Owner Is Draw On Balance Sheet

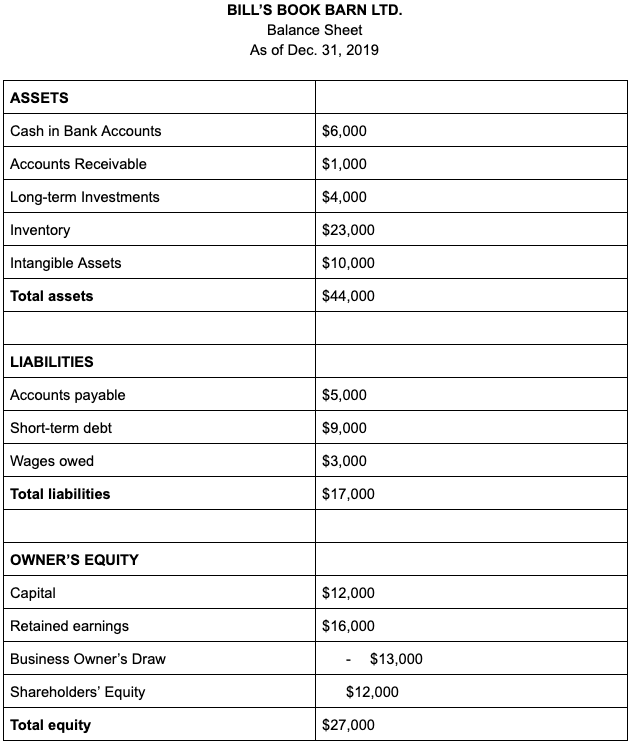

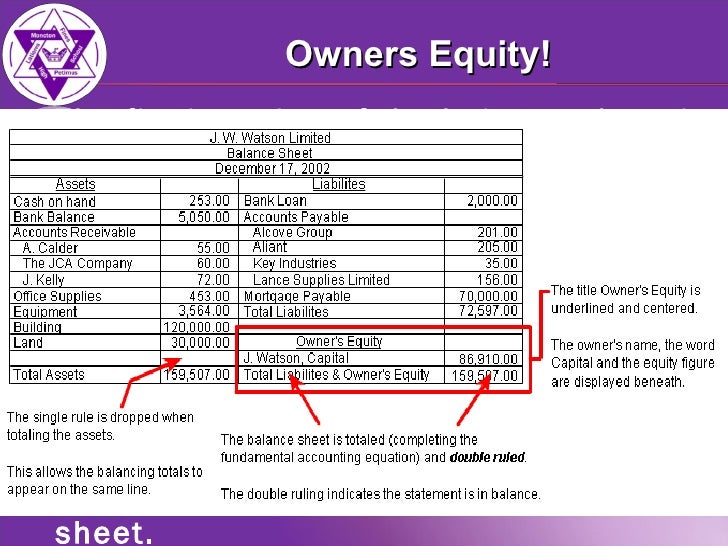

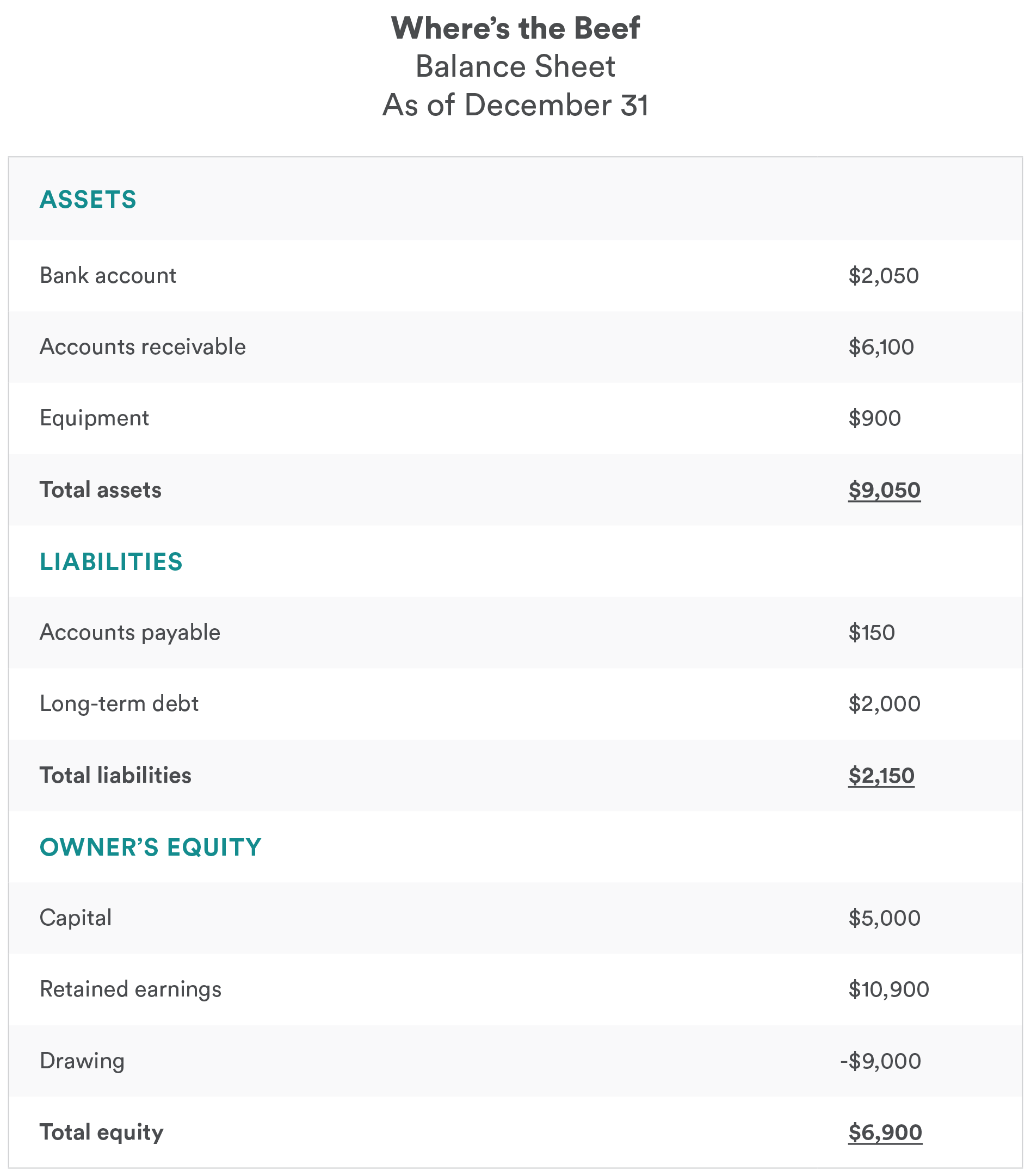

Owner Is Draw On Balance Sheet - This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Web enter the dollar amount. Patty could withdraw profits from her business or take out funds that she previously contributed to her company. Business taxes on owner's draw. Owner’s equity grows when an owner increases their investment or the company increases its profits. The simple explanation of owner's equity is that it is the amount of money. For a sole proprietor, the equity section of the balance sheet will have at least three items: The owner’s drawings of cash will also affect the financing activities section of the statement of cash flows. To record owner’s draws, you need to go to your owner’s equity account on your balance sheet. Web owner’s draws represent the direct withdrawal of funds or assets for the business owner’s personal use or expenses. Many small business owners compensate themselves using a draw rather than paying themselves a salary. For a sole proprietor, the equity section of the balance sheet will have at least three items: A draw may seem like a superior option over a salary. Web owner's equity is an account found on the balance sheet. The account in which the draws. A draw may seem like a superior option over a salary. Record your owner’s draw by debiting your owner’s draw account and crediting your cash account. Your tax responsibilities on an owner's draw depend primarily on your business structure. Equity includes accumulated capital you've contributed to the business and shares of profits and losses if any. Web owner’s draws represent. So, the simple answer of how to calculate owner's equity on a balance sheet is to subtract a business. Technically, it’s a distribution from your equity account, leading to a reduction of your total share in the company. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. A draw and a distribution are the same thing. Web an owner’s draw refers to an owner taking funds out of the business for personal use. The account in which the draws are recorded is a. Owner’s equity grows when an owner increases their investment or the company increases its profits. The simple explanation of owner's equity is that it is the amount of money. Web owner's equity refers to the portion of a business that is the property of the business' shareholders or owners. Web at the end of the year or period, subtract your. Your tax responsibilities on an owner's draw depend primarily on your business structure. Record your owner’s draw by debiting your owner’s draw account and crediting your cash account. What is the difference between a draw vs distribution? Web owner's equity refers to the portion of a business that is the property of the business' shareholders or owners. Web an owner's. Accountants may help business owners take an owner's draw as compensation. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit balance is contrary to the normal credit balance of the owner’s equity or. Web an owner's draw is an amount of money an owner takes out of. What is the difference between a draw vs distribution? Accountants may help business owners take an owner's draw as compensation. A draw lowers the owner's equity in the business. We usually record owner’s draws as reductions in the owner’s equity or capital accounts within the company’s financial records. Web owner's equity is an account found on the balance sheet. An owner of a c corporation may not. Web owner's equity is an account found on the balance sheet. A drawing account is an accounting record maintained. Equity includes accumulated capital you've contributed to the business and shares of profits and losses if any. Web updated july 24, 2022. Equity includes accumulated capital you've contributed to the business and shares of profits and losses if any. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. To record owner’s draws, you need to go to your owner’s equity account on your balance sheet. So, the simple answer of. Accountants may help business owners take an owner's draw as compensation. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Web at the end of the year or period, subtract your owner’s draw account balance from your owner’s equity account total. Irs terminology on tax forms shows the latter “owners distribution” as the filing term. The owner’s drawings of cash will also affect the financing activities section of the statement of cash flows. An owner of a c corporation may not. Owner’s draws) ($50,000) total closing owner’s equity: Web owner's equity refers to the portion of a business that is the property of the business' shareholders or owners. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit balance is contrary to the normal credit balance of the owner’s equity or. Need to make sure i'm handling owner equity and owner draw correctly. Web the owner’s drawings will affect the company’s balance sheet by decreasing the asset that is withdrawn and by the decrease in owner’s equity. Web in order to balance their balance sheet, they have to add the net profit to their equity. The simple explanation of owner's equity is that it is the amount of money. Your tax responsibilities on an owner's draw depend primarily on your business structure. Technically, it’s a distribution from your equity account, leading to a reduction of your total share in the company. Patty could withdraw profits from her business or take out funds that she previously contributed to her company.

Owners Draw Quickbooks Desktop DRAWING IDEAS

Balance Sheet Training Business Literacy Institute Financial Intelligence

Owner's Draws What they are and how they impact the value of a business

Owner's Equity

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

How to Read a Balance Sheet Bench Accounting (2023)

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Acct120 Class 13 Creating A Balance Sheet Formatting And Rules

Understanding Balance Sheet Definition and Examples XoroHelp

how to take an owner's draw in quickbooks Masako Arndt

It Represents Your Stake In The Company.

A Negative Owner’s Equity Often Shows That A Company Has More Liabilities.

Owner’s Equity Grows When An Owner Increases Their Investment Or The Company Increases Its Profits.

Web Owner’s Equity Is Listed On A Company’s Balance Sheet.

Related Post: