Maximum Earnings While Drawing Social Security

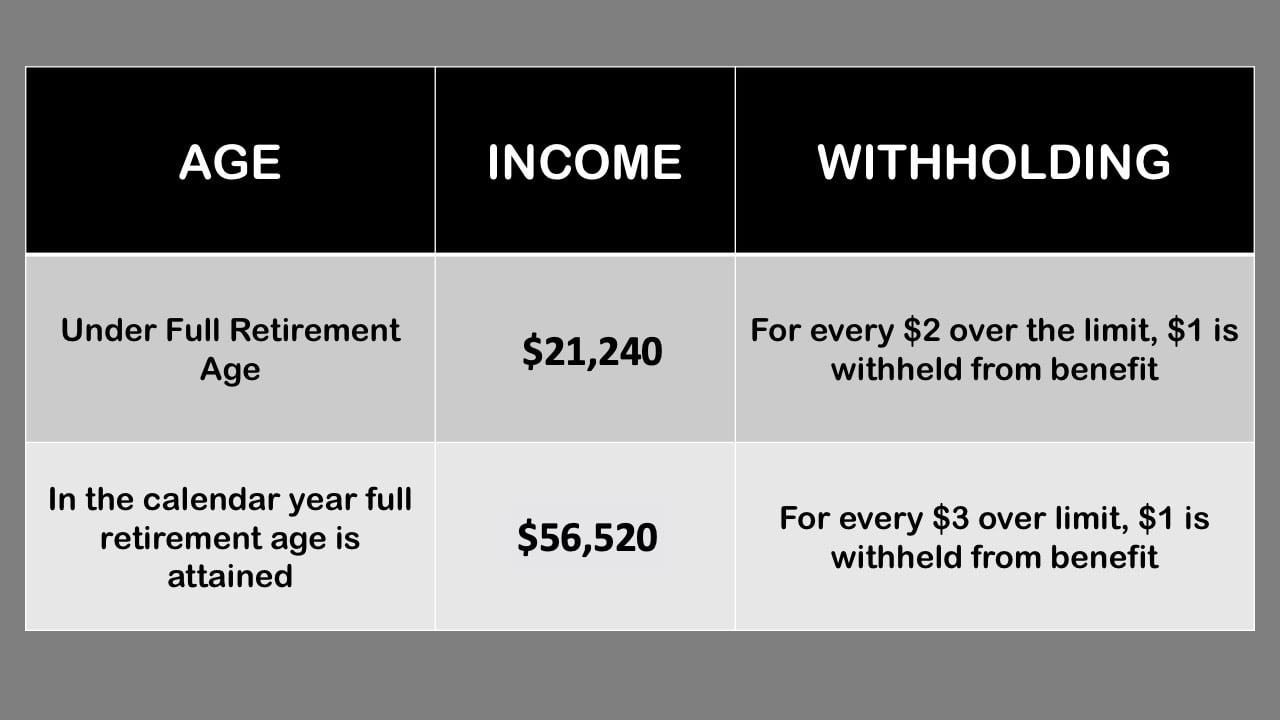

Maximum Earnings While Drawing Social Security - The limit is $22,320 in 2024. For every $2 you earn above this limit, your benefits will be reduced by $1. The one exception is during the calendar year you attain full retirement age. But that limit is rising in 2024, which means seniors who are working and collecting social. This amount is known as the “maximum taxable earnings” and changes each year. Web benefits planner | social security tax limits on your earnings | ssa. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). Web in 2024, the social security income limit is $22,320 (up from $21,240 in 2023) if you are under full retirement age for the entire year. The most current version of this article uses numbers for 2023. Web if you make more than $21,240 in 2023, the social security administration will withhold $1 in benefits for every $2 over that amount that you earn. Web nearly 6 in 10 retirees say social security is a major source of income in retirement, according to an annual gallup poll. If you will reach full. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Web this year, the limit is $142,800 per year, but in 2022, it will. But in order to get the biggest monthly. This amount is known as the “maximum taxable earnings” and changes each year. But that limit is rising in 2024, which means seniors who are working and collecting social. Others can afford to wait until age 70 to get that increase of 8% per year of deferral. Should your income surpass this. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. We have a special rule for this situation. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. / updated december 04, 2023. Web if you haven't. You might be eligible for a higher social security benefit later. / updated december 04, 2023. Web the special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings. Others can afford to wait until age 70 to get that increase of 8% per year of deferral. Web. Web some people need to start drawing monthly checks at age 62. The social security earnings limit changes each year. Working while collecting social security. Web if you haven't reached your fra yet, the ssa imposes an earnings limit, which for 2024 stands at $22,320. During the trial work period, there are no limits on your earnings. If you will reach fra in 2024, the earnings limit goes up to $59,520 and $1 is deducted from your benefits for every $3 you earn over that. This amount is known as the “maximum taxable earnings” and changes each year. The social security administration deducts $1 from your social security check. Each year we review the records for every. For 2024 that limit is $22,320. Web some people need to start drawing monthly checks at age 62. Web benefits planner | social security tax limits on your earnings | ssa. You must promptly tell social security how much you expect to earn so that the correct amount can be withheld. Web the threshold isn’t terribly high: Web in 2024, the social security income limit is $22,320 (up from $21,240 in 2023) if you are under full retirement age for the entire year. Web if you haven't reached your fra yet, the ssa imposes an earnings limit, which for 2024 stands at $22,320. 50% of anything you earn over the cap. Web in that case, the earnings. 50% of anything you earn over the cap. Web claiming prior to age 64 was the least optimal age to file, according to the data, as only 6.5% of retirees would maximize their lifetime income by filing at ages 62 or 63. The most current version of this article uses numbers for 2023. Working while collecting social security. This amount. The special earnings limit rule is an exception to social security’s earnings limit — the cap on the amount you can make from work in. We have a special rule for this situation. If you will reach fra in 2024, the earnings limit goes up to $59,520 and $1 is deducted from your benefits for every $3 you earn over. / updated december 04, 2023. / updated december 22, 2022. Web how your earnings afect your social security benefits. Web some people need to start drawing monthly checks at age 62. Each year we review the records for every working social security beneficiary to see if their additional earnings will increase their monthly benefit amount. Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings that is taxed by social security. The one exception is during the calendar year you attain full retirement age. If you will reach full. The special rule lets us pay a full social security check for any whole. This amount is known as the “maximum taxable earnings” and changes each year. That applies until the date you hit fra: Web you are entitled to $800 a month in benefits. The amount you earn can impact the benefits you receive. You must earn $6,920 to get the maximum four credits for the year. Web the special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings. You might be eligible for a higher social security benefit later.

When is it best to begin drawing Social Security Benefits?

Your Social Security Benefits Are Based On The Average Highest 35 Years

Social Security Limit What Counts as Social Security

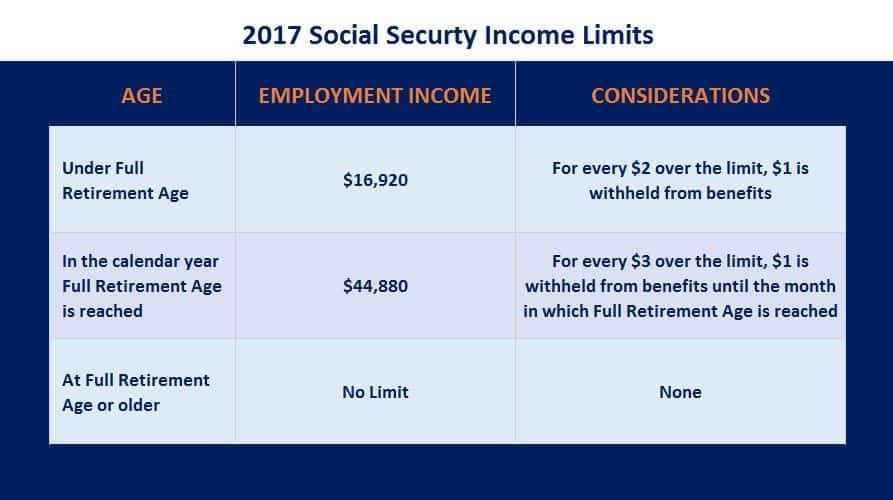

Social Security Limits 2017 Social Security Intelligence

Social Security Limit for 2022 Social Security Genius

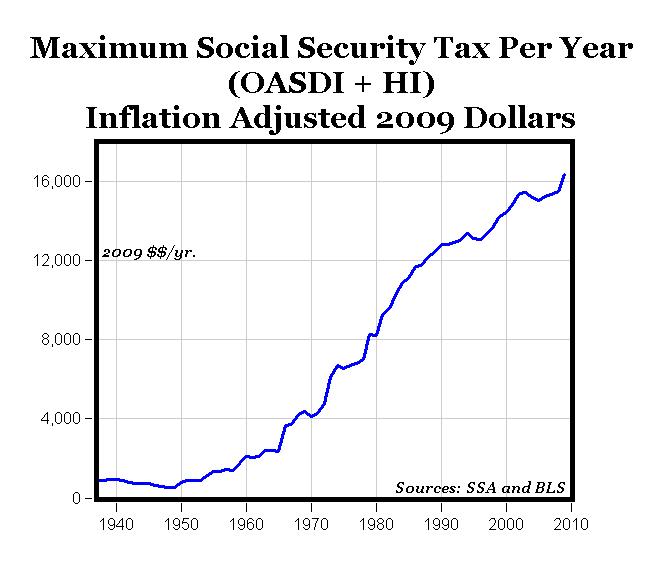

Maximum Social Security Taxes 4X Increase Since 1970 Seeking Alpha

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc

Maximum Taxable Amount For Social Security Tax (FICA)

Introduction to Social Security Aspire Wealth Advisory

Limit For Maximum Social Security Tax 2022 Financial Samurai

If You’re Not Full Retirement Age In 2024, You’ll Lose $1 In Social Security Benefits For Every $2 You Earn Above $22,320.

The Special Earnings Limit Rule Is An Exception To Social Security’s Earnings Limit — The Cap On The Amount You Can Make From Work In.

Web Published October 10, 2018.

To Do This, We Would Withhold All Benefit Payments From January 2024 Through March 2024.

Related Post: