Earliest Age To Draw From 401K

Earliest Age To Draw From 401K - Under the terms of this rule, you can withdraw funds from your current job’s 401 (k) or 403 (b) plan with no 10% tax penalty if you leave that job in or after the year you turn 55. Terminate service with the employer. Have left your employer voluntarily or involuntarily in the year you turn 55 or later. Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: Each year you wait beyond your full retirement age (fra) to claim, your benefit increases by 8%. Early withdrawals are typically taxed as income and may be subject to a 10% penalty. Web what is the rule of 55? A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Ira withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. Web first, let’s recap: Web delaying your social security claim can lead to a larger benefit. Web exceptions to the early withdrawal penalty include total and permanent disability, unreimbursed medical expenses, and separation from service at age 55 or older from the employer plan at the job you are leaving. However, you are entitled to full benefits when you reach your full retirement age.. Early withdrawals are typically taxed as income and may be subject to a 10% penalty. Web what is the rule of 55? A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Turn 65 (or the plan’s normal retirement age, if earlier); Web delaying. Web what is the rule of 55? Each year you wait beyond your full retirement age (fra) to claim, your benefit increases by 8%. The irs waives the 10% penalty in. Have left your employer voluntarily or involuntarily in the year you turn 55 or later. Most 401 (k) plans allow workers to withdraw money early. With a roth 401 (k) (not offered by all employer plans), your money also grows. Most 401 (k) plans allow workers to withdraw money early. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. Web you’re age 55 to 59 ½. Web you can make a 401 (k) withdrawal at. If you delay taking your benefits from your full retirement age. Luckily, there are ways for you to take money out of your retirement account for any hardships that might arise without paying the 10% penalty. Web chris gentry has been saving diligently for retirement but is concerned about fees in his 401 (k). Web beginning in 2023, the secure. Web how much can an early withdrawal cost you? Web the “official” retirement age varies based on your birth year. However, you are entitled to full benefits when you reach your full retirement age. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. If you reach. Turn 65 (or the plan’s normal retirement age, if earlier); The best idea for 401(k) accounts from a previous employer is to roll them over when you leave a job. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. Under the terms of this rule, you can withdraw funds from your current job’s. Web under normal circumstances, participants in a traditional 401 (k) plan are not allowed to withdraw funds until they reach age 59½ or become permanently unable to work due to disability, without. If you delay taking your benefits from your full retirement age. Under the terms of this rule, you can withdraw funds from your current job’s 401 (k) or. Web the minimum withdrawal age for a traditional 401 (k) is technically 59½. If you delay taking your benefits from your full retirement age. Ira withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty. Web use the 401(k) early withdrawal calculator to how much you could be giving up by withdrawing funds early. If that happens, you might need to begin taking distributions from your 401 (k). Early withdrawals are typically taxed as income and may be subject to a 10% penalty. Turn 65 (or the plan’s normal retirement age, if earlier); Unfortunately, there's. The irs rule of 55 recognizes you might leave or lose your job before you reach age 59½. Web what is the rule of 55? With a roth 401 (k) (not offered by all employer plans), your money also grows. When can a retirement plan distribute benefits? Web what is the rule of 55? Sign up for fidelity viewpoints weekly email for our latest insights. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Third, money you take out of your 401 (k). If you delay taking your benefits from your full retirement age. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Ira withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. Terminate service with the employer. Web the minimum withdrawal age for a traditional 401 (k) is technically 59½. Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: Turn 65 (or the plan’s normal retirement age, if earlier); Web use the 401(k) early withdrawal calculator to how much you could be giving up by withdrawing funds early.:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

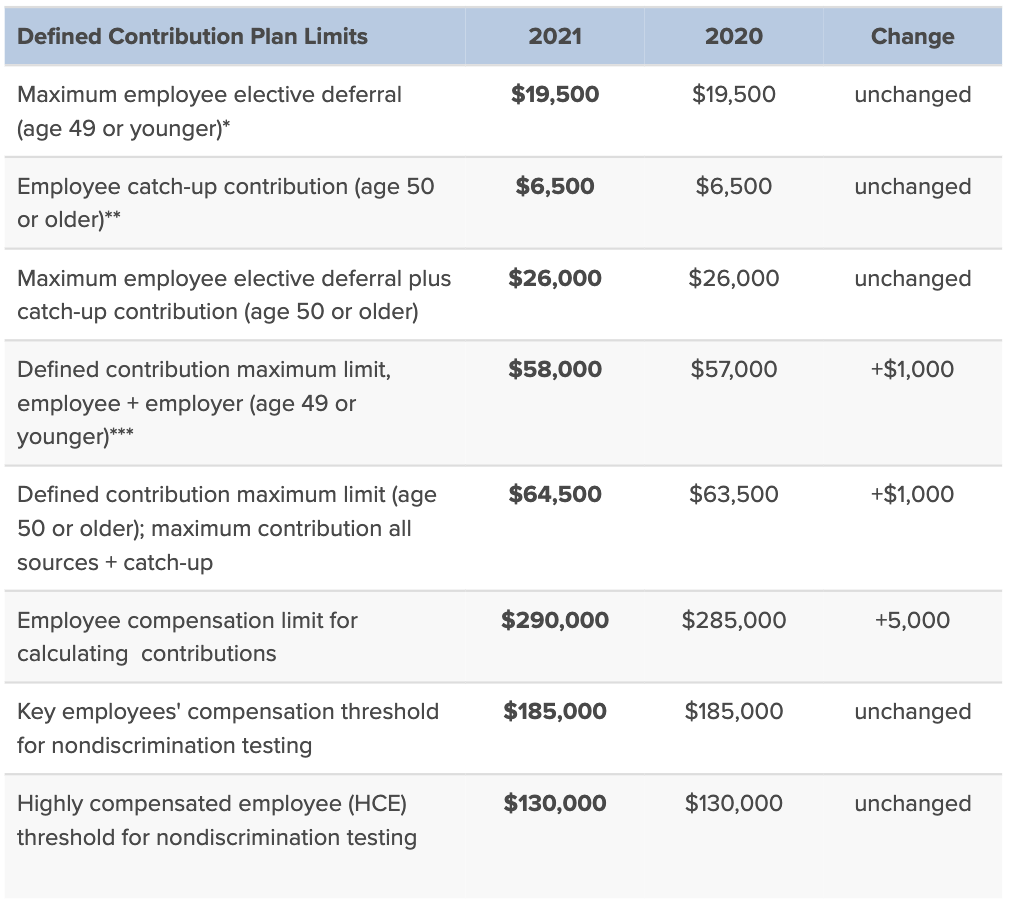

12 of the Most Common Employee 401(k) Questions, Answered Gusto

at what age do you have to take minimum distribution from a 401k Hoag

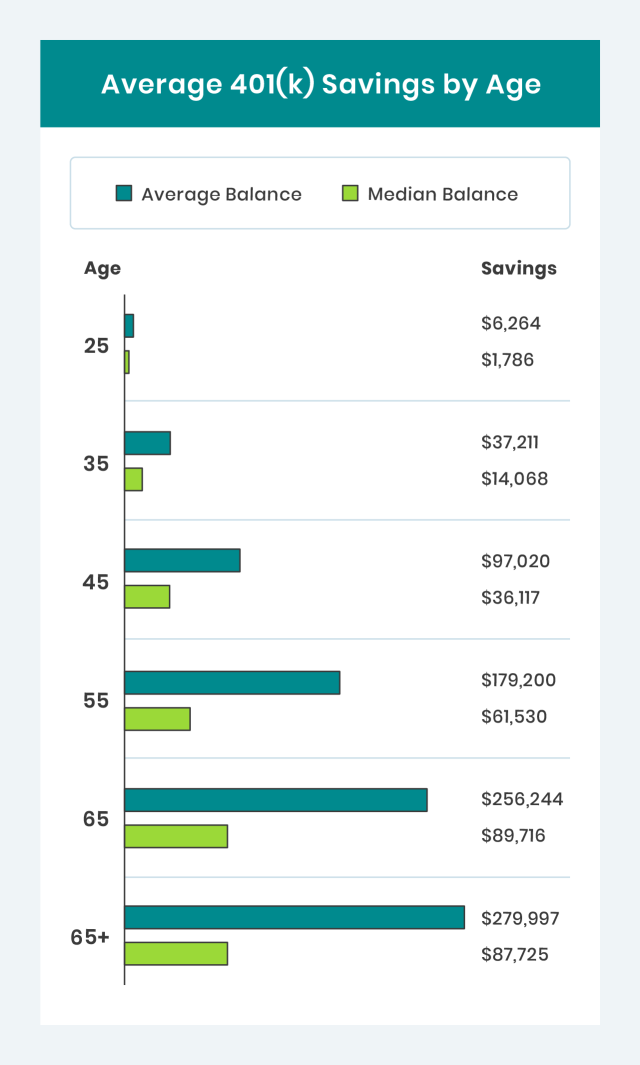

Average 401(k) Balance by Age Your Retirement Timeline

The Average And Median 401(k) Account Balance By Age

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

401k By Age Are You Saving Enough For Retirement?

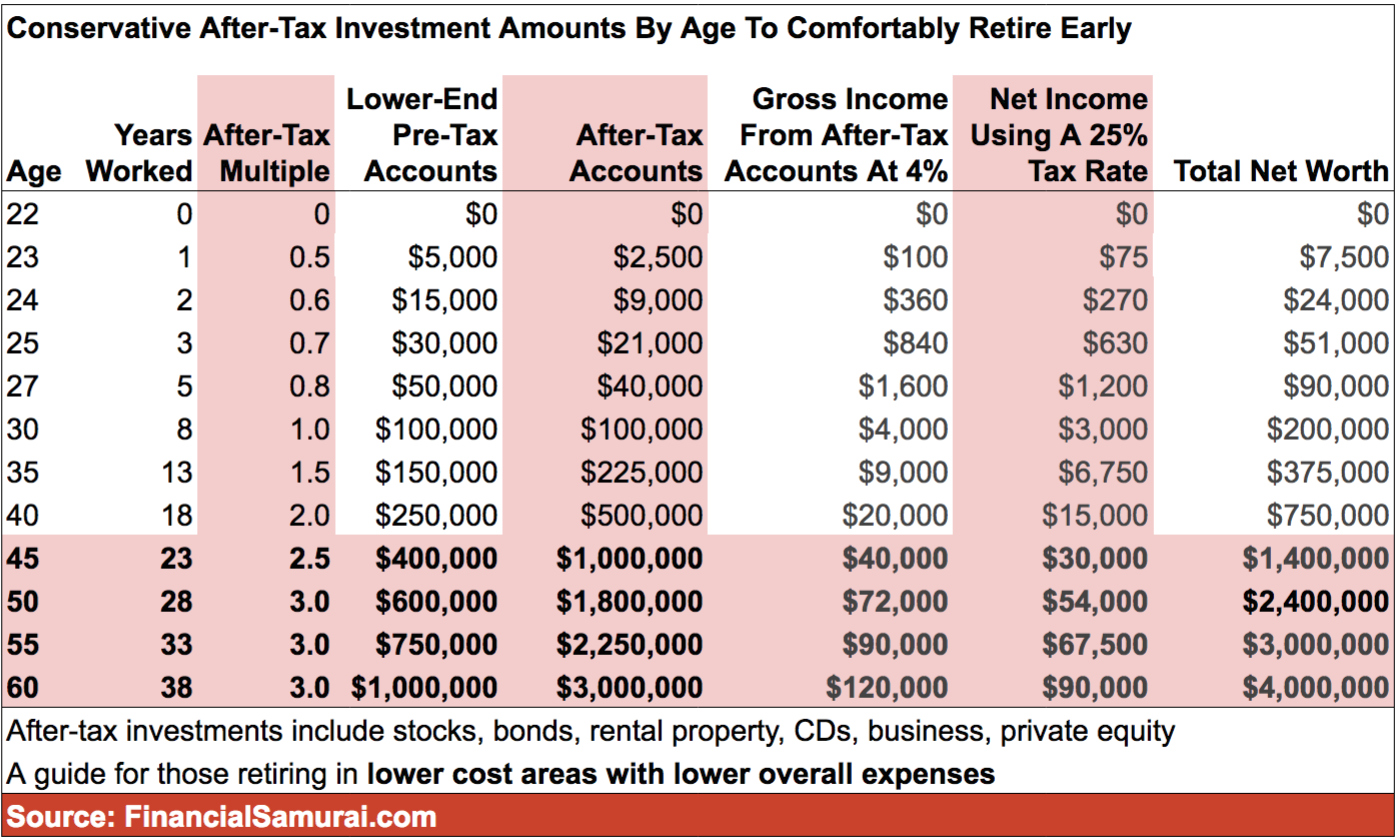

401k By Age PreTax Savings Goals For Retirement Financial Samurai

401k Calculator for Excel Savings calculator, 401k calculator

401k Savings By Age How Much Should You Save For Retirement

If That Happens, You Might Need To Begin Taking Distributions From Your 401 (K).

(Qualified Public Safety Workers Can Start Even Earlier, At 50.) It Doesn’t Matter Whether You Were Laid Off, Fired, Or Just Quit.

Web How Much Can An Early Withdrawal Cost You?

Early Withdrawals Are Typically Taxed As Income And May Be Subject To A 10% Penalty.

Related Post: