How To Draw From 401K

How To Draw From 401K - Web you can withdraw $600.25 at the beginning of each month to deplete your expected balance by the end of your retirement. A 401(k) account alone may not help you save as much as you need for retirement.; An unexpected job loss, illness or other emergencies can wreak havoc on family finances, but taking an. Find out how to calculate your 401(k) penalty if you plan to access funds early. Web your plan description or plan document should outline these points clearly. A hardship withdrawal avoids a penalty charge but not taxes. Understand 401 (k) withdrawal after age 59.5. The rules for accessing your money are determined by your employer's plan. Web age 59½ is the earliest you can withdraw funds from an ira account and pay no penalty. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional. At the age of 59.5, you are to considered to have reached the minimum. You generally must start taking withdrawals. That could mean giving the government $1,000,. How to withdraw from your 401 (k) plan in retirement. Web to make a qualified withdrawal from a roth 401 (k) account, retirement savers must have been contributing to the account for at. Check out a few rules and options to consider before withdrawing. What is the 4% withdrawal rule? Web age 59½ is the earliest you can withdraw funds from an ira account and pay no penalty. Web drawbacks of 401(k) accounts: The rules for accessing your money are determined by your employer's plan. Web here’s how it works. How to withdraw from your 401 (k) plan in retirement. Web factors such as savings amount, investment returns, and withdrawal rate significantly impact the duration of a 401(k) in retirement. However, no law requires companies to permit 401. Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial. 401 (k) withdrawals are often subject to heavy penalties and additional taxes. Web to make a qualified withdrawal from a roth 401 (k) account, retirement savers must have been contributing to the account for at least the previous five years and be at least 59½. You can withdraw money when you retire, take out a 401 (k) loan, make a. Check out a few rules and options to consider before withdrawing. Not everyone has access to a 401(k) plan at their workplace. 401 (k) withdrawals are often subject to heavy penalties and additional taxes. You can withdraw money when you retire, take out a 401 (k) loan, make a hardship withdrawal,. If you are under age 59½, in most cases. Web whether you’ve reached retirement age or need to tap your 401(k) early to pay for an unexpected expense, there are various ways to withdraw money from your employer. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. Learn finance easily.learn more.free animation videos.learn at no cost. You can also check. What is the 4% withdrawal rule? Web early withdrawals from a 401(k) retirement plan are taxed by the irs. For 2024, you can’t put more than $7,000 into a roth, plus another $1,000 if. Web spousal benefits cap at 50% of a spouse's monthly payout. Understand 401 (k) withdrawal after age 59.5. Your options are subject to the conditions set forth in your retirement plan, so depending on how your. Taking cash out early can be costly. Understand 401 (k) withdrawal after age 59.5. The rules for accessing your money are determined by your employer's plan. Every employer's plan has different rules for 401 (k) withdrawals and loans, so. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k). Taking cash out early can be costly. Web early withdrawals from a 401(k) retirement plan are taxed by the irs. Web drawbacks of 401(k) accounts: A hardship withdrawal. If you are under age 59½, in most cases you will incur a 10% early withdrawal. The rules for accessing your money are determined by your employer's plan. Web factors such as savings amount, investment returns, and withdrawal rate significantly impact the duration of a 401(k) in retirement. 401 (k) how to make a 401 (k) hardship withdrawal. You generally. Web factors such as savings amount, investment returns, and withdrawal rate significantly impact the duration of a 401(k) in retirement. Web whether you’ve reached retirement age or need to tap your 401(k) early to pay for an unexpected expense, there are various ways to withdraw money from your employer. Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial penalties. How to withdraw from your 401 (k) plan in retirement. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. Understand the costs before you act. A 401(k) account alone may not help you save as much as you need for retirement.; Web here’s how it works. At the age of 59.5, you are to considered to have reached the minimum. Web you can withdraw $600.25 at the beginning of each month to deplete your expected balance by the end of your retirement. You generally must start taking withdrawals. 401 (k) withdrawals are often subject to heavy penalties and additional taxes. Find out how to calculate your 401(k) penalty if you plan to access funds early. Web early withdrawals from a 401(k) retirement plan are taxed by the irs. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k). You can access funds from an old 401(k) plan after you reach age 59½ even if you.

When Can I Draw From My 401k Men's Complete Life

Your Guide To 401k 11 Common Questions Answered PensionsWeek

When Can I Draw From My 401k Men's Complete Life

How To Draw Money From 401k LIESSE

.jpg)

What Is a 401(k)? Everything You Need to Know Ramsey

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

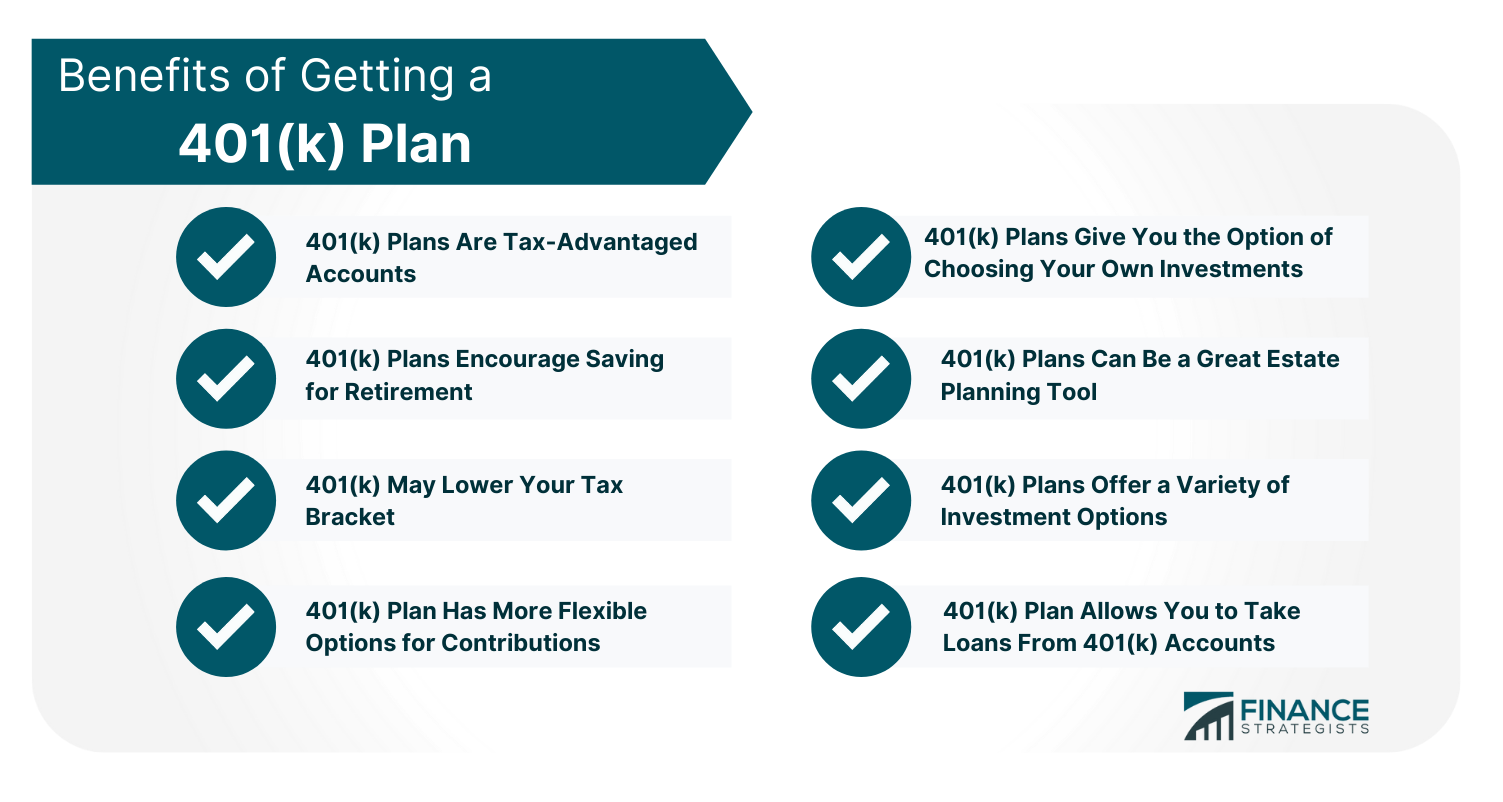

What Are the Benefits of Having 401(k) Plan?

3 Ways to Withdraw from Your 401K wikiHow

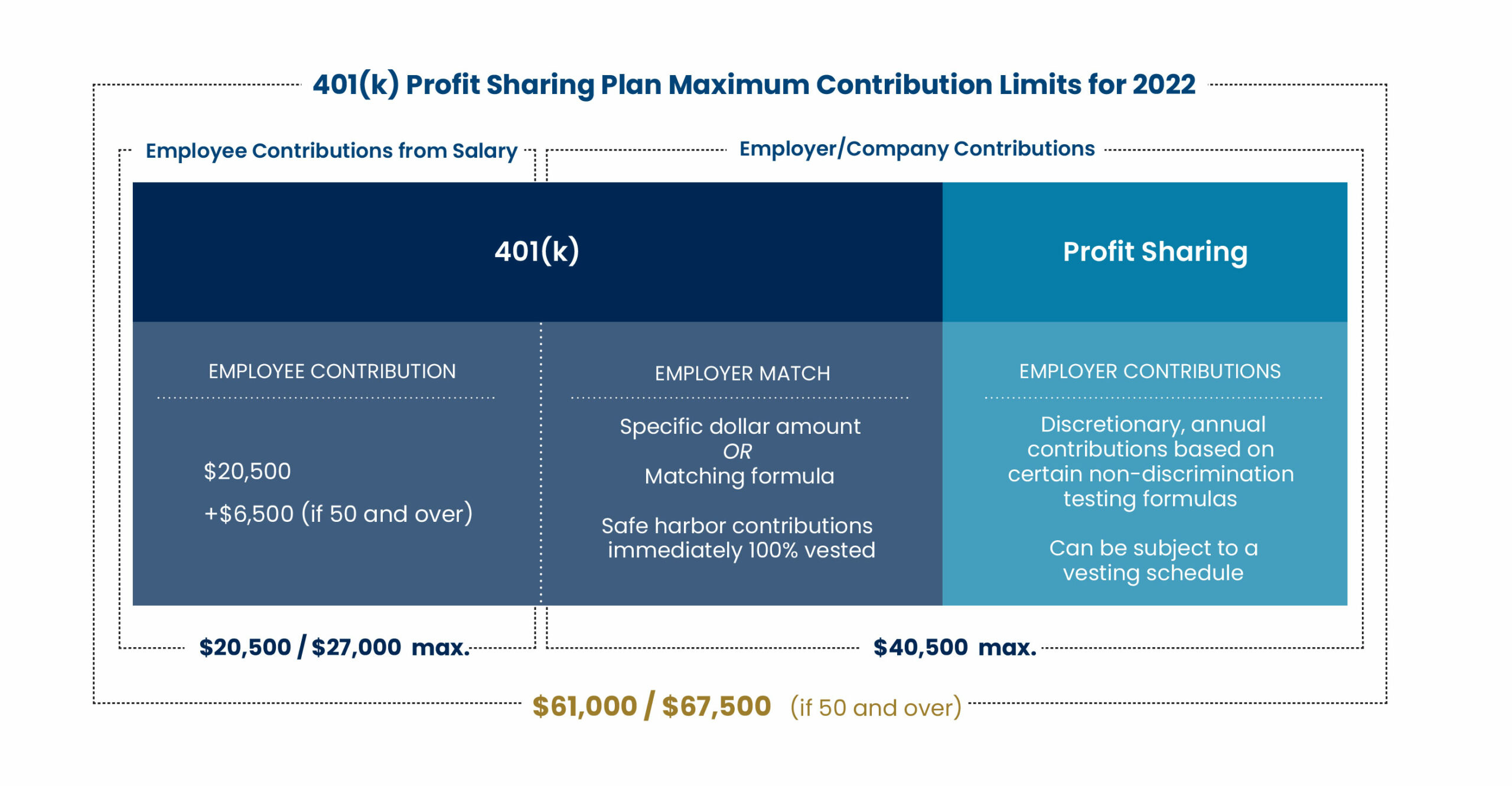

Best Guide to 401k for Business Owners 401k Small Business Owner Tips

401(k) Contribution Limits & How to Max Out the BP Employee Savings

A Hardship Withdrawal Avoids A Penalty Charge But Not Taxes.

An Unexpected Job Loss, Illness Or Other Emergencies Can Wreak Havoc On Family Finances, But Taking An.

Web Consider These Withdrawal Rules:

You Can Also Check With Your Benefits Department.

Related Post: