Drawing Social Security From Ex Spouse

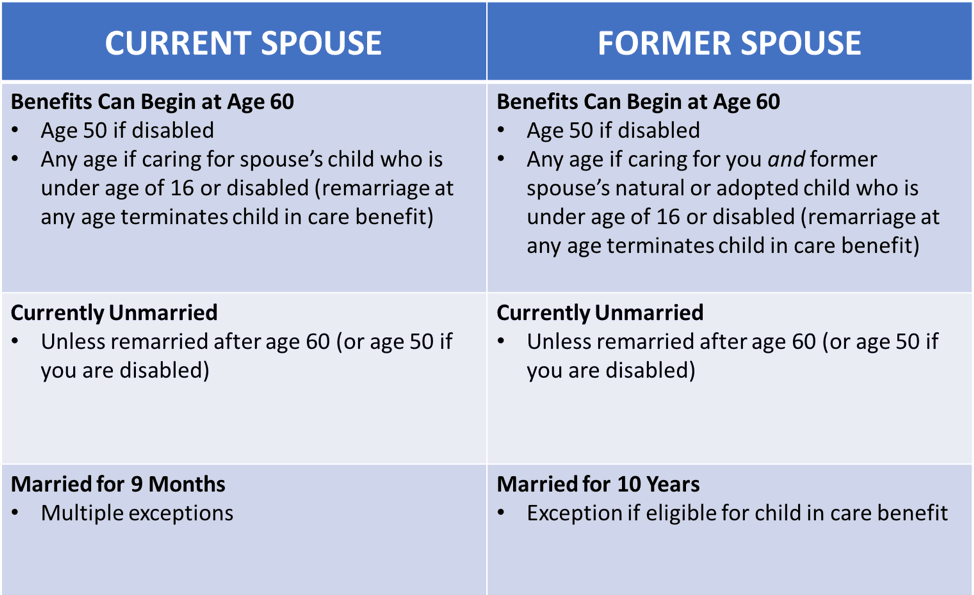

Drawing Social Security From Ex Spouse - And if they're remarried, their partner's earnings are safe. You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: Web if you’re getting social security retirement benefits, some members of your family may also qualify to receive benefits on your record. Second, her marriage to the ex must. You are not yet full retirement age, you must apply for both benefits (known as deemed filing). A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. Web the motley fool. Eligibility for spousal benefits typically requires that the. There are other rules, of course. Web published april 07, 2022. Web as of feb. You are at least 62 years of age. Web the motley fool. The marriage lasted at least 10 years. Social security spousal benefits allow spouses to claim benefits based on their partner's earnings record. Web if you’re getting social security retirement benefits, some members of your family may also qualify to receive benefits on your record. Web the motley fool. There are other rules, of course. Web a spouse’s social security benefit is directly tied to the payout that the primary beneficiary receives. Eligible children under 16 can also receive survivor benefits, worth up. Web to qualify for spouse’s benefits, you must be one of the following: There are other rules, of course. Any age and have in your care a child younger than age 16, or who has a disability and is entitled to receive benefits on your spouse’s record. You are not yet full retirement age, you must apply for both benefits. Second, her marriage to the ex must. Eligible children under 16 can also receive survivor benefits, worth up to 75% of the deceased's benefit. Web published may 10, 2021. Any age and have in your care a child younger than age 16, or who has a disability and is entitled to receive benefits on your spouse’s record. You are at. You will receive the higher of the two benefits. If you turn 62 on or after january 2, 2016, and: A representative at your local social security office can provide estimates of the benefit you can receive as a divorced spouse, based on your former wife’s or husband’s earnings record. Web if you’re getting social security retirement benefits, some members. / updated december 06, 2023. Web you are eligible for benefits both as a retired worker and as a spouse (or divorced spouse) in the first month you want your benefits to begin and. You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: A representative at your local social security. Web you are eligible for benefits both as a retired worker and as a spouse (or divorced spouse) in the first month you want your benefits to begin and. Under social security’s “deemed filing” rule, individuals filing for retirement benefits who are also eligible for spousal benefits must claim both at the same time. The average social security benefit is. Web published october 10, 2018. Second, her marriage to the ex must. The provision applies to divorced as well as married filers. Social security doesn't allow for double dipping. Web the motley fool. Web you are eligible for benefits both as a retired worker and as a spouse (or divorced spouse) in the first month you want your benefits to begin and. You can even begin drawing benefits before your ex has retired, as long as they qualify and you’ve been divorced at least two years. Web a spouse can choose to retire. If you are divorced and your marriage lasted at least 10 years, you may be able to get benefits on your former spouse’s record and your former spouse may be able to get benefits on your record. Web you are eligible for benefits both as a retired worker and as a spouse (or divorced spouse) in the first month you. That's not bad, but you might be able to do a lot better with a little. Web to start, you must be at least 61 years and 9 months old and want your benefits to start in no more than four months, according to the social security administration (ssa). Second, her marriage to the ex must. 62 years of age or older. You can apply online or. Eligibility for spousal benefits typically requires that the. Web published october 10, 2018. Under social security’s “deemed filing” rule, individuals filing for retirement benefits who are also eligible for spousal benefits must claim both at the same time. The provision applies to divorced as well as married filers. You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. Web unlike with married spouses, your ex spouse does not need to be drawing social security for you to draw a spousal benefit off him. You can even begin drawing benefits before your ex has retired, as long as they qualify and you’ve been divorced at least two years. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. You will receive the higher of the two benefits. Web if you are age 62, unmarried, and divorced from someone entitled to social security retirement or disability benefits, you may be eligible to receive benefits based on their record.

How Many Spouses Can Draw Social Security From ONE ExHusband? YouTube

Social Security Benefits For Spouses

3 Most Important Things to Know About the Social Security Surviving

/social-security-ex-spouse-2388947_V3-49a27ada826c4b8a84d087f7178b9e84.png)

Top 14 can ex spouse collect social security in 2022 Gấu Đây

What’s The Right Age To Start Drawing Social Security? To Our

How To Draw Social Security From Your First Spouse YouTube

Heres How to Draw Social Security From an ExSpouse YouTube

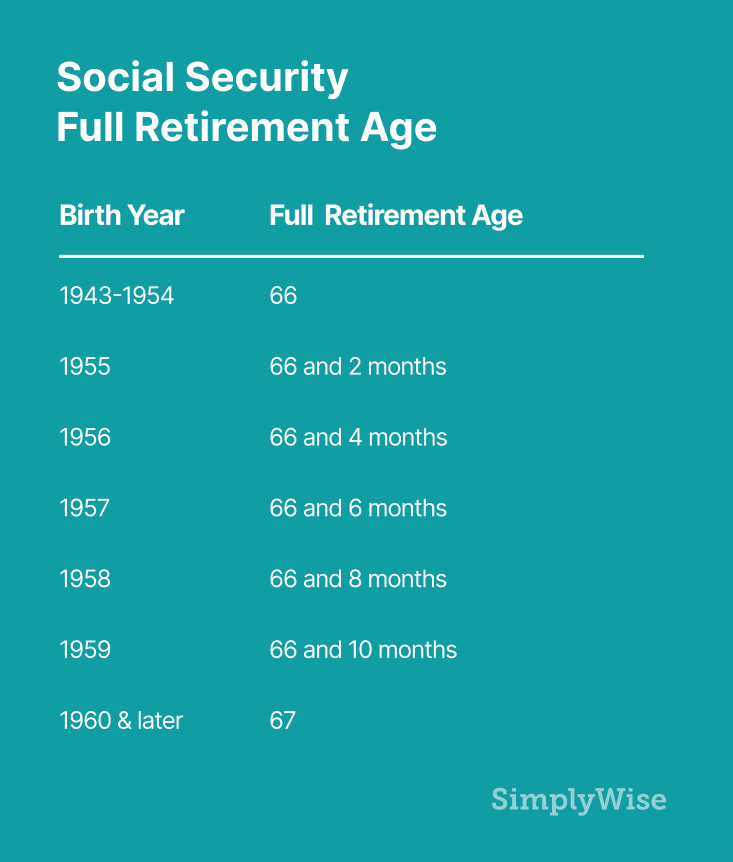

How is Social Security calculated? SimplyWise

Can a Divorced Person Collect Social Security From an Ex? in 2023

A guide to social security spousal ex spouse and widow s benefits Artofit

A Representative At Your Local Social Security Office Can Provide Estimates Of The Benefit You Can Receive As A Divorced Spouse, Based On Your Former Wife’s Or Husband’s Earnings Record.

Web If You Are Age 62, Unmarried, And Divorced From Someone Entitled To Social Security Retirement Or Disability Benefits, You May Be Eligible To Receive Benefits Based On His Or Her Record.

Keep In Mind That Social Security Benefits And Spousal Benefits Are Mainly Meant To Supplement An Individual’s Retirement.

Anyone Who Was Married To A Social Security Beneficiary Can Potentially Receive Survivor Benefits On The Death Of That Person.

Related Post: