How Much Can I Earn And Still Draw Social Security

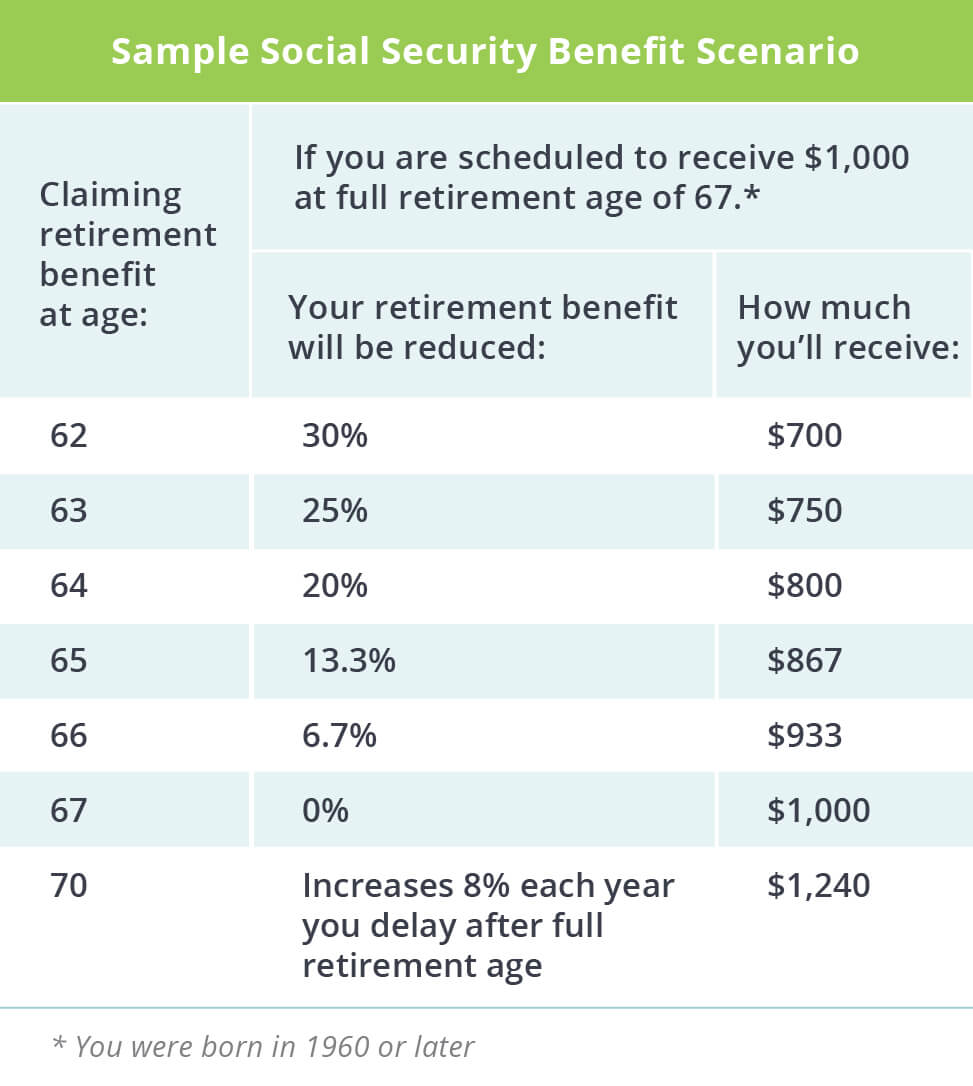

How Much Can I Earn And Still Draw Social Security - But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. Web $1 for every $2 of earned income above $22,320 until the year you reach full retirement age. Web we would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). Privacy assuranceonline servicesexpert helppersonal online account Many people receiving social security retirement benefits choose to continue working or return to. Before you make your decision. Web if you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is $59,520. Taking early benefits from social security while continuing to work can come with a cost. Web in 2024, the highest monthly benefit you can receive at the full retirement age of 67 is $3,822. Web this year, you can earn up to $19,560 without impacting your social security benefits. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. If you will reach full. From there, you'll have $1 in social security withheld for every $2 you earn. It is important to note that you cannot. Those who are 70 can collect. Web in 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every $2 you earn. Let's say you're 64 and earn $25,000 from working, and you're already getting. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3. Starting with the month you reach full retirement age,. Web in 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every $2 you earn. Many people receiving social security retirement benefits choose to continue working or return to. Starting with the month you reach full. Social security optimization if you save more than $250,000; Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. One easy trick could pay you as much as $ 22,924. Web if you will reach full retirement age in 2024, the limit on your earnings for the months before. Past that, there is no benefit. If you retire at age 62 in 2024, the maximum amount is $2,710. A majority of new retirees claim social security retirement benefits before age 65, according to new research from the alliance for. Many people receiving social security retirement benefits choose to continue working or return to. Taking early benefits from social security. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings. Web if you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is $59,520. 50% of anything you earn over the cap. If you retire at age 62 in 2024,. Web there’s a limit on how much you can earn and still receive your full social security retirement benefits while working. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. Web for the year 2024, the maximum income you can earn after. Web in 2024, you can earn up to $22,320 without having your social security benefits withheld. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. Web if you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is $59,520. 160 years strongretirement productshighest service standardsprofessional excellence Web if. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. Taking early benefits from social security while continuing to work can come with a cost. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. A majority. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. Web in 2024, you can earn up to $22,320 without having your social security benefits withheld. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Web this example is based on an estimated monthly benefit of $1000 at full retirement age. Web there’s a limit on how much you can earn and still receive your full social security retirement benefits while working. Web strategies to optimize your social security benefits; Three social security changes in 2024 to know; One easy trick could pay you as much as $ 22,924. Web using the ssa’s example in its “how work affects your benefits” publication, if your monthly social security payment at 62 years is $600 ($7,200/year) and you intend to. Before you make your decision. From there, you'll have $1 in social security withheld for every $2 you earn. If you will reach full. 160 years strongretirement productshighest service standardsprofessional excellence But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings. Web how much can you earn while on social security:

How Much Can You Earn in 2022 and Still Draw Social Security Benefits?

🔴How Much Social Security Benefits on 60,000 YouTube

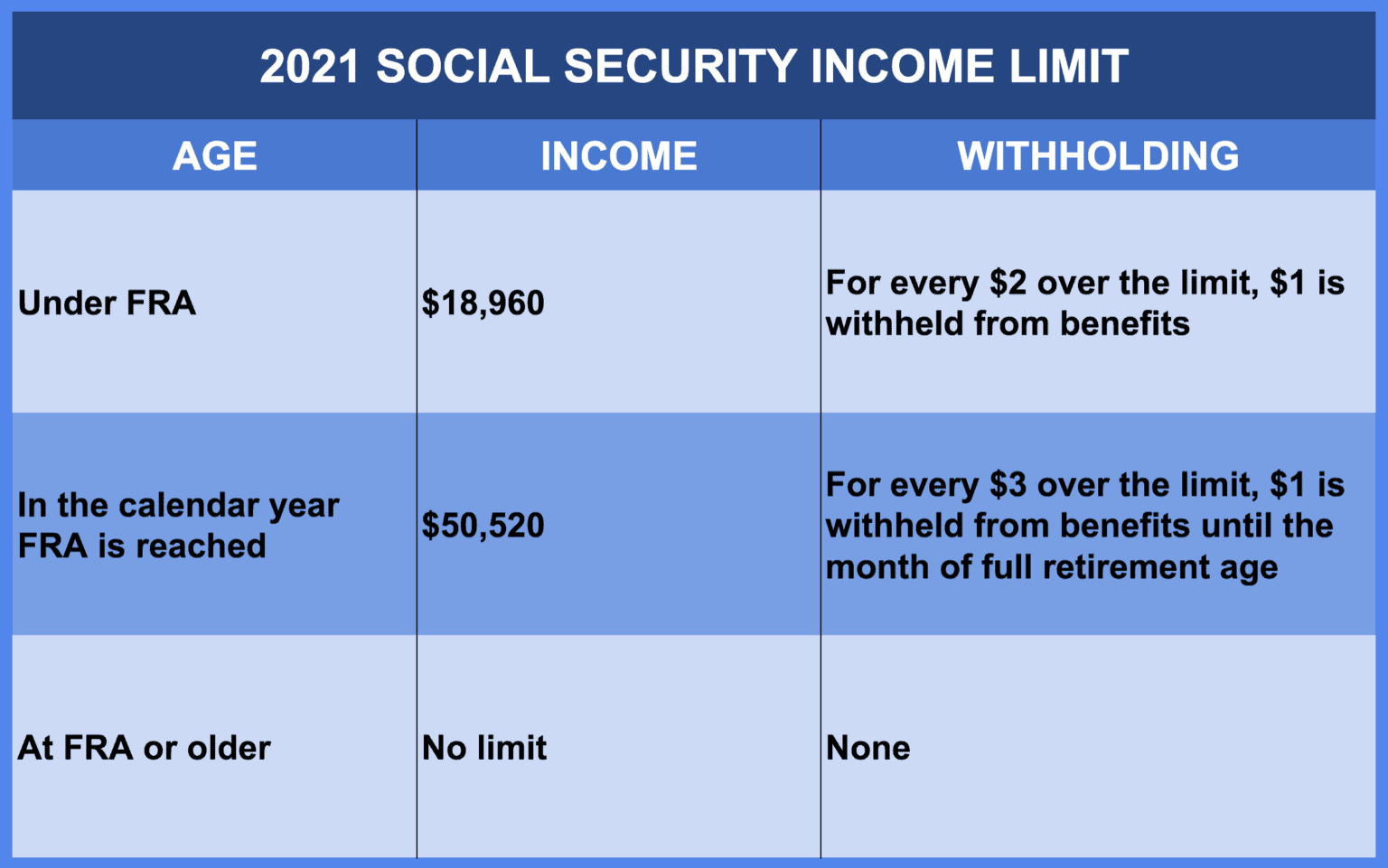

Social Security Limit 2021 Social Security Intelligence

Can You Collect Social Security At 66 And Still Work Full Time?

Introduction to Social Security Aspire Wealth Advisory

How Does Social Security Work? Top Questions Answered

Social Security full retirement age and benefits Nectar Spring

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

How much can you earn and collect on Social Security?

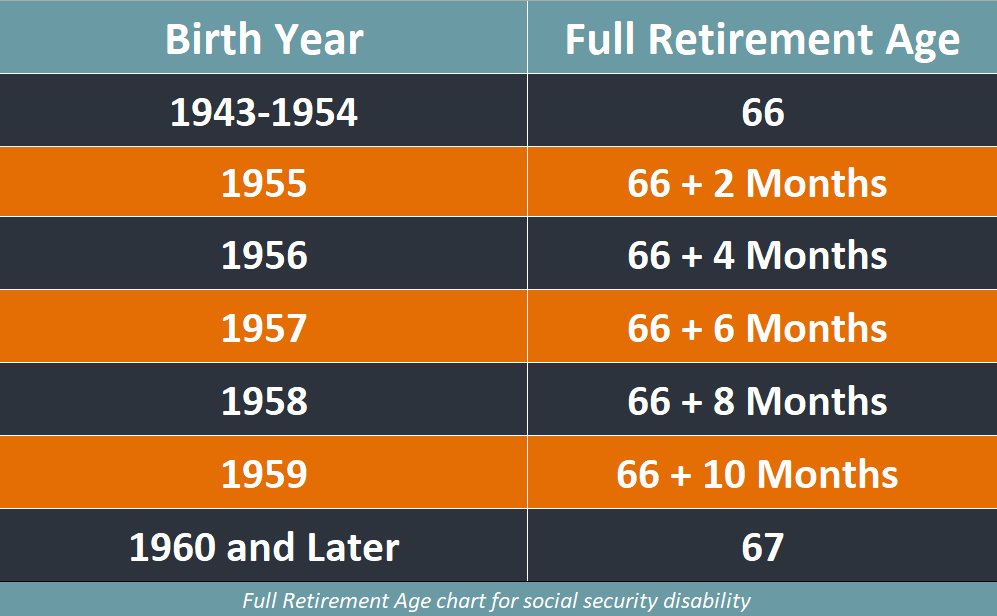

Full Retirement And Age 62 Benefit By Year Of Birth.

Web This Year, You Can Earn Up To $19,560 Without Impacting Your Social Security Benefits.

Social Security Has Established An Earnings Test That Calculates How Much.

Web Once You Have Turned Your Full Retirement Age, There Is No Limit On How Much You Can Earn While Collecting Social Security Payments.

Related Post: