How Much Can I Earn While Drawing Social Security

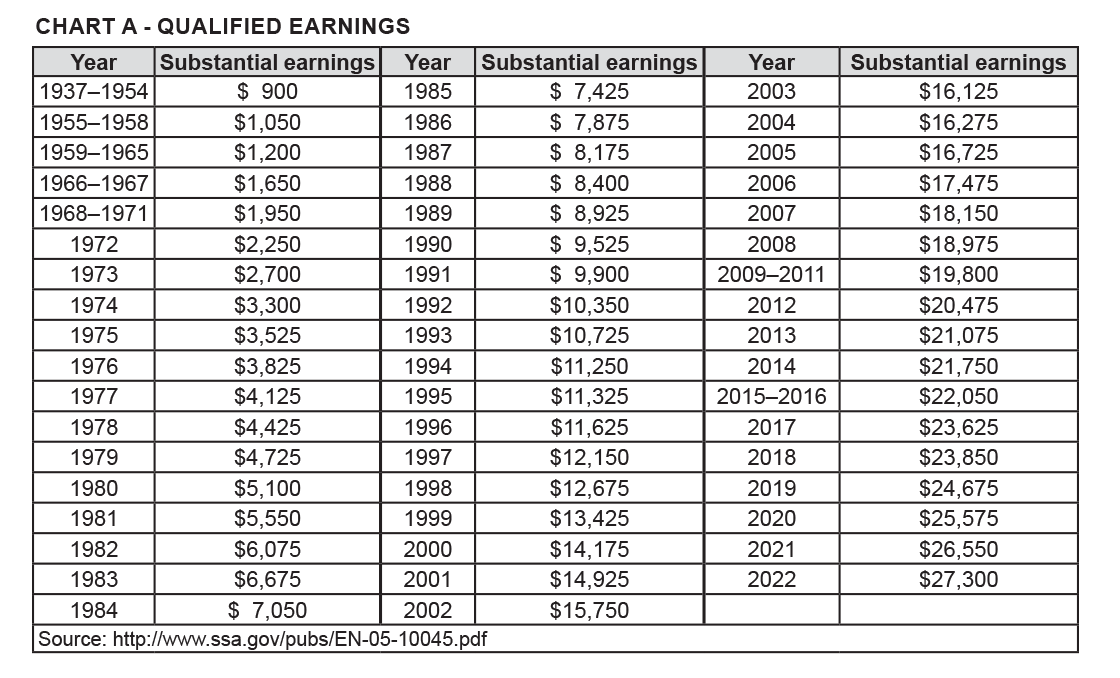

How Much Can I Earn While Drawing Social Security - These rules apply whether you're an older worker taking benefits based on. Others can afford to wait until age 70 to get that increase of 8% per year of deferral. If you will reach full. Web the web page explains the factors that influence social security benefits and how much you can expect to earn from social security at various ages. Web should your income surpass this threshold, your social security benefits will be reduced by $1 for every $2 you earn above the limit. Double your annual social security benefit, then add in that year's earned income limit. Web there is a special rule that applies to earnings for 1 year, usually the first year of retirement. $1 for every $3 of earned income above $56,520. Your full retirement age is based on the. For example, $23,320 of earnings would. Although the quick calculator makes an initial assumption about your past earnings, you will have the. It also covers the income. Past that, there is no benefit. Web how well would the job have to pay? A majority of new retirees claim social security retirement benefits before age 65, according to new research from the alliance for. Web under the ssa’s rules, you would receive $5,000 a year less in benefits ($31,240 minus the limit of $21,240 is $10,000, half of which is $5,000). Many people receiving social security retirement benefits choose to continue working or return to. The policy has substantially evolved since then, but the idea essentially is. Web how well would the job have. Web in the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age. Web we would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). Web if you file. Web once you have turned your full retirement age, there is no limit on how much you can earn while collecting social security payments. Web the threshold isn’t terribly high: Web under the ssa’s rules, you would receive $5,000 a year less in benefits ($31,240 minus the limit of $21,240 is $10,000, half of which is $5,000). For example, $23,320. Web $1 for every $2 of earned income above $21,240. Under this rule, you can get a full social security benefit for any whole month you are. It also covers the income. You can earn up to 4 credits each year. Multilingual optionsfaqspersonal online accountonline services Web so benefit estimates made by the quick calculator are rough. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Those who are 70 can collect up to. In the year you reach your full. Web $1 for every $2 of earned income above $21,240. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. The amount needed for a work credit. Web in 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every $2 you earn. But that. Web the web page explains the factors that influence social security benefits and how much you can expect to earn from social security at various ages. Past that, there is no benefit. For example, $23,320 of earnings would. Web how well would the job have to pay? Be under full retirement age for all of 2024, you are considered retired. Others can afford to wait until age 70 to get that increase of 8% per year of deferral. Web calculating your social security retirement benefit — a crucial source of income for many retirees — can be an important step in choosing when to retire (signing up for and. Multilingual optionsfaqspersonal online accountonline services Web some people need to start. Although the quick calculator makes an initial assumption about your past earnings, you will have the. Web how much can you earn while on social security: If you will reach full retirement age in 2024, the limit on your earnings for. Be under full retirement age for all of 2024, you are considered retired in any month that your earnings. In the year you reach your full. To do this, we would withhold all benefit payments from january 2024 through. Web $1 for every $2 of earned income above $21,240. Under this rule, you can get a full social security benefit for any whole month you are. Web some people need to start drawing monthly checks at age 62. So if you were due $12,000 from social security in. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Although the quick calculator makes an initial assumption about your past earnings, you will have the. Your full retirement age is based on the. Web you are entitled to $800 a month in benefits. Web calculating your social security retirement benefit — a crucial source of income for many retirees — can be an important step in choosing when to retire (signing up for and. Web how your earnings afect your social security benefits. For example, $23,320 of earnings would. Web should your income surpass this threshold, your social security benefits will be reduced by $1 for every $2 you earn above the limit. However, this changes in the year you. Web if you file for social security retirement benefits before your full retirement age, there is a limit on the amount of income you can earn.

How much your Social Security benefits will be if you make 30,000

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

How Much Can I Earn Without Losing My Social Security?

How Does Social Security Work? Top Questions Answered

Best How Much Can I Earn While Drawing Social Security Disability of

Social Security SERS

Introduction to Social Security Aspire Wealth Advisory

How Much Can I Earn While On Social Security?

Working While Drawing Social Security — SimpliFi

Web You Can Work While You Receive Social Security Retirement Or Survivors Benefits, But There Is A Limit To How Much You Can Earn And Still Get Full Benefits.

Web The Threshold Isn’t Terribly High:

Many People Receiving Social Security Retirement Benefits Choose To Continue Working Or Return To.

A Majority Of New Retirees Claim Social Security Retirement Benefits Before Age 65, According To New Research From The Alliance For.

Related Post: