How Much To Draw From 401K In Retirement

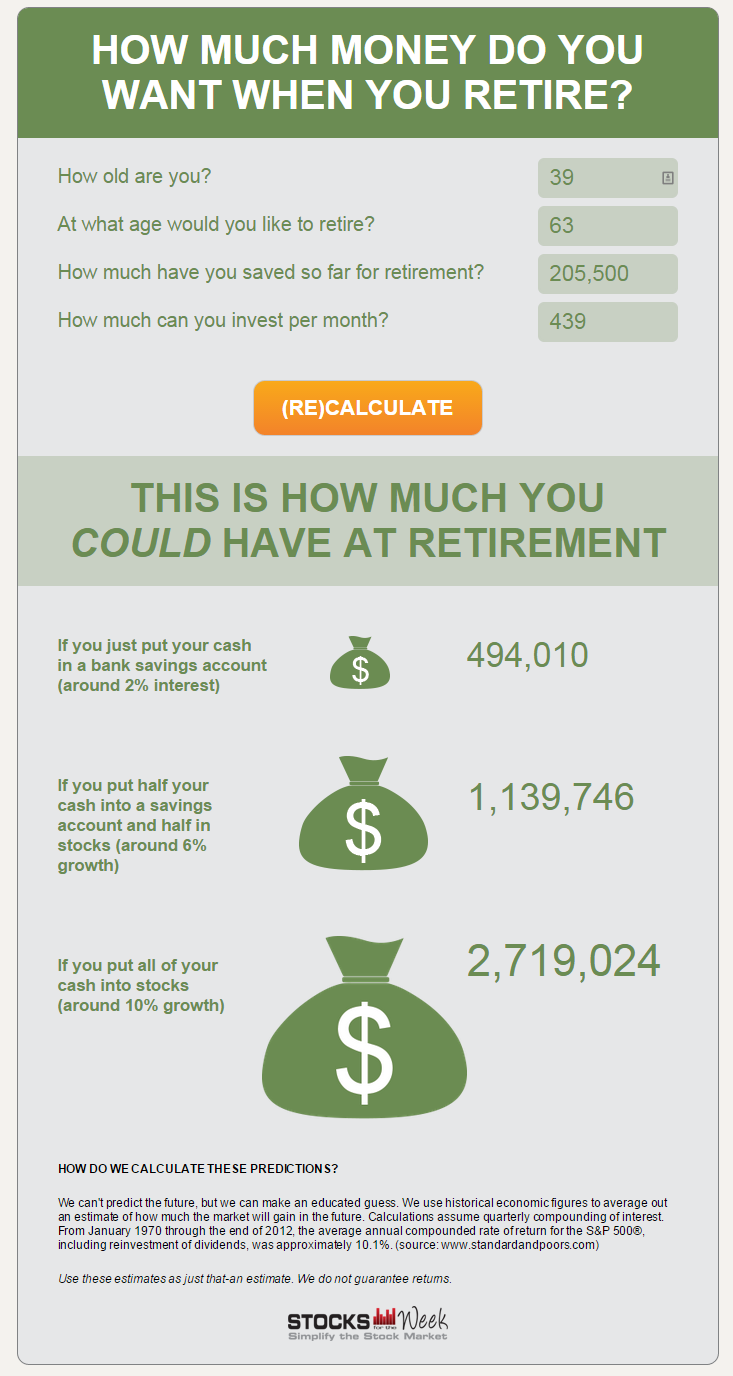

How Much To Draw From 401K In Retirement - They each save $150 per month and get an 8% average annual return on their investments. With potential investment gains, jayla could. Web like the 4% retirement withdrawal rule, the safe withdrawal rate model usually leads to a retiree using no more than 3% or 4% of their total available retirement investment funds on an annual. Web if you withdraw $10,000 from your 401 (k) over the year, you will only pay income taxes on that $10,000. * denotes a required field. Some employers match contributions up to a certain percentage. Monthly 401 (k) contributions$833 /mo. You can choose how much of your paycheck you want to contribute to your 401 (k). Web even if your plan allows for a hardship distribution before age 59.5, you’ll usually be charged a 10% early distribution penalty. Your 401 (k) will contribute. Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. Web how much money can i withdraw during retirement? Web even if your plan allows for a hardship distribution before age 59.5, you’ll usually be charged a 10% early distribution penalty. Web if you withdraw $10,000 from your 401. Web so if you withdrew $10,000, you might only receive $7,000 after the 20% irs tax withholding and a 10% penalty. Generally speaking, the only penalty assessed on early withdrawals from a traditional 401 (k) retirement plan is the. * denotes a required field. May 31, 2023, at 2:45 p.m. Web like the 4% retirement withdrawal rule, the safe withdrawal. Web they take the standard deduction ($27,700) and make no other adjustments, making their taxable income $62,300. Web in 2024, the limit that you can contribute to your 401 (k) plan is $23,000 annually if under the age of 50. (updated march 14, 2023) required minimum distributions (rmds) are minimum amounts that ira and retirement plan account owners generally must. Web like the 4% retirement withdrawal rule, the safe withdrawal rate model usually leads to a retiree using no more than 3% or 4% of their total available retirement investment funds on an annual. There are some situations in which you may be able to avoid the 10% penalty on an early distribution. The good news is that you will. Gili benita for the new york times. Web factors such as savings amount, investment returns, and withdrawal rate significantly impact the duration of a 401(k) in retirement. Web so if you withdrew $10,000, you might only receive $7,000 after the 20% irs tax withholding and a 10% penalty. What's more, you can follow the progress of your balance in a. Monthly 401 (k) contributions$833 /mo. Not everyone has access to a 401(k) plan at their workplace. Generally speaking, the only penalty assessed on early withdrawals from a traditional 401 (k) retirement plan is the. Web they take the standard deduction ($27,700) and make no other adjustments, making their taxable income $62,300. Is your 401k a security blanket? (updated march 14, 2023) required minimum distributions (rmds) are minimum amounts that ira and retirement plan account owners generally must withdraw annually starting with the year they reach age 72 (73 if you reach age 72 after dec. With potential investment gains, jayla could. A 401(k) account alone may not help you save as much as you need for retirement.;. Web use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year. Web you expect to live another 30 years in retirement. Web even if you contribute $1,000 a month toward retirement savings from this point on, and even if you still manage to. We designed the retirement withdrawal calculator to find the answer to these questions. Gili benita for the new york times. Web with the rule of 55, those who leave a job in the year they turn 55 or later can remove funds from that employer’s 401 (k) or 403 (b) without having to pay a 10% early withdrawal penalty. The. Web use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year. 5 genius things all wealthy people do with their money if you don’t start planning for retirement as soon as you can. It’s possible to withdraw your entire account in one lump. Gili benita for the new york times. View how this impacts their savings. (they may be able to. 6 money moves to make when your 401(k) hits $1 million read more: Some reasons for taking an. Web chris gentry has been saving diligently for retirement but is concerned about fees in his 401 (k). Web you expect to live another 30 years in retirement. Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. You can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. If i deposit a certain amount in my 401k each month what will it grow to by any future point in time? Web so if you withdrew $10,000, you might only receive $7,000 after the 20% irs tax withholding and a 10% penalty. Web even if you contribute $1,000 a month toward retirement savings from this point on, and even if you still manage to score an average annual 8% return in your portfolio (which could mean taking on. Jayla is 23 and hannah is 33. If 50 or older, that limit increases to $30,000. Use the calculator to let the math prove which is the optimum choice. Web like the 4% retirement withdrawal rule, the safe withdrawal rate model usually leads to a retiree using no more than 3% or 4% of their total available retirement investment funds on an annual.

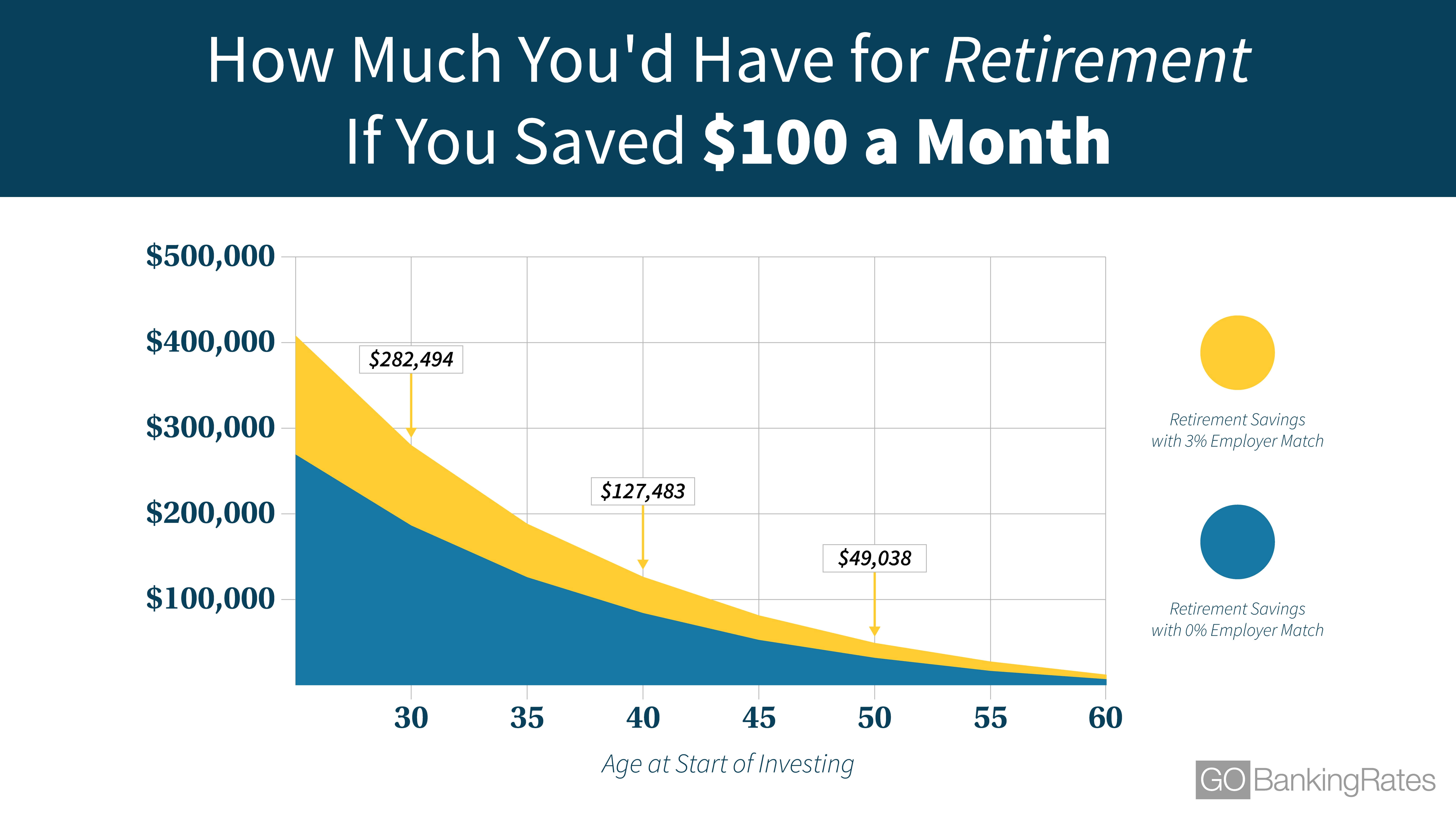

Can You Retire by Saving One Hundred Dollars a Month? GOBankingRates

How Much Should I Have Saved In My 401k By Age?

The Maximum 401(k) Contribution Limit For 2021

How Much Should I Have in My 401k During My 20's, 30's, 40's and 50's

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

How to Estimate How Much Your 401k will be Worth at Retirement

The complete 401K rollover guide — Retire

Free 401(k) Calculator Google Sheets and Excel Template

Why The Median 401(k) Retirement Balance By Age Is So Low

401k Savings By Age How Much Should You Save For Retirement

Your Current And Future Contributions Are A Function Of How Much You Are Saving And Any Employer Matching Available.

They Each Save $150 Per Month And Get An 8% Average Annual Return On Their Investments.

The Timing Of Your Retirement Account Withdrawals Can Play A Role In How Much Tax You Pay On Your Retirement Savings.

It’s Possible To Withdraw Your Entire Account In One Lump Sum, Though This Could Push You Into A Higher Tax Bracket For The Year, So It’s Smart To Take Distributions More Gradually.

Related Post: