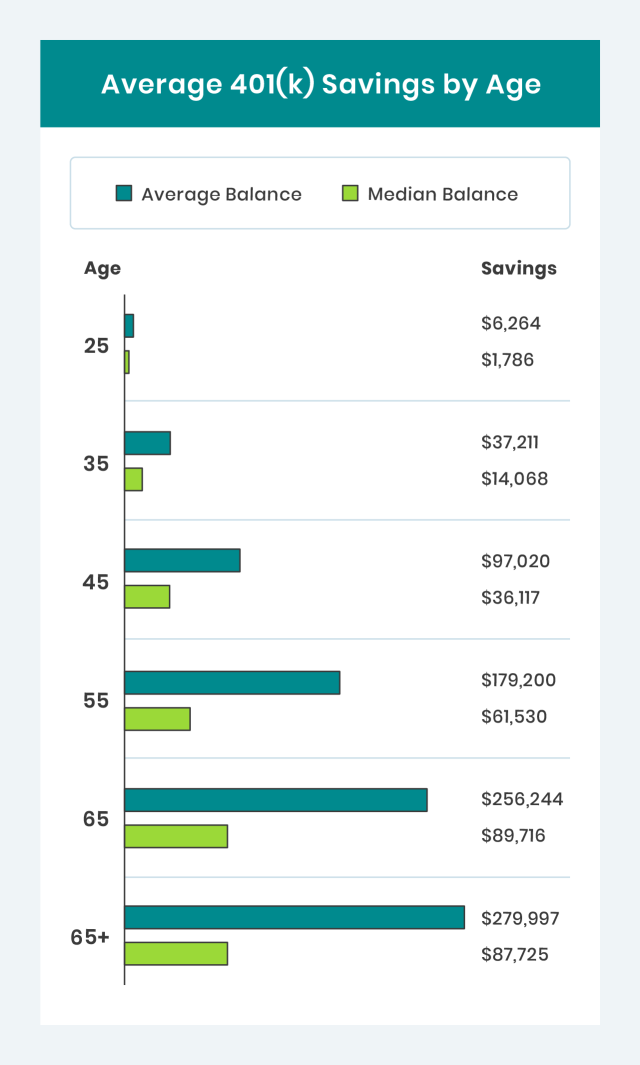

Average 401(k) Balance by Age Your Retirement Timeline

Free 401(k) Calculator Google Sheets and Excel Template

![Average 401k Balance By Age [Including Median Balance] YouTube](https://i.ytimg.com/vi/iHG96h5kt4E/maxresdefault.jpg)

Average 401k Balance By Age [Including Median Balance] YouTube

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

401k Savings By Age How Much Should You Save For Retirement

The Rise Of 401k Millionaires Living Large In Retirement

The Best Idea For 401(K) Accounts From A Previous Employer Is To Roll Them Over When You Leave A Job.

Web You Reach Age 59½ Or Experience A Financial Hardship.

Web You Generally Must Start Taking Withdrawals From Your Traditional Ira, Sep Ira, Simple Ira, And Retirement Plan Accounts When You Reach Age 72 (73 If You Reach Age 72 After Dec.

Web You Can Make A 401 (K) Withdrawal At Any Age, But Doing So Before Age 59 ½ Could Trigger A 10% Early Distribution Tax, On Top Of Ordinary Income Taxes.

Related Post: