Owner Is Draw Quickbooks

Owner Is Draw Quickbooks - Typically, you account for owner draws with a temporary account that offsets the company’s owner equity or owner capital account. When you put money in the business you also use an equity account. The owner's equity is made up of different funds, including money you've invested in your business. You may see one or more of these names: Sole proprietors can take money directly out of their company as an owner draw and use the funds to pay personal expenses unrelated to the business. When you record an owner's draw from a bank feed, are you supposed to record a categorize or transfer? Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. In a corporation, owners can receive compensation by a salary or dividends from ownership shares but not owner draws. Web before deciding which method is best for you, you must first understand the basics. There are an array of ways available that can help record an owner’s draw in quickbooks, such as banking and chart of accounts options. It represents a reduction in the owner’s equity in the business. The disposal option allows you to record the disposal of a fixed asset and calculate any gain or loss from its sale. So your chart of accounts could look like this. To create an owner's equity: Web the owner's draws are usually taken from your owner's equity account. August 12, 2022 08:41 am. Web owner’s draw refers to the process of withdrawing money from a business for personal use by the owner. So your chart of accounts could look like this. Web december 10, 2018 08:45 pm. Know that you can select the equity account when creating a. Web taking an owner’s draw is a relatively simple process since it should not trigger a “taxable event.”. Owner equity (parent account) owner draws (sub account of owner equity) Using this option means that the asset is no. However, the amount withdrawn must be reasonable and should consider all aspects of business finance. There are an array of ways available. Click gear, and then click chart of accounts. When you put money in the business you also use an equity account. To pay back your account using an owner's draw in quickbooks, follow these steps: Typically this would be a sole proprietorship or llc where the business and the owner are. Since there is a balance in the owner's personal. Web the owner's draws are usually taken from your owner's equity account. December 10, 2018 05:56 pm. To pay back your account using an owner's draw in quickbooks, follow these steps: Learn how to pay an owner of a sole proprietor business in quickbooks online. Web december 10, 2018 05:29 pm. Web i'm here to guide you on how to delete a fixed asset and record an owner's draw in quickbooks online. Web december 10, 2018 05:29 pm. Can someone explain how to account for owners draw starting with the bank feed. Web taking an owner’s draw is a relatively simple process since it should not trigger a “taxable event.”. Web. A clip from mastering quick. August 12, 2022 08:41 am. Typically this would be a sole proprietorship or llc where the business and the owner are. December 10, 2018 05:56 pm. When done correctly, taking an owner’s draw does not result in you owing more or less. The owner's equity is made up of different funds, including money you've invested in your business. So your chart of accounts could look like this. Business owners can withdraw profits earned by the company. Web a sole proprietor, partner, or an llc owner can legally draw as much as he wants for the owner’s equity. There are an array of. Web i'm here to guide you on how to delete a fixed asset and record an owner's draw in quickbooks online. Draws can happen at regular intervals or when needed. Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. There are an array of ways. October 04, 2023 08:30 pm. This process has a significant impact on the financial statements and the equity of the business. A draw may seem like a superior option over a salary. This transaction impacts the owner’s equity and is essential for accurate financial management within. This will handle and track the withdrawals of the company's assets to pay an. October 04, 2023 08:30 pm. The business owner takes funds out of the business for personal use. In quickbooks online advanced, you can either dispose of or delete assets. This transaction impacts the owner’s equity and is essential for accurate financial management within. So your chart of accounts could look like this. Since there is a balance in the owner's personal expenses account, i assume that means that the owner has not reimbursed the company for those expenses? Sole proprietors can take money directly out of their company as an owner draw and use the funds to pay personal expenses unrelated to the business. Business owners can withdraw profits earned by the company. There are an array of ways available that can help record an owner’s draw in quickbooks, such as banking and chart of accounts options. Can someone explain how to account for owners draw starting with the bank feed. If that's the case, you can make a journal entry by debiting owner's draw and crediting owner's personal expenses. In a corporation, owners can receive compensation by a salary or dividends from ownership shares but not owner draws. A draw may seem like a superior option over a salary. The owner's equity is made up of different funds, including money you've invested in your business. Draws can happen at regular intervals or when needed. Owner’s equity, owner’s investment, or.

How to record personal expenses and owner draws in QuickBooks Online

How to record owner's draw in QuickBooks Online Scribe

Owners Draw Quickbooks Desktop DRAWING IDEAS

Owners draw balances

How to record owner's draw in QuickBooks Online Scribe

How to Create an Owner's Draw Account in QuickBooks Online Luca Financial

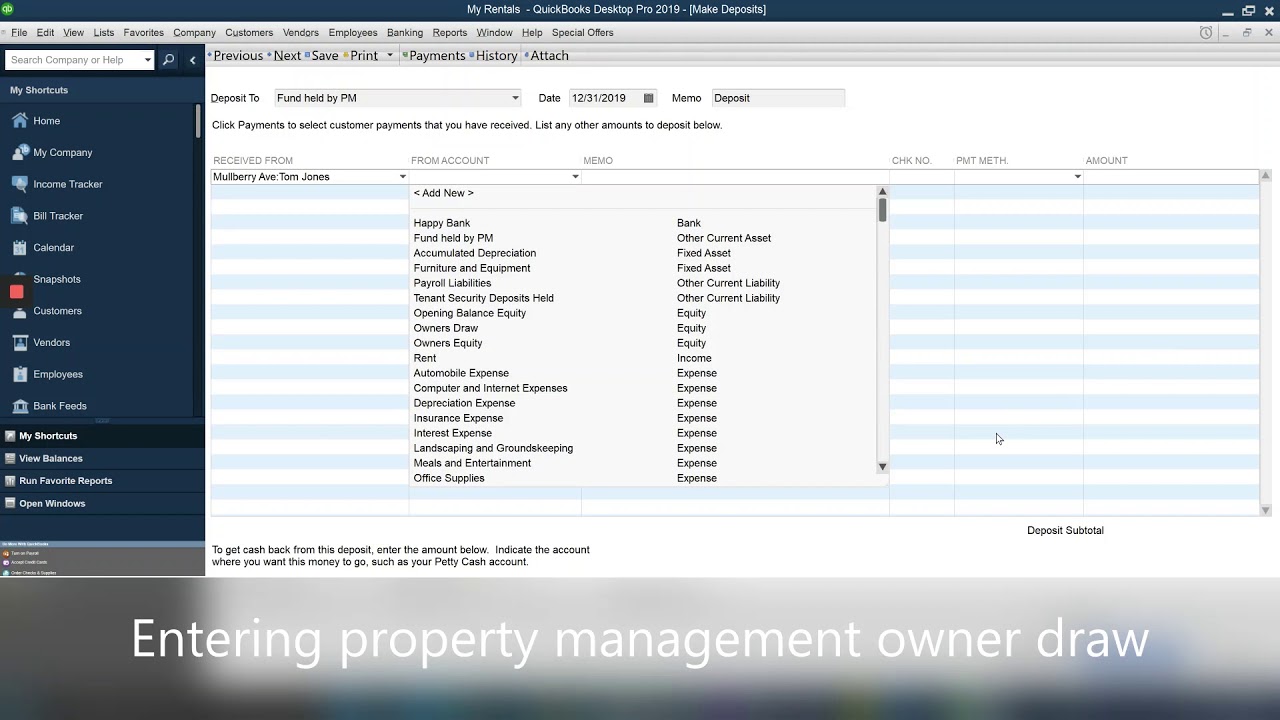

How to enter the property management owner draw to QuickBooks YouTube

Quickbooks Owner Draws & Contributions YouTube

Owner's Draw Via Direct Deposit QuickBooks Online Tutorial The Home

Owner Draw Report Quickbooks

Typically This Would Be A Sole Proprietorship Or Llc Where The Business And The Owner Are.

Learn How To Pay Yourself As A Business Owner Or Llc With Quickbooks.

Web December 10, 2018 05:29 Pm.

Learn How To Pay An Owner Of A Sole Proprietor Business In Quickbooks Online.

Related Post: