How Much To Draw From 401K

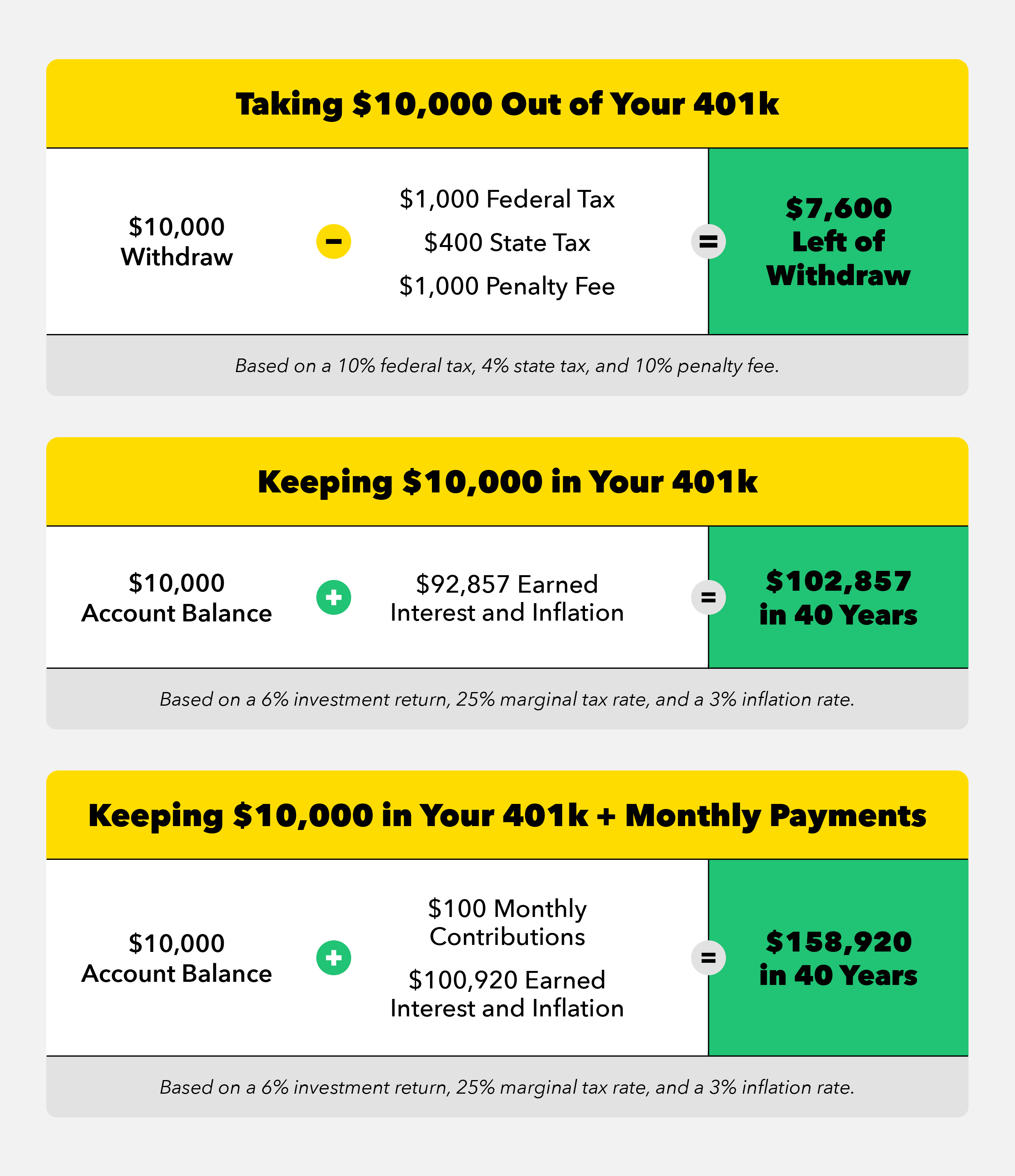

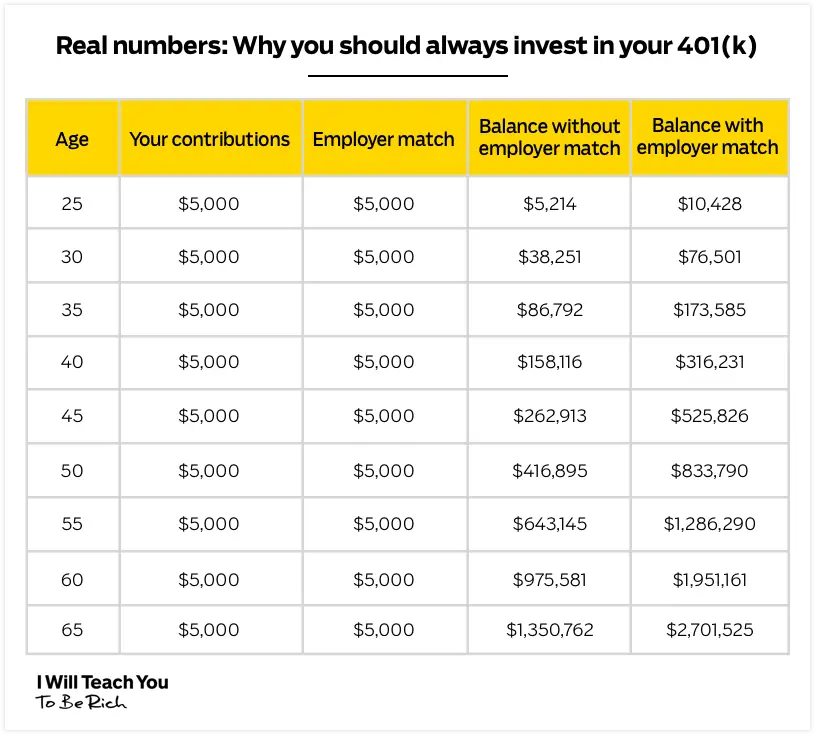

How Much To Draw From 401K - Use the calculator to let the math prove which is the optimum choice. Perhaps the biggest consequence of an early 401 (k). Web what are required minimum distributions? Generally speaking, the only penalty assessed on early withdrawals from a traditional 401 (k) retirement plan is the. We designed the retirement withdrawal calculator to find the answer to these questions. Enter the annual interest rate you expect to earn (%): Web updated on december 29, 2022. The distributions are required to start when you turn age 72 (or 70 1/2 if you were born before 7/1/1949). Web so if you withdrew $10,000, you might only receive $7,000 after the 20% irs tax withholding and a 10% penalty. Web those limits are up from tax year 2023. Enter the expected average annual rate of. This calculator has been updated for the 'secure act of 2019 and cares. That could mean giving the government $1,000, or 10% of a. Web what are required minimum distributions? (updated march 14, 2023) required minimum distributions (rmds) are minimum amounts that ira and retirement plan account owners generally must withdraw annually starting. Web updated february 09, 2024. Web while it's impossible to know exactly how markets will behave, the standard & poor's (s&p) 500 index, which tracks the performance of 500 of the leading public u.s. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty. Web updated on december 29, 2022. Be sure you know the 401 (k) withdrawal rules. Web how much money can i withdraw during retirement? Enter the age you plan to retire at (#): Enter the number of years you would like to make the monthly withdrawals (#): 401 (k) early withdrawal calculator. Enter the amount you would like to withdraw each month ($): Please review the highlighted fields. Web you could withdraw 3.3 percent of this money, or $3,300, in that first year. Your 401 (k) will contribute. Web you could withdraw 3.3 percent of this money, or $3,300, in that first year. Web so if you withdrew $10,000, you might only receive $7,000 after the 20% irs tax withholding and a 10% penalty. Like the 4% retirement withdrawal rule, the safe withdrawal rate model usually leads to a retiree using no more than 3% or 4% of. (they may be able to. Be sure you know the 401 (k) withdrawal rules. An early withdrawal from a 401 (k) means missing out on the investment growth in the fund. Edited by jeff white, cepf®. What's more, you can follow the progress of your balance in a dynamic chart or a withdrawal schedule to help you to make a. 401 (k) withdrawals are an option in certain circumstances. Maybe even a little frustrated that you're in. Like the 4% retirement withdrawal rule, the safe withdrawal rate model usually leads to a retiree using no more than 3% or 4% of their total available. Come retirement, though, your withdrawals are subject to income taxes and other rules. The balance /. Web use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year. Web those limits are up from tax year 2023. Fact checked by aaron johnson. Some fields are incomplete or the information is incorrect. Web updated february 09, 2024. Generally speaking, the only penalty assessed on early withdrawals from a traditional 401 (k) retirement plan is the. Enter the amount you would like to withdraw each month ($): Please review the highlighted fields. Your 401 (k) will contribute. Like the 4% retirement withdrawal rule, the safe withdrawal rate model usually leads to a retiree using no more than 3%. Web while it's impossible to know exactly how markets will behave, the standard & poor's (s&p) 500 index, which tracks the performance of 500 of the leading public u.s. Enter the annual interest rate you expect to earn (%): Your 401 (k) will contribute. A 401(k) account alone may not help you save as much as you need for retirement.;. The balance / catherine song. Web drawbacks of 401(k) accounts: Web use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year. In retirement at your current savings rate. Some employers will also match some of your contributions, which means “free money” for you. Web if you withdraw money from your 401 (k) before you’re 59 ½, the irs usually assesses a 10% tax as an early distribution penalty. Fact checked by aaron johnson. Enter the amount you would like to withdraw each month ($): 401 (k) early withdrawal calculator. Come retirement, though, your withdrawals are subject to income taxes and other rules. This calculator has been updated for the 'secure act of 2019 and cares. A 401(k) account alone may not help you save as much as you need for retirement.; Web updated february 09, 2024. 401 (k) early withdrawal calculator. Web updated on december 29, 2022. Enter your current age (#):

How Much Should I Have In My 401k By Age? Here's The Answer Digest

Simple Ira 2024 Catch Up Ellie Hesther

How Much Can I Take Out of My 401k? A Guide to Calculating and

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

Is it smart to withdraw from 401k to pay off debt? Leia aqui Is it

What are the pros and cons of borrowing from a 401k? Leia aqui What is

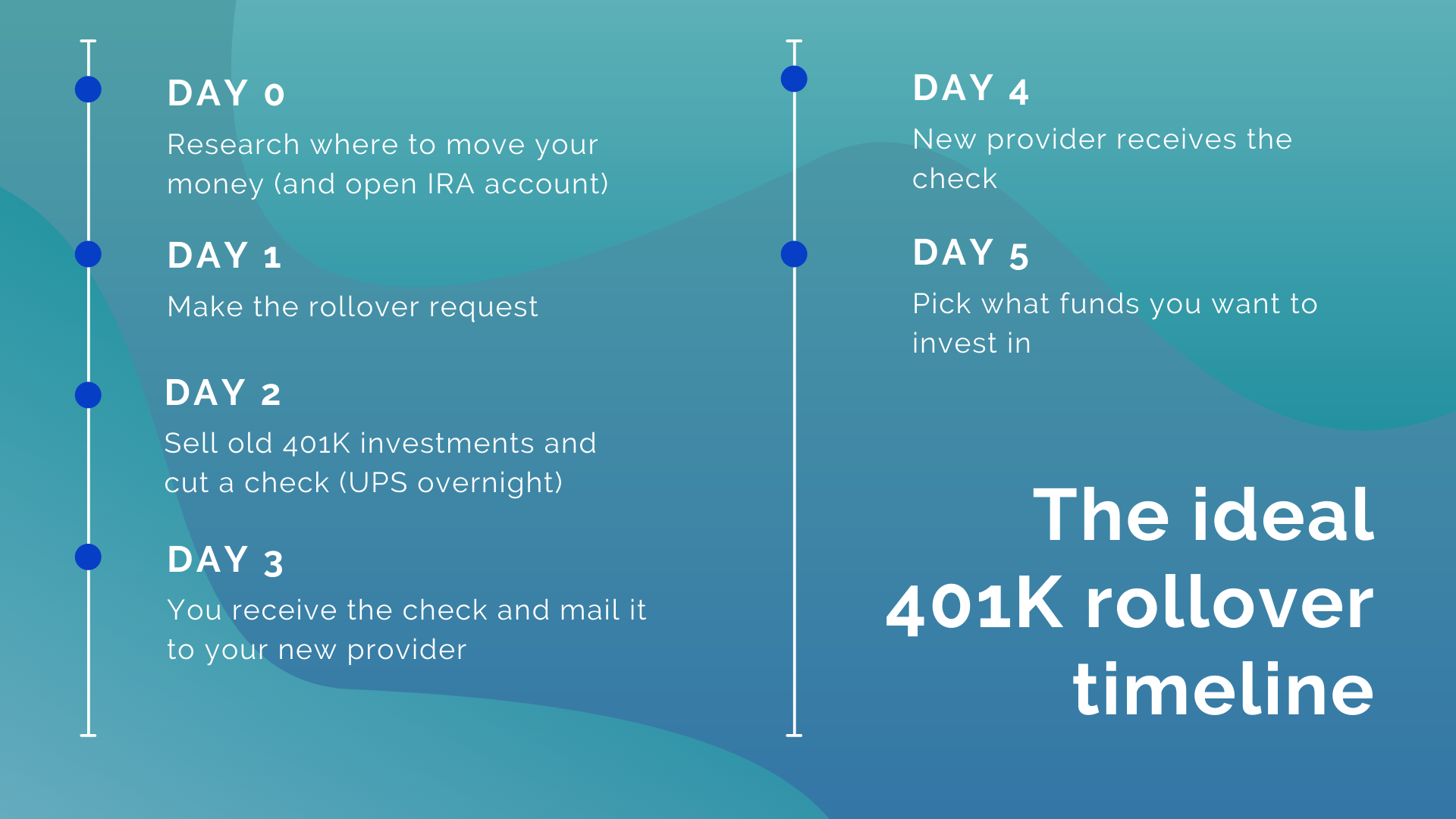

How To Rollover 401k From Previous Employer To New Employer Free Hot

:max_bytes(150000):strip_icc()/howtotakemoneyoutofa401kplan-79531c969f74433db11c032e3cfd3636.png)

How To Take Money out of a 401(k) Plan

How Do I Transfer My 401k To A New Job

The Hidden Pitfalls of 401(k) Accounts Why an IRA Rollover Could Be

How To Draw Money From 401k LIESSE

That Could Mean Giving The Government $1,000, Or 10% Of A.

Enter The Number Of Years You Would Like To Make The Monthly Withdrawals (#):

Some Fields Are Incomplete Or The Information Is Incorrect.

Web So If You Withdrew $10,000, You Might Only Receive $7,000 After The 20% Irs Tax Withholding And A 10% Penalty.

Related Post: