How Much Can You Draw From 401K

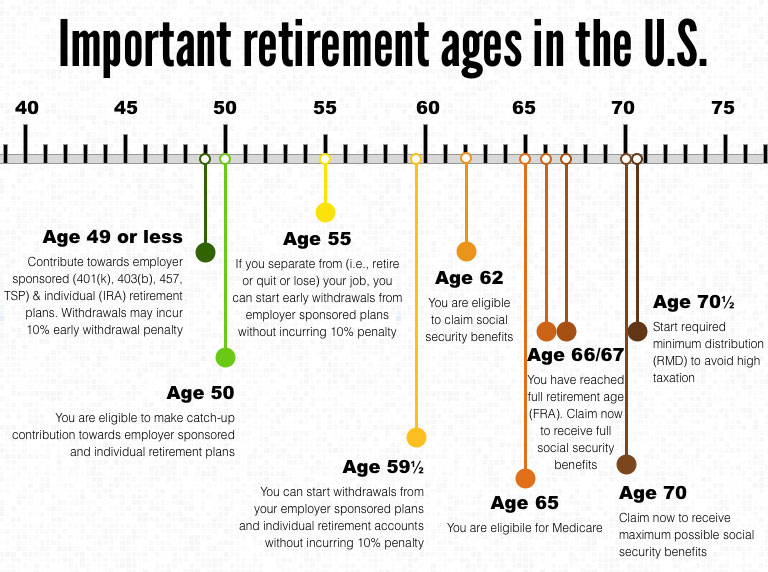

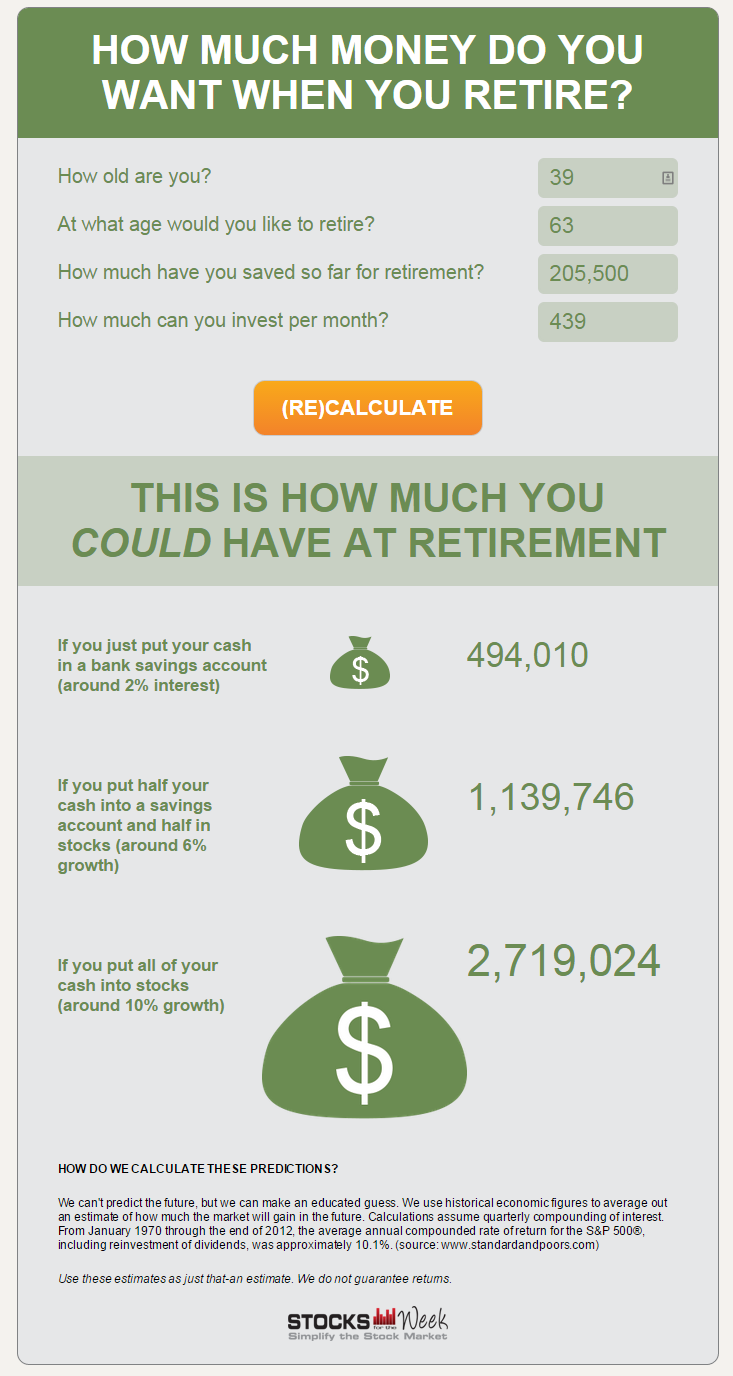

How Much Can You Draw From 401K - Web ways to avoid taxes. Fact checked by aaron johnson. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. Web in addition to social security benefits, the key question is how much you can reliably earn from your total retirement plan. Web calculating the basic penalty. Web if you withdrew $10,000 from your 401(k) and were about 30 years away from retirement, you could be giving up about $263,000 in total returns. With $400,000 in your 401 (k), how much can you expect. Web a hardship withdrawal from a 401(k) retirement account is for large, unexpected expenses. Web your tax bracket will determine your effective tax rate and thus, how much tax you’ll pay on your income—including disbursements from your 401 (k). This is in addition to the tax ordinarily assessed on 401 (k) withdrawals, which. Web the median 401(k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation's largest 401(k) provider. Web your tax bracket will determine your effective tax rate and thus, how much tax you’ll pay on your income—including disbursements from your 401 (k). The balance / catherine. Web for 2023, you can contribute up to $22,500 per year ($23,000 in 2024), or $30,000 if you are age 50 or older ($30,500 in 2024). Web a hardship withdrawal from a 401(k) retirement account is for large, unexpected expenses. Web jayla and hannah started contributing to their 401 (k) plans. Can you minimize taxes on. Web however, the irs. Market insightslow cost fundsretirement planningfund comparison tool This is in addition to the tax ordinarily assessed on 401 (k) withdrawals, which. Web updated on december 29, 2022. Web if you withdrew $10,000 from your 401(k) and were about 30 years away from retirement, you could be giving up about $263,000 in total returns. The maximum contribution for employees and. Web a hardship withdrawal from a 401(k) retirement account is for large, unexpected expenses. Veterans resourcestax advice & toolsbudget guides & advicepersonal finance & taxes Web for 2024, the figure is $168,600. This is in addition to the tax ordinarily assessed on 401 (k) withdrawals, which. The rules on 401 (k). Jayla is 23 and hannah is 33. Web the median 401(k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation's largest 401(k) provider. To sum it up, you'll owe income tax on 401 (k) distributions when you take them, but no social security tax. A. Web the median 401(k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation's largest 401(k) provider. Web the minimum age when you can withdraw money from a 401 (k) is 59.5. Web calculating the basic penalty. Web for example, you can park up to $7,000. Web ways to avoid taxes. You don’t pay back your hardship withdrawal—unlike a loan, it’s taxable income to you. Web a hardship withdrawal from a 401(k) retirement account is for large, unexpected expenses. Web however, the irs has established the rule of 55, which allows those who leave a job in the year they turn 55 or later to remove. Fact checked by aaron johnson. This year, you can contribute up to $23,000 to a 401(k) and. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. Unlike a 401(k) loan, the funds need not be repaid. Web if you withdrew $10,000. Web for example, you can park up to $7,000 or $8,000 in an ira, you can add some or all of that $25,000 to your regular, taxable brokerage account, you can send some or all of it. With $400,000 in your 401 (k), how much can you expect. They each save $150 per month and get an 8% average annual. Jayla is 23 and hannah is 33. Web in these instances, you can withdraw the amount you need and no more. But you must pay taxes on the. Web for 2024, the figure is $168,600. The maximum contribution for employees and. Web for example, taking a $10,000 early withdrawal would require you to pay $1,000 in tax to the irs. The rules on 401 (k). Unlike a 401(k) loan, the funds need not be repaid. Fact checked by aaron johnson. Plus, the amount of your social security. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. Web if you withdrew $10,000 from your 401(k) and were about 30 years away from retirement, you could be giving up about $263,000 in total returns. Web in these instances, you can withdraw the amount you need and no more. Web for example, you can park up to $7,000 or $8,000 in an ira, you can add some or all of that $25,000 to your regular, taxable brokerage account, you can send some or all of it. Withdrawing money before that age typically results in a 10% penalty on the amount you withdraw. Web if you can max out both your 401(k) and roth ira contributions, you’ll invest a total of $30,000 by the end of 2024. Can you minimize taxes on. Advice & guidanceaccess to advisors Web for 2023, you can contribute up to $22,500 per year ($23,000 in 2024), or $30,000 if you are age 50 or older ($30,500 in 2024). To sum it up, you'll owe income tax on 401 (k) distributions when you take them, but no social security tax. You don’t pay back your hardship withdrawal—unlike a loan, it’s taxable income to you.

8+ 401k Contribution Calculator Templates Excel Templates

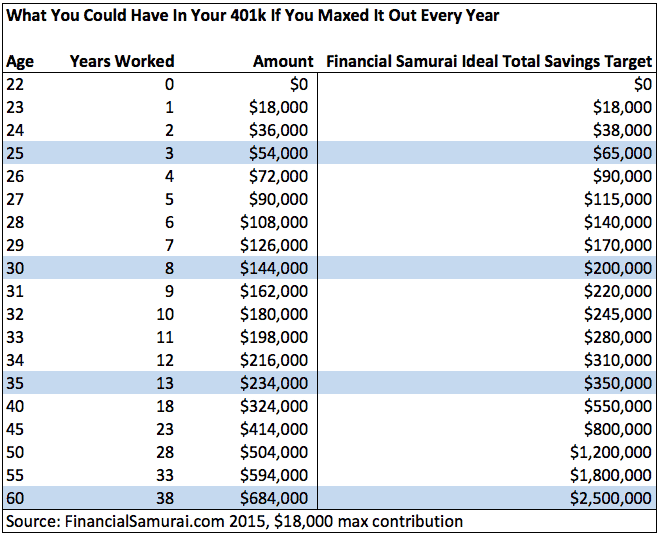

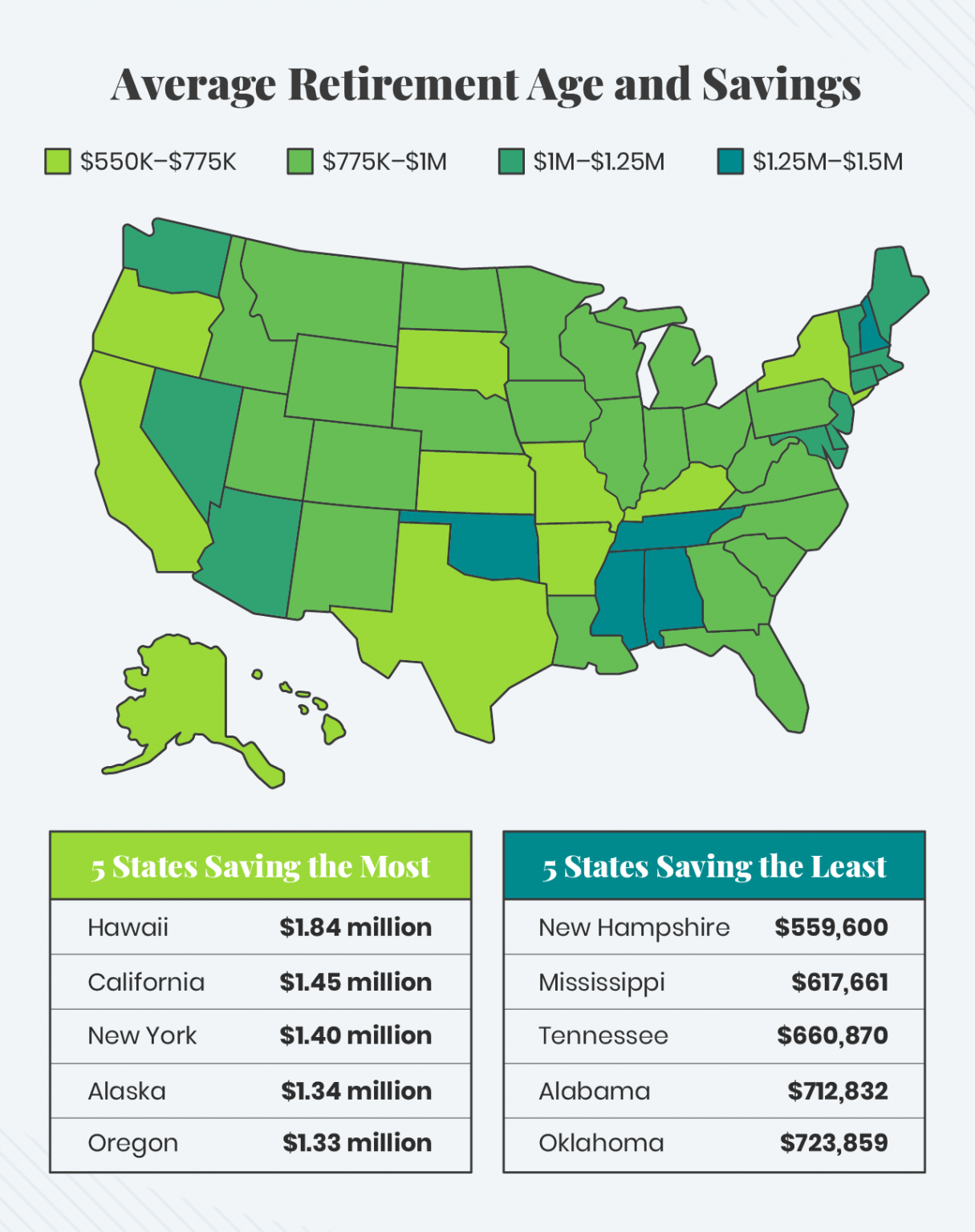

How Much Should I Have in My 401k? (at Every Age)

How much should I have in my 401k at 45? Retirement News Daily

How Much Should I Have in My 401k During My 20's, 30's, 40's and 50's

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

The Maximum 401(k) Contribution Limit For 2021

How much can I contribute to my 401k and Roth 401k in 2022? IRA vs 401k

Important ages for retirement savings, benefits and withdrawals 401k

401k Savings By Age How Much Should You Save For Retirement

How to Estimate How Much Your 401k will be Worth at Retirement

Market Insightslow Cost Fundsretirement Planningfund Comparison Tool

Roth 401 (K) Withdrawal Rules.

If You’re 50 Or Older, You Can Add An Extra $7,500 To Your.

This Year, You Can Contribute Up To $23,000 To A 401(K) And.

Related Post: