How To Categorize Owner Is Draw In Quickbooks Online

How To Categorize Owner Is Draw In Quickbooks Online - Open the chart of accounts. Click chart of accounts and click add. 3. Web what is the owner’s draw in quickbooks? This includes ensuring that the. Are there directions for those who have a newer. 20k views 6 years ago. Web categorizing owner distribution in transactions within quickbooks involves assigning specific labels or categories to the financial activities related to the allocation of profits. Web setting up categories in quickbooks online involves customizing the chart of accounts to accurately represent the financial categories relevant to the business. Web set up and pay an owner's draw. A complete quickbooks online training. 3k views 1 year ago quickbooks online training tutorial: Click the list option on the menu bar at the top of the window. Are there directions for those who have a newer. Typically this would be a sole proprietorship or llc where the business and the. This includes ensuring that the. Learn how to pay an owner of a sole proprietor business in quickbooks online. 20k views 6 years ago. Web in quickbooks desktop application, you can simply set up or categorize an owner’s draw account in addition to writing a check from it. Business owners often use the company’s. Last updated march 21, 2022 7:40 pm. Similar to the process of recording owner’s draw, the first step in zeroing out owner’s draw requires opening the chart of accounts in. Web categorizing owner distribution in transactions within quickbooks involves assigning specific labels or categories to the financial activities related to the allocation of profits. If you're a sole proprietor, you must be paid with an owner's draw.. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. You must set owner draw in quickbooks to record the withdrawn amount and transaction details. Business owners often use the company’s. Select the equity account option. Web owners draw or owners deposits and entering them into quickbooks online can be confusing. As an owner of a. Web what is the owner’s draw in quickbooks? Solved • by quickbooks • 875 • updated 1 year ago. Creating equity account for owner's draw. This includes ensuring that the. Typically this would be a sole proprietorship or llc where the business and the. Creating equity account for owner's draw. Web owners draw or owners deposits and entering them into quickbooks online can be confusing. 3k views 1 year ago quickbooks online training tutorial: Don't forget to like and subscribe. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Last updated march 21, 2022 7:40 pm. Solved • by quickbooks • 875 • updated 1 year ago. March 21, 2022 07:40 pm. Typically this would be a sole proprietorship or llc where the business and the. Web owners draw or owners deposits and entering them into quickbooks online can be confusing. 10k views 2 years ago. Typically this would be a sole proprietorship or llc where the business and the. Solved • by quickbooks • 875 • updated 1 year ago. An owner’s draw is when an owner takes money out of the business. Web categorizing owner distribution in transactions within quickbooks involves assigning specific labels or categories to the financial activities related to the allocation of profits. Open the chart of accounts. Web in quickbooks desktop application, you can simply set up or categorize an owner’s draw account in addition to writing a check from it. Select the equity account option. Similar to. 20k views 6 years ago. Solved • by quickbooks • 875 • updated 1 year ago. Maybe you don’t know which account to put them in? Learn how to pay an owner of a sole proprietor business in quickbooks online. Web in quickbooks desktop application, you can simply set up or categorize an owner’s draw account in addition to writing. Click chart of accounts and click add. 3. Maybe you don’t know which account to put them in? As an owner of a. Similar to the process of recording owner’s draw, the first step in zeroing out owner’s draw requires opening the chart of accounts in. Creating equity account for owner's draw. Learn about recording an owner’s draw in intuit quickbooks online with the. Typically this would be a sole proprietorship or llc where the business and the. An owner’s draw is when an owner takes money out of the business. Click the list option on the menu bar at the top of the window. You must set owner draw in quickbooks to record the withdrawn amount and transaction details. Don't forget to like and subscribe. 10k views 2 years ago. Last updated march 21, 2022 7:40 pm. If you're a sole proprietor, you must be paid with an owner's draw. Select the equity account option. You can use the chart of accounts to.

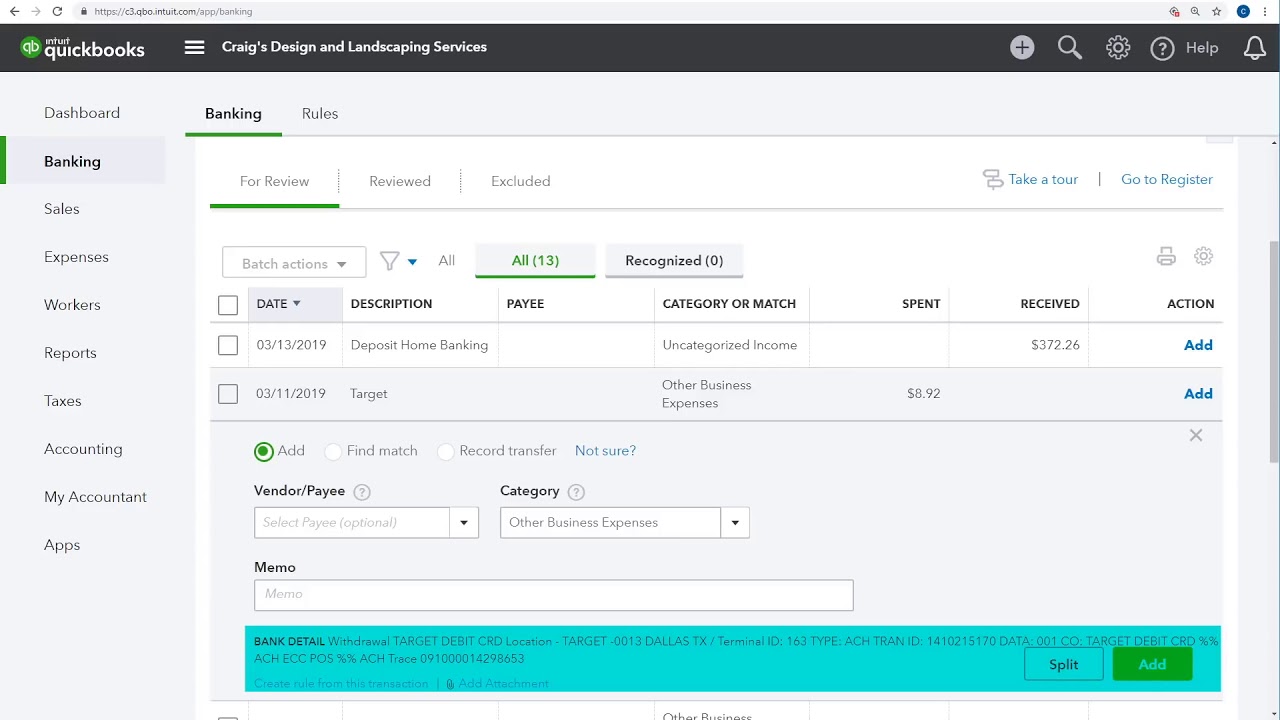

How to categorize/record transaction in QuickBooks Online YouTube

How to record owner's draw in QuickBooks Online Scribe

Learn How to Record Owner Investment in QuickBooks Easily

How to record owner's draw in QuickBooks Online Scribe

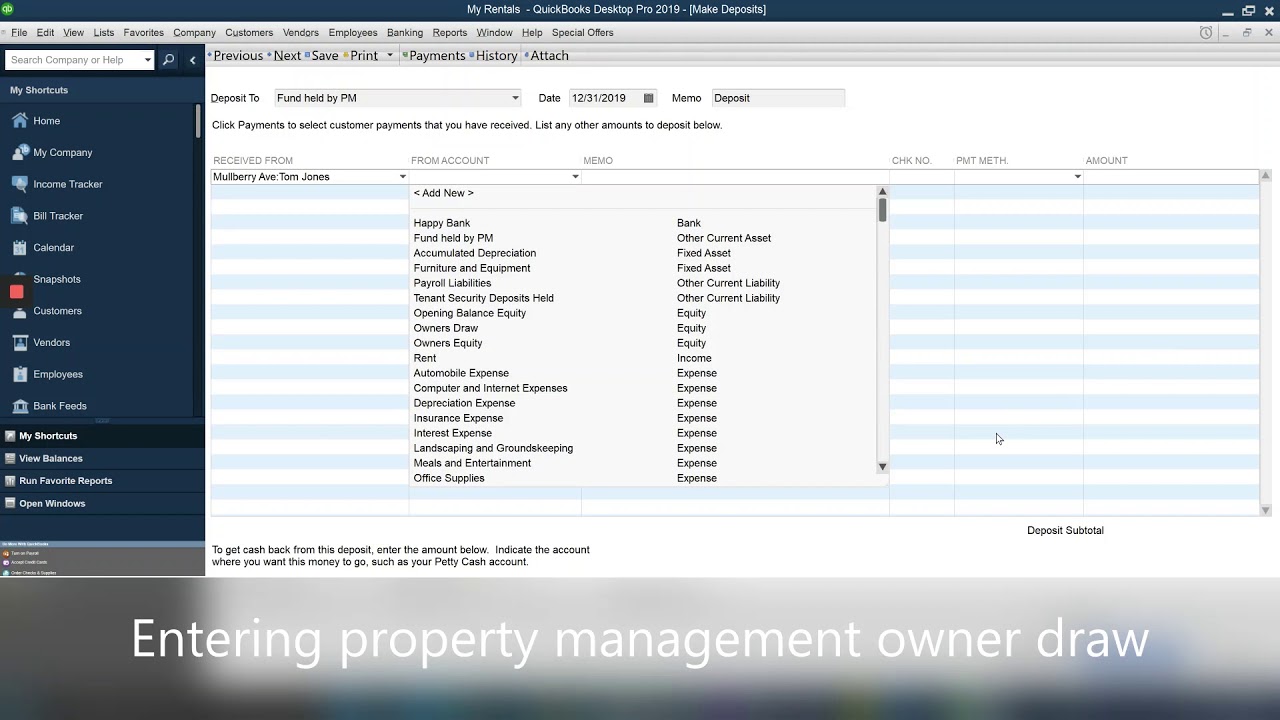

Owners Draw Quickbooks Desktop DRAWING IDEAS

Quickbooks Owner Draws & Contributions YouTube

How to Categorize Transactions From Your Bank & Credit Card QuickBooks

How to Record Owner's Equity Draws in QuickBooks Online YouTube

How to enter the property management owner draw to QuickBooks YouTube

Owners draw balances

Web Owners Draw Or Owners Deposits And Entering Them Into Quickbooks Online Can Be Confusing.

Web Set Up And Pay An Owner's Draw.

Web What Is The Owner’s Draw In Quickbooks?

A Complete Quickbooks Online Training.

Related Post: