How To Draw Money From Your 401K

How To Draw Money From Your 401K - Web withdrawing money from a 401 (k): Let's look at the pros and cons of different types of 401 (k) loans. Most 401 (k) plans allow workers to withdraw money early. Understand 401 (k) withdrawal after age 59.5. Learn your options for accessing funds in your 401 (k) or 403 (b) if you retire early. If you retire after age 59½, you can start taking withdrawals without paying an early withdrawal penalty. Learn how to avoid penalties and take money out the right way. You can make a 401 (k) withdrawal in a lump sum, but in most cases, if you do and are younger than 59½, you'll pay a 10% early withdrawal penalty in addition to taxes. At the age of 59.5, you are to considered to have reached the minimum distribution age, and can therefore begin withdrawal from your 401 (k) without being subject to a 10% penalty on early distributions. Some reasons for taking an early 401 (k). Taking an early withdrawal from your 401 (k) should only be done as a last resort. If you don’t need to access your savings just yet, you can let them. Fortunately, there are several distribution options to choose from, though there may be fees or tax implications depending on the distribution you choose. Some reasons for taking an early 401. For 2024, you can stash away up to $23,000 in your. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web other plans offer just two options: Make adjustments to that percentage depending on your circumstances. The balance. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Employees decide which investments they want and allocate funds toward those investments. Web there are three main ways to withdraw money from your 401 (k) before you. The balance / catherine song. Web it expects to report to congress with recommendations by the end of 2025, ms. Early withdrawals are typically taxed as income and may be subject to a 10% penalty. Edited by jeff white, cepf®. Understand 401 (k) withdrawal after age 59.5. Taking cash out early can be costly. Edited by jeff white, cepf®. By emily brandon and rachel hartman. Updated on december 29, 2022. Perhaps you’re met with an unplanned expense or an investment opportunity outside of your retirement plan. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web request a withdrawal (see below for exceptions to the 10% early withdrawal penalty) request a loan from your qualified retirement plan—401 (k), 403 (b), or 457 (b) (unavailable. Edited by jeff white, cepf®. Web most people younger than 59 1/2 who cash out their 401 (k) and withdraw all their money will owe a substantial tax penalty that can wipe out months, if not years, of savings. Leave the money in the plan without regular withdrawals, or take the entire amount in a lump sum. You can start. Here's how to minimize taxes and penalties as you withdraw money from retirement accounts. Learn how to avoid penalties and take money out the right way. Updated on december 29, 2022. Web it expects to report to congress with recommendations by the end of 2025, ms. An unexpected job loss, illness or other emergencies can wreak havoc on family finances,. Most 401 (k) plans allow workers to withdraw money early. Web request a withdrawal (see below for exceptions to the 10% early withdrawal penalty) request a loan from your qualified retirement plan—401 (k), 403 (b), or 457 (b) (unavailable for iras) apply for a hardship, or unforeseen emergency, withdrawal by meeting certain requirements (unavailable for iras) Make adjustments to that. Web request a withdrawal (see below for exceptions to the 10% early withdrawal penalty) request a loan from your qualified retirement plan—401 (k), 403 (b), or 457 (b) (unavailable for iras) apply for a hardship, or unforeseen emergency, withdrawal by meeting certain requirements (unavailable for iras) At the age of 59.5, you are to considered to have reached the minimum. Taking qualified distributions from your retirement plan. If you took an early withdrawal of $10,000 from your 401 (k) account, the irs could assess a 10% penalty on the withdrawal if it’s not covered by any of the exceptions outlined. The balance / catherine song. Fact checked by aaron johnson. Withdrawing your 401 (k) money incorrectly can be costly. Web a 401 (k) hardship withdrawal is the process of accessing funds in your workplace 401 (k) account before retirement age (currently age 59 ½). Deciding how to withdraw your savings in retirement can be tricky due to two unknowns: While there are typically penalties for withdrawing funds prior to retirement age, a hardship withdrawal allows certain individuals to access specific funds within retirement accounts without paying a 10. Let's look at the pros and cons of different types of 401 (k) loans. Understand 401 (k) withdrawal after age 59.5. Web request a withdrawal (see below for exceptions to the 10% early withdrawal penalty) request a loan from your qualified retirement plan—401 (k), 403 (b), or 457 (b) (unavailable for iras) apply for a hardship, or unforeseen emergency, withdrawal by meeting certain requirements (unavailable for iras) Market performance and your longevity. Web it expects to report to congress with recommendations by the end of 2025, ms. Web there are many different ways to take money out of a 401 (k), including: Some reasons for taking an early 401 (k). Web other plans offer just two options:

15 Easy Money Drawing Ideas How to Draw Money

How to Draw Money Step by Step Easy for Beginners Simple Money

How to Draw Money Easy StepbyStep YouTube

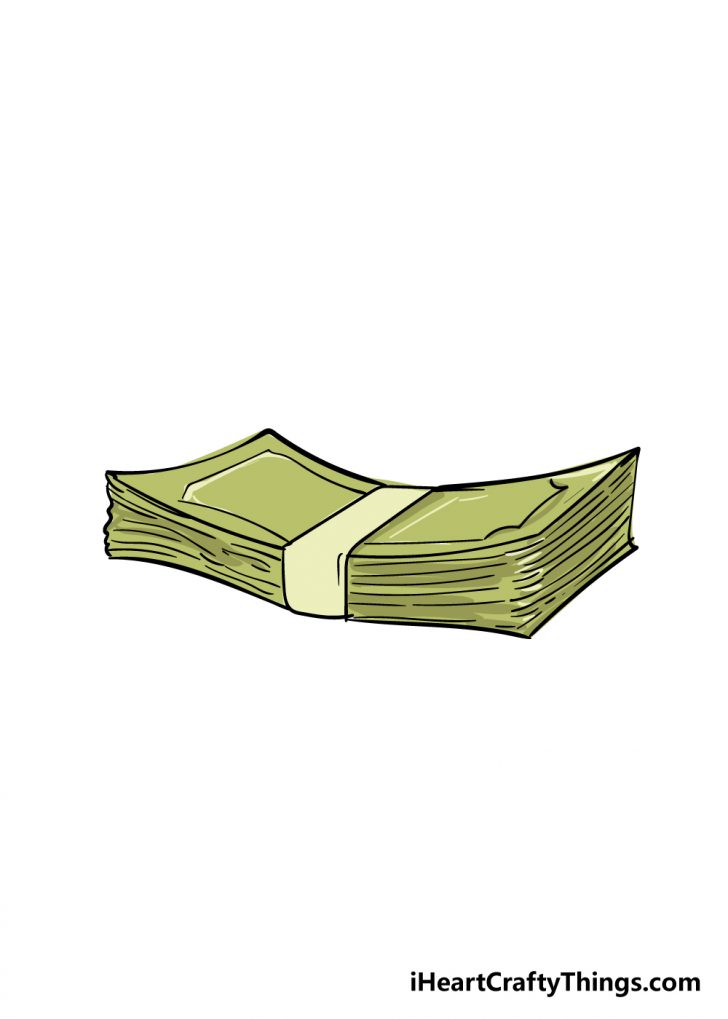

Money Drawing How To Draw Money Step By Step

HOW TO DRAW MONEY EASY STEP BY STEP YouTube

Money Drawing How To Draw Money Step By Step

How to Draw MONEY EASY Step by Step YouTube

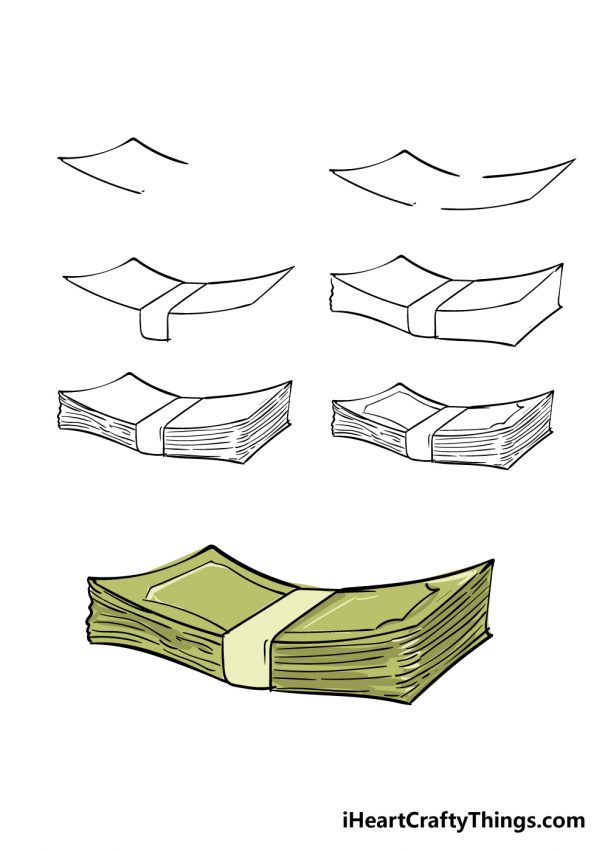

How to Draw a Stack of Money Really Easy Drawing Tutorial

Money Drawing How To Draw Money Step By Step

Money Drawing How To Draw A Money Step by Step for Beginners YouTube

Employees Decide Which Investments They Want And Allocate Funds Toward Those Investments.

Fortunately, There Are Several Distribution Options To Choose From, Though There May Be Fees Or Tax Implications Depending On The Distribution You Choose.

If You Are Under Age 59½, In Most Cases You Will Incur A 10% Early Withdrawal Penalty And Owe.

401 (K) How To Make A 401 (K) Hardship Withdrawal.

Related Post: