Maximum Income While Drawing Social Security

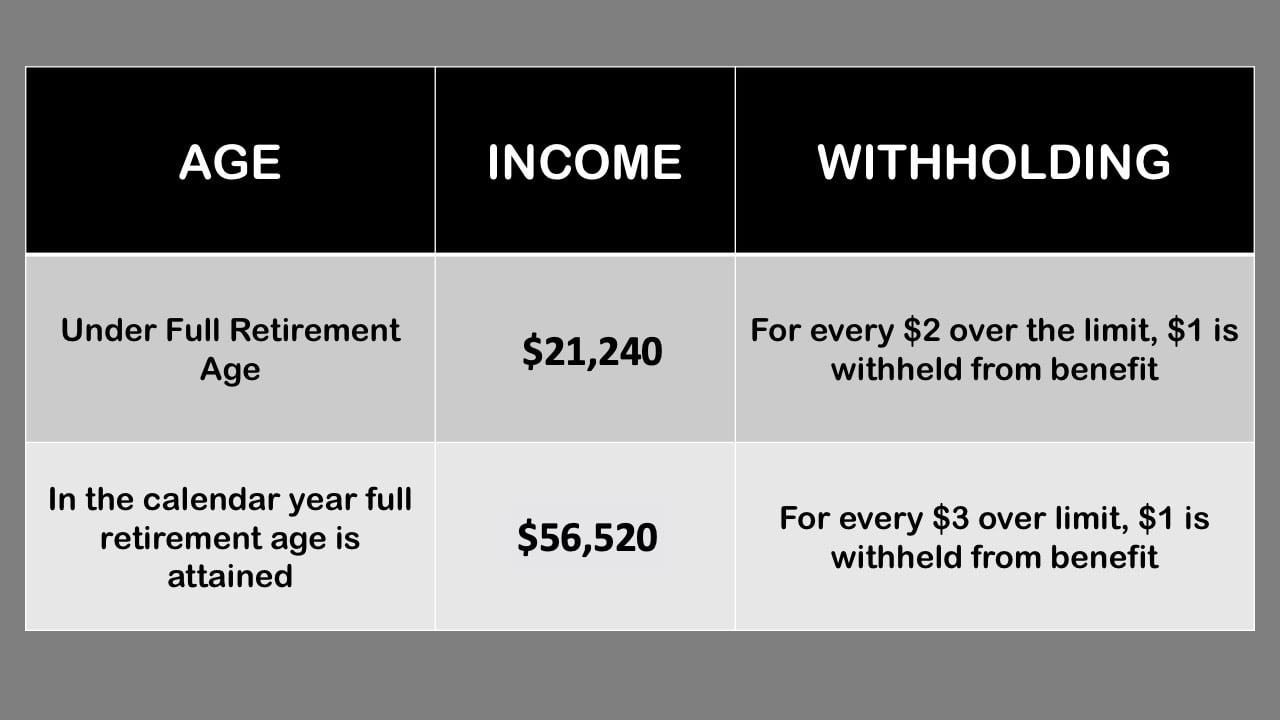

Maximum Income While Drawing Social Security - Web for example, in 2023, you earn one social security credit for every $1,730 in covered earnings each year. Web in 2024, the maximum social security benefit is $4,873 per month. Web for every $3 you earn over the income limit, social security will withhold $1 in benefits. Faqsprivacy assurancepersonal online accountmultilingual options Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. The maximum benefit depends on the age you retire. Web some people need to start drawing monthly checks at age 62. The withholding amount on dollars earned over that limit is not as steep, either. In 2024, you can earn up to $22,320 without having your social security benefits withheld. 50% of anything you earn over the cap. You must earn $6,920 to get the maximum four credits. Web for example, in 2023, you earn one social security credit for every $1,730 in covered earnings each year. Web during that period, the earnings limit that will apply to you nearly triples to $56,520. There are several factors that impact your benefit amount. During the trial work period, there. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. The limit is $22,320 in 2024. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). You don't have to hand in your notice when you start getting. Web published october 10, 2018. The maximum benefit depends on the age you retire. If you exceed the limit, which is $21,240 in 2023, $1 of your benefits will be withheld for every $2 you make. The withholding amount on dollars earned over that limit is not as steep, either. Getting that much, however, depends on several factors, including how. At your full retirement age, there is no income limit. / updated december 22, 2022. But in order to get the. The withholding amount on dollars earned over that limit is not as steep, either. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). Web we use the following earnings limits to reduce your benefits: Web some people need to start drawing monthly checks at age 62. Web how your earnings afect your social security benefits. If you earn above the maximum taxable earnings for at least 35 years in your career, you'll be able to claim the maximum possible benefit. Web those who. Web for every $3 you earn over the income limit, social security will withhold $1 in benefits. Others can afford to wait until age 70 to get that increase of 8% per year of deferral. You can earn up to $2,364 per month by claiming at age 62. Those who are 62, by. There are several factors that impact your. During the trial work period, there are no limits on your earnings. Learn more.free animation videos.master the fundamentals.find out today. / updated december 22, 2022. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Web for every $3 you earn over the income limit, social security. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. The limit is $22,320 in 2024. The maximum benefit depends. Web published october 10, 2018. The $21,240 amount is the number for. Web in 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for. Getting that much, however, depends on several factors, including how many years you worked,. Web to find out how much your benefit. Those who are 62, by. Web during that period, the earnings limit that will apply to you nearly triples to $56,520. For 2024 that limit is $22,320. At your full retirement age, there is no income limit. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Learn more.free animation videos.master the fundamentals.find out today. If you exceed the limit, which is $21,240 in 2023, $1 of your benefits will be withheld for every $2 you make. But continuing to draw income from work might reduce the amount of your. Web in 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for. Web in other words, if your income exceeds the cap on yearly earnings — which in 2024 is $22,320 for people who claim benefits before full retirement age — social. Web for every $3 you earn over the income limit, social security will withhold $1 in benefits. The $21,240 amount is the number for. 50% of anything you earn over the cap. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. Web those who are 70 can collect up to $4,873 in monthly benefits this year, or $58,476. Web for example, in 2023, you earn one social security credit for every $1,730 in covered earnings each year. Web during that period, the earnings limit that will apply to you nearly triples to $56,520. Getting that much, however, depends on several factors, including how many years you worked,. At your full retirement age, there is no income limit. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit).

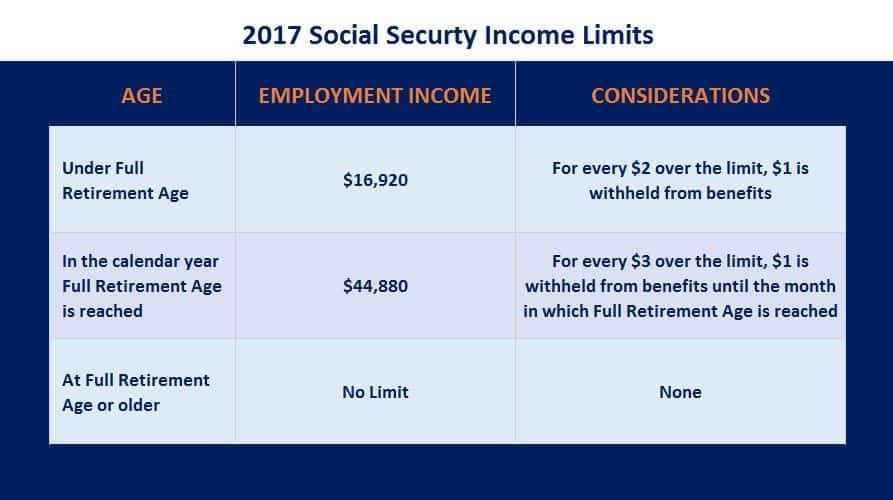

Social Security Limits 2017 Social Security Intelligence

Limit For Maximum Social Security Tax 2022 Financial Samurai

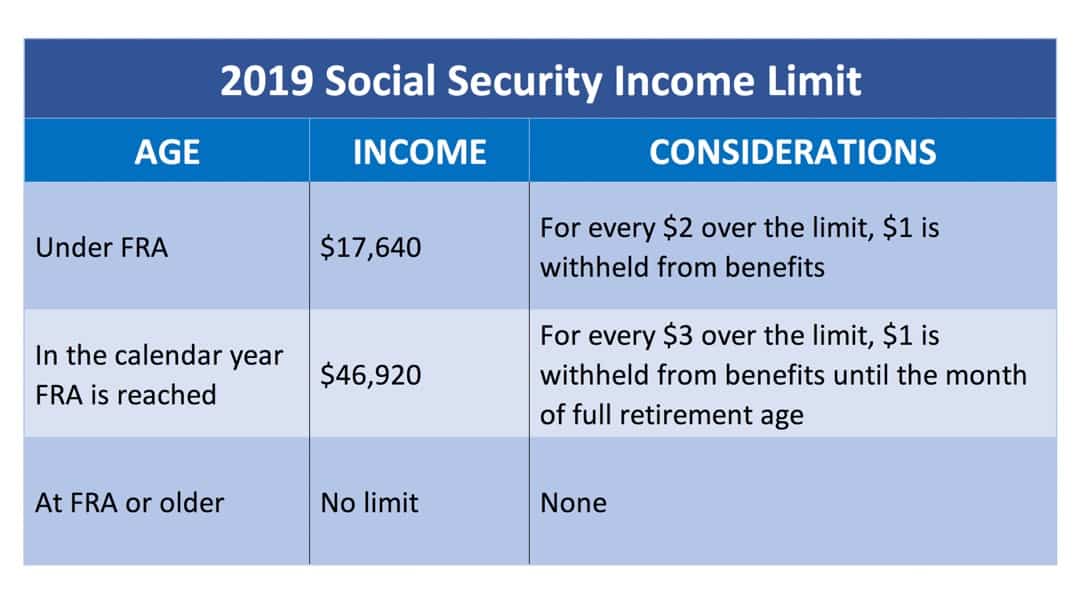

2019 SS LIMIT Social Security Intelligence

Social Security Limit What Counts As YouTube

Maximum Taxable Amount For Social Security Tax (FICA)

Social Security Limit 2021 Social Security Intelligence

Social Security Limit for 2022 Social Security Genius

Maximum Social Security Benefit 2022 Calculation & How to Get It

Introduction to Social Security Aspire Wealth Advisory

Social Security Limit What Counts as Social Security

Web To Find Out How Much Your Benefit Will Be Reduced If You Begin Receiving Benefits From Age 62 Up To Your Full Retirement Age, Use The Chart Below And Select Your Year Of Birth.

What Is The Maximum Social Security Retirement Benefit Payable?

For Example, If You Retire At Full.

Web How Your Earnings Afect Your Social Security Benefits.

Related Post: