How Much Will I Draw At 62

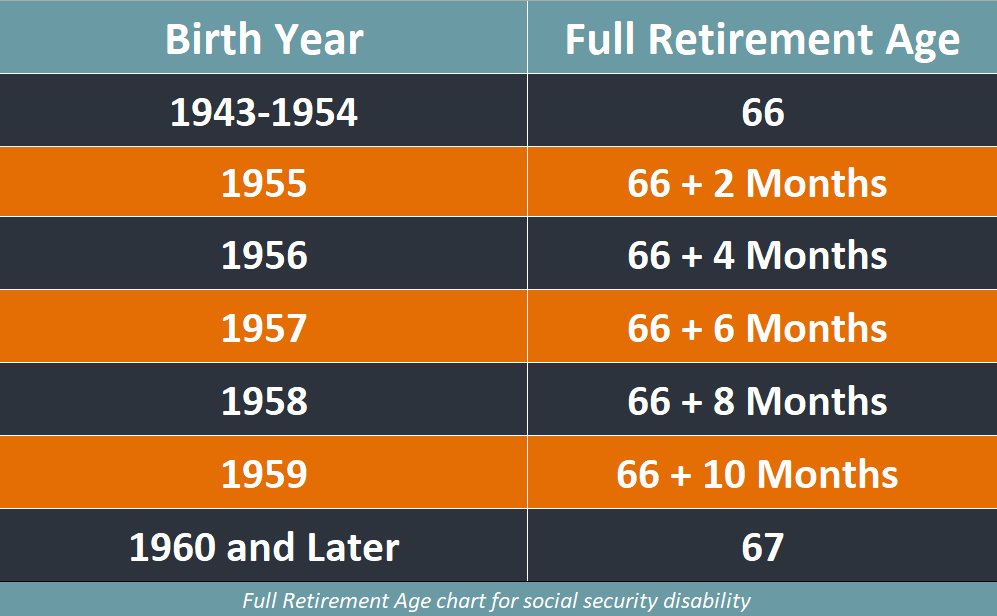

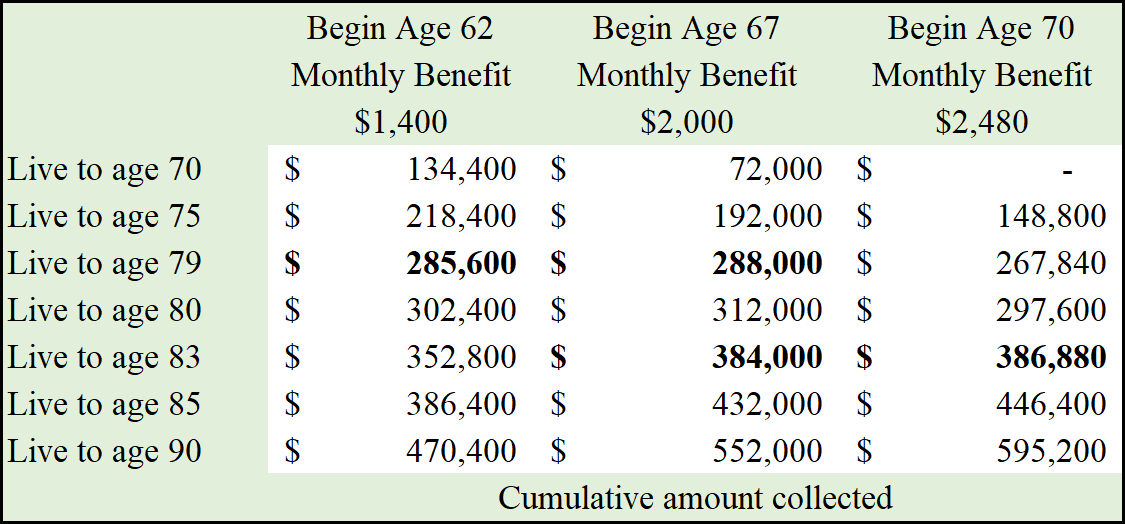

How Much Will I Draw At 62 - Web however, the social security administration reduces benefits by 30% for people who retire at 62, meaning they receive just 70% of their full retirement benefit. / updated december 12, 2023. If, for example, you stop working at age 60 but wait until 67 to claim social security, your. If you were born in 1962 or later, for instance, filing at 62. For example, if you were born between 1943 and 1954, your payouts will be reduced 25% if you start. Today's dollars or inflated (future). Those who are 62, by. Web published october 10, 2018. That's enough to replace the median income in the u.s. Select to see your benefit estimate in. Today's dollars or inflated (future). Web most people first become eligible to collect social security retirement benefits at age 62. Web claiming when you turn 62 would provide a spousal benefit equal to 35 percent of your mate's full retirement benefit. But if you do so, rather than waiting until your full retirement age of 67, your monthly benefit. Desired. That's enough to replace the median income in the u.s. But if you do so, rather than waiting until your full retirement age of 67, your monthly benefit. Web most people first become eligible to collect social security retirement benefits at age 62. Web if you do not give a retirement date and if you have not reached your normal. Web most people first become eligible to collect social security retirement benefits at age 62. For example, if you were born between 1943 and 1954, your payouts will be reduced 25% if you start. Select to see your benefit estimate in. The proportion increases each month you. But if you do so, rather than waiting until your full retirement age. So all told, it's hard to say definitively that you'll lose out financially by claiming social. You will qualify for benefits at age 62. Every month you delay increases your benefits. That's enough to replace the median income in the u.s. Web if you do not give a retirement date and if you have not reached your normal (or full). Web filing at age 67, or fra, leaves you with $216,000, which is $19,200 less. Today's dollars or inflated (future). Easy retirement planningpersonalized action plantakes just 3 minutes So all told, it's hard to say definitively that you'll lose out financially by claiming social. For example, if you were born between 1943 and 1954, your payouts will be reduced 25%. Today's dollars or inflated (future). Easy retirement planningpersonalized action plantakes just 3 minutes If, for example, you stop working at age 60 but wait until 67 to claim social security, your. Select to see your benefit estimate in. Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your. For example, if you were born between 1943 and 1954, your payouts will be reduced 25% if you start. It depends on when you were born. Web however, the social security administration reduces benefits by 30% for people who retire at 62, meaning they receive just 70% of their full retirement benefit. The proportion increases each month you. That's enough. Web however, the social security administration reduces benefits by 30% for people who retire at 62, meaning they receive just 70% of their full retirement benefit. Desired age to begin social security. The proportion increases each month you. Web if you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age. Web claiming when you turn 62 would provide a spousal benefit equal to 35 percent of your mate's full retirement benefit. Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. So all told, it's. If you were born in 1962 or later, for instance, filing at 62. Today's dollars or inflated (future). Every month you delay increases your benefits. Web most people first become eligible to collect social security retirement benefits at age 62. Web by filing at 62, or any time before you reach full retirement age, you forfeit a portion of your. Select to see your benefit estimate in. Web in order to confidently answer this question, you'll first need to be aware of the factors used to calculate your social security benefit, know how much the average. Web published october 10, 2018. Every month you delay increases your benefits. Web the average retiree collects around $739 more per month at age 70 than at age 62, according to the social security administration's most recent data released in. Web most people first become eligible to collect social security retirement benefits at age 62. Easy retirement planningpersonalized action plantakes just 3 minutes However, if you wait, your future monthly retirement benefit increases each. Starting with the month you reach full retirement age, you. It depends on when you were born. Web if you do not give a retirement date and if you have not reached your normal (or full) retirement age, the quick calculator will give benefit estimates for three different retirement ages. Web estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70) calculate what payments you would receive based on your. Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. That's enough to replace the median income in the u.s. Desired age to begin social security. Web claiming when you turn 62 would provide a spousal benefit equal to 35 percent of your mate's full retirement benefit.

How To Draw A Dog From Number 62 Cute Dog Drawing Easy Step By Step

How Much Social Security Will I Get At Age 63?

Can You Answer These 5 Social Security Questions?

Managing Your Social Security Benefits

Can I Draw Medicare At 62

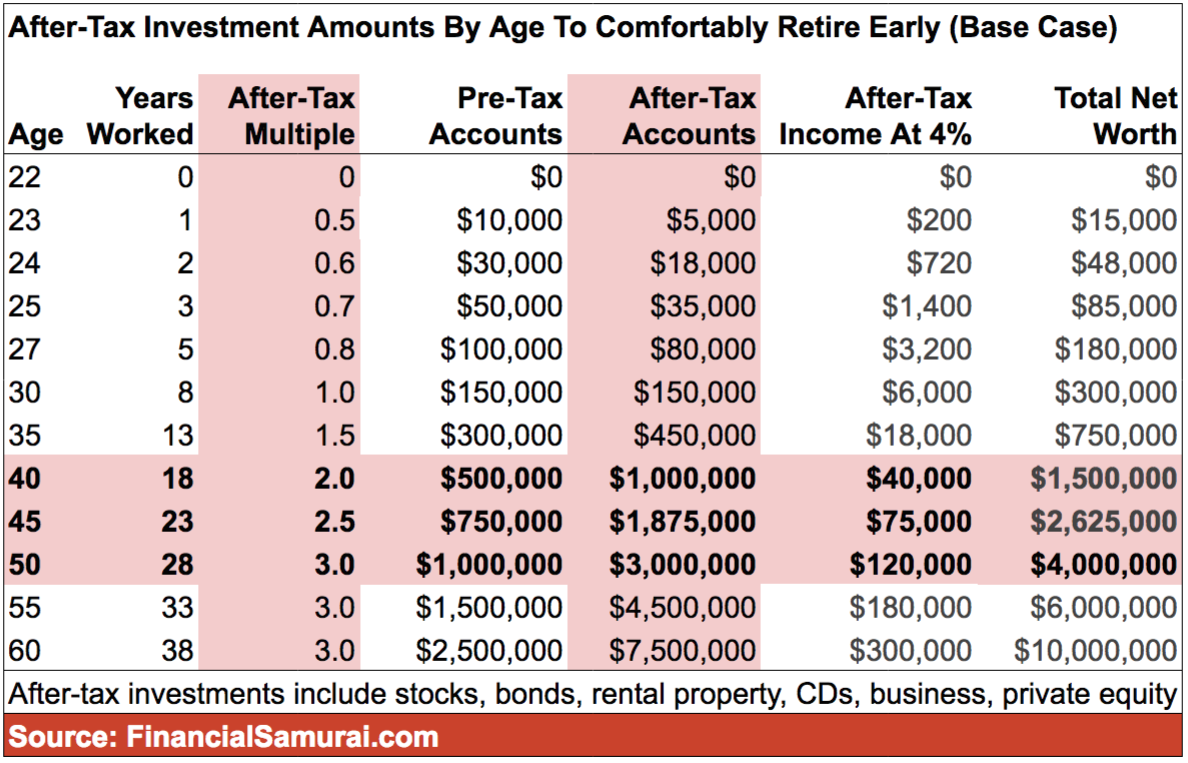

How Much Money Do I Need By Age To Retire Early? Financial Samurai

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

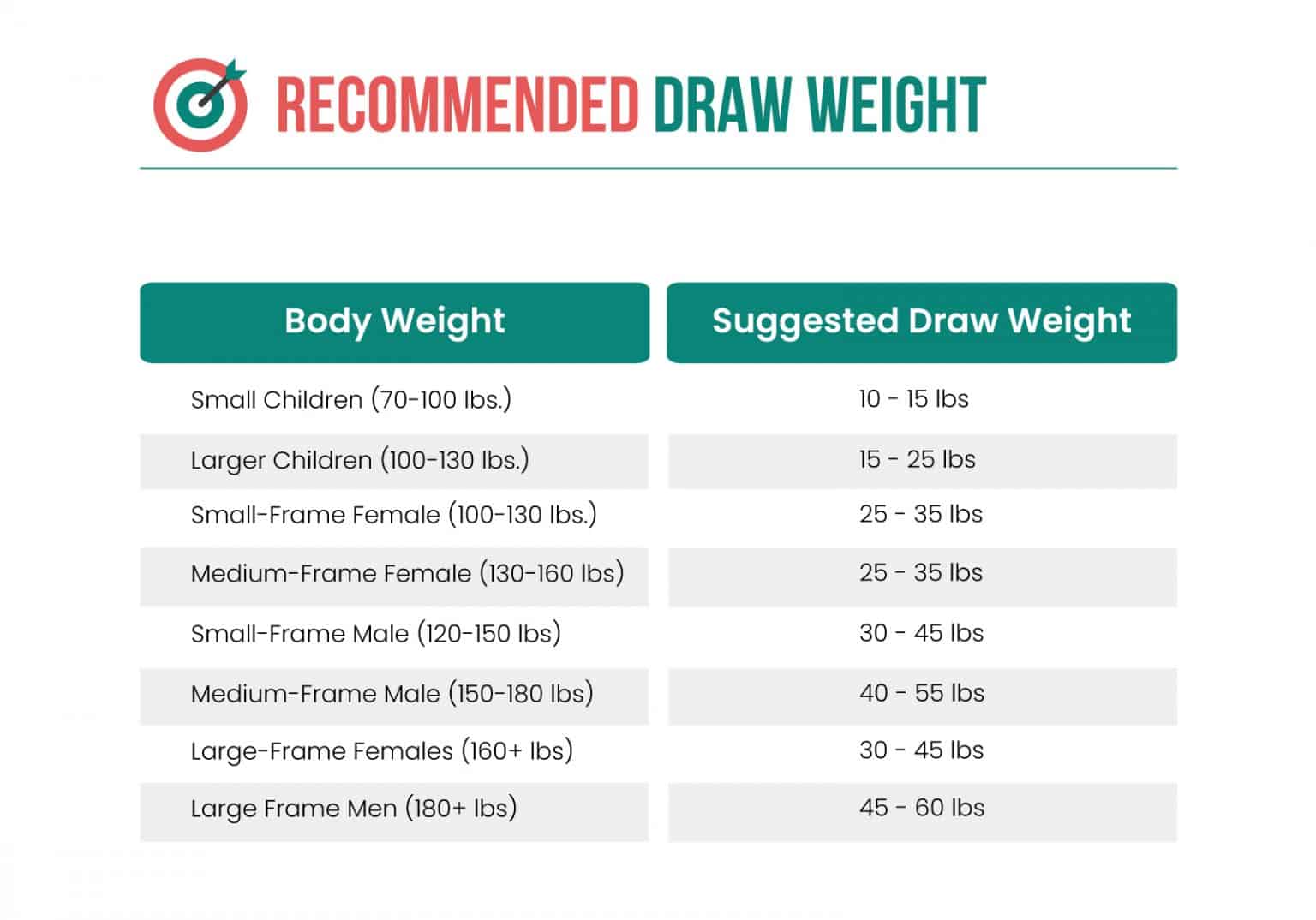

How to Calculate & Determine Bow Draw Weight

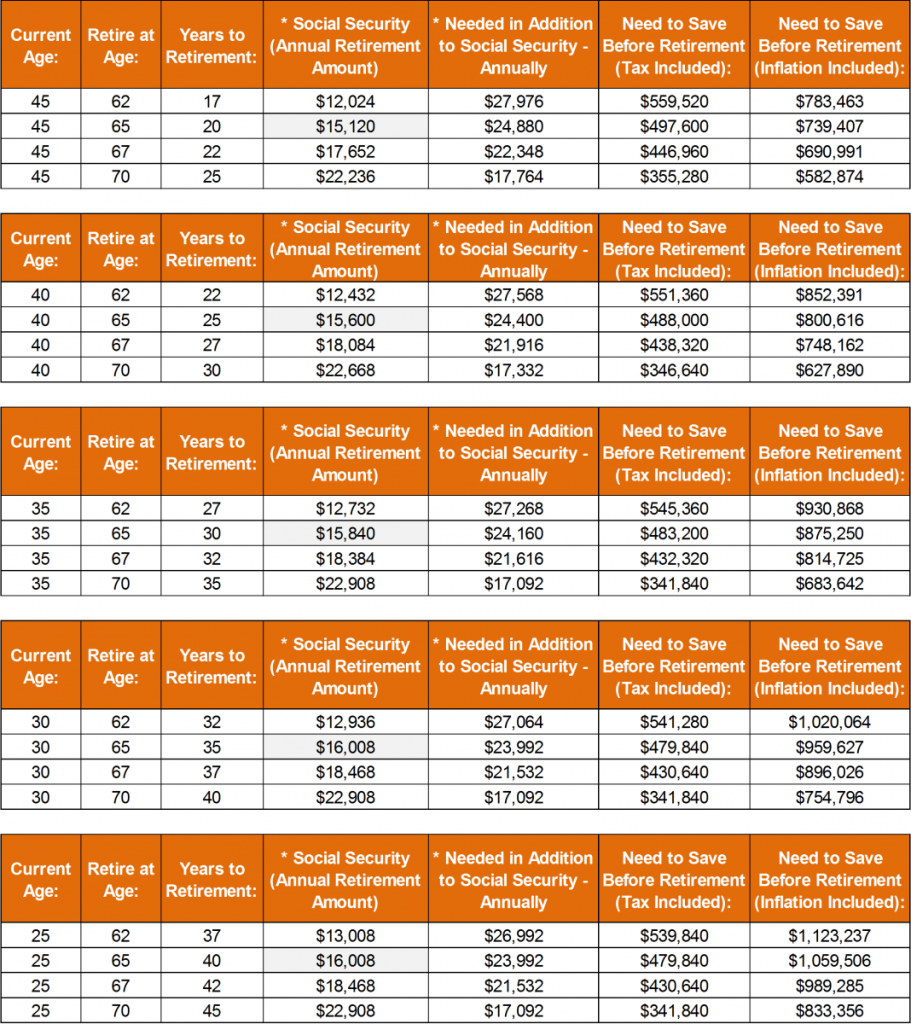

How Much Do I Need To Retire at 55, 62, 65, 70 or at any age? Market

Should I retire now at age 62 and collect Social Security benefits, or

You Will Qualify For Benefits At Age 62.

Web By Filing At 62, Or Any Time Before You Reach Full Retirement Age, You Forfeit A Portion Of Your Monthly Benefit.

Web In 2024, You Will Turn 62, The Minimum Age To Claim Retirement Benefits.

If You Claim Social Security At Age 62, Rather Than Wait Until Your Full Retirement Age (Fra), You Can Expect A 30% Reduction In.

Related Post: