Drawer On Cheque

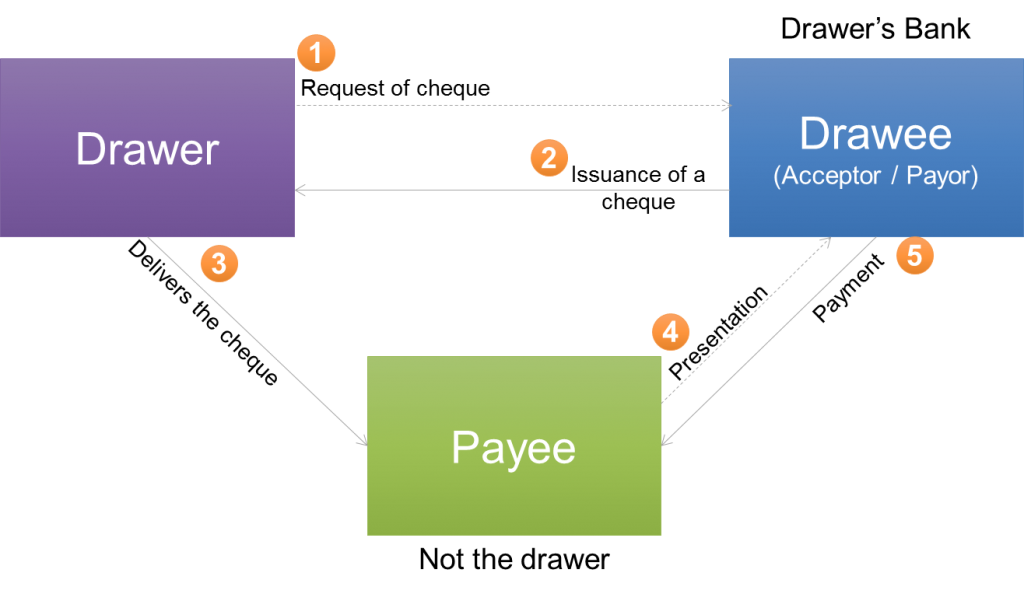

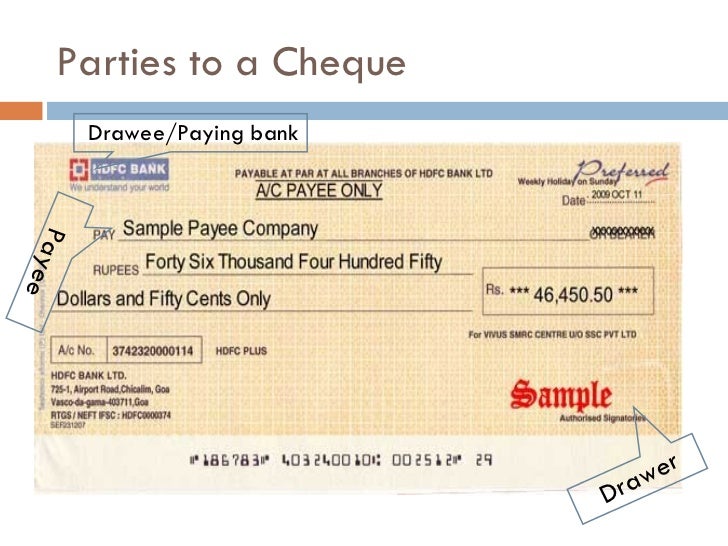

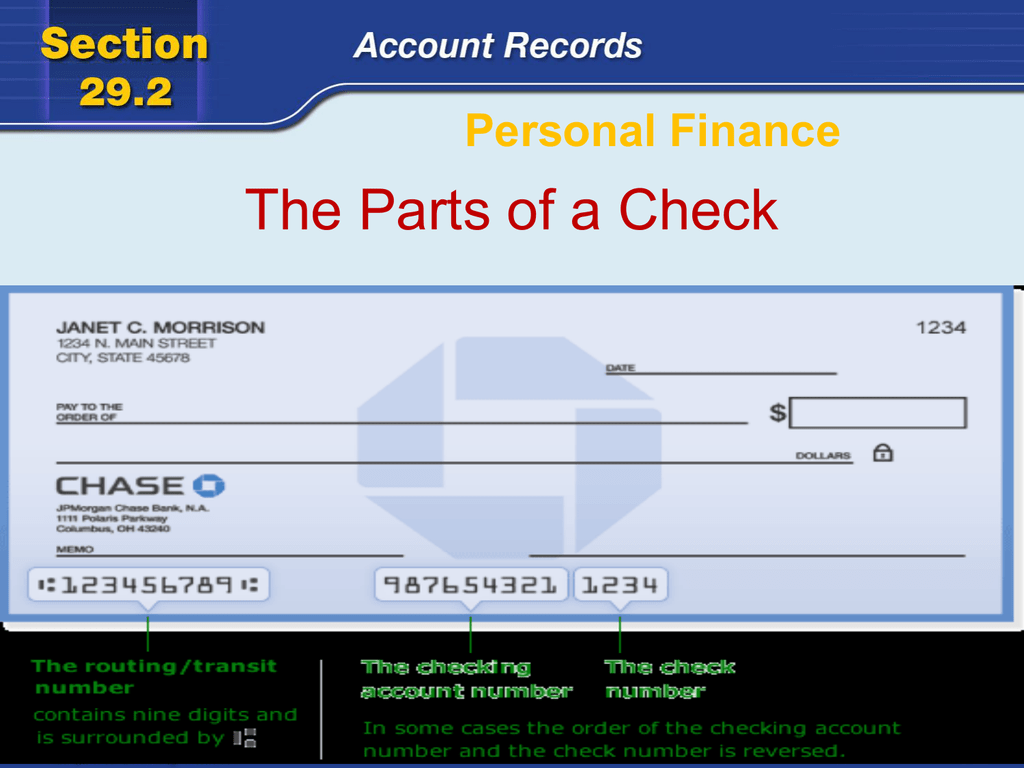

Drawer On Cheque - Web at no cost! Web a dishonoured cheque (also spelled check) is a cheque that the bank on which it is drawn declines to pay (“honour”). The person or entity to whom the funds are to be paid. The person or entity whose transaction account is to be drawn. Web the acceptor is the person or other organization that pays the check owner, the check maker is the drawer, and the check recipient is the payee. Web drawer, drawee, acceptor and payee : Web generally a written notice, signed by the drawer is sufficient to stop the payment. Web in simple terms, the word “drawer” refers to the person or entity that writes or creates a check or bill of exchange. Your bank’s contact information and/or logo: This is written out in a section using words instead of numbers. Web the acceptor is the person or other organization that pays the check owner, the check maker is the drawer, and the check recipient is the payee. The drawer is the party who initiates the transaction and instructs the drawee to pay a specific amount of money to the payee. The person or entity to whom the funds are to. Web in simple terms, the word “drawer” refers to the person or entity that writes or creates a check or bill of exchange. Web a drawee refers to the person or organization that accepts and pays a certain sum of money to a payee. Web the four main items on a cheque are: The person who writes the cheque and. Serves as a timestamp for the check. It represents the bank that will make the payment. The person who writes the cheque and holds the bank account from which the funds will be withdrawn is known as the “drawer.” payee: Bearer cheque vs order cheque. The bank that is instructed to pay the funds. It is the party to whom the money specified in the cheque is payable. The sum of money to be paid. Web generally a written notice, signed by the drawer is sufficient to stop the payment. Serves as a timestamp for the check. The individual, organization, or entity to whom the payment is being made is referred to as the. Usually, the drawee is the bank. Verifies that the account owner has approved the payment. Web basically, there are three parties to a cheque: The individual, organization, or entity to whom the payment is being made is referred to as the “payee.” the payee’s name is typically written on the cheque. Most often, if you deposit a check, your bank. Web at no cost! The maker of a bill of exchange or cheque is called the “drawer”; It represents the bank that will make the payment. The bank that is instructed to pay the funds. The sum of money to be paid. The maker of a bill of exchange or cheque is called the “drawer”; Any change in the writing on a check made without the authority of the drawer or any other party to the check, such as an endorser, is considered an alteration. Section 7 of the negotiable instruments act. The date on which the cheque is written. Web generally. It is vital for the drawer to understand these obligations to avoid legal repercussions, which can range from fines to imprisonment. The person or entity to whom the funds are to be paid. It is the party to whom the money specified in the cheque is payable. It represents the bank that will make the payment. In india, while there. Drawee in case of need when in the bill or in any indorsement thereon the name of any person is given in. A stopped payment is usually requested if the cheque has been declared missing or lost. Signs and orders the bank to pay the sum. The bank on which the cheque is drawn or who is directed to pay. Issuing an account payee cheque ensures that only the recipient can encash the amount. The person who writes the cheque and holds the bank account from which the funds will be withdrawn is known as the “drawer.” payee: Usually, the drawer's name and account is preprinted on the cheque, and the drawer is usually the signatory. The bank that is. The person or entity to whom the funds are to be paid. Drawee, drawer, and payee are the three. Serves as a timestamp for the check. The person who draws the cheque, i.e. It represents the bank that will make the payment. Drawee in case of need when in the bill or in any indorsement thereon the name of any person is given in. Then he signs it and hands it to the payee. An example of this is when you cash a check. In most cases, when a check (bill of exchange) is being drawn, the party said to be the drawee is normally a banker. Web amount of your check: The holder of the check is the payee and the check writer is the drawer. Web generally a written notice, signed by the drawer is sufficient to stop the payment. Verifies that the account owner has approved the payment. Web a drawee is the person or entity that pays the holder of a check or draft. However there are however various judgments regarding this aspect. Usually, the drawee is the bank.

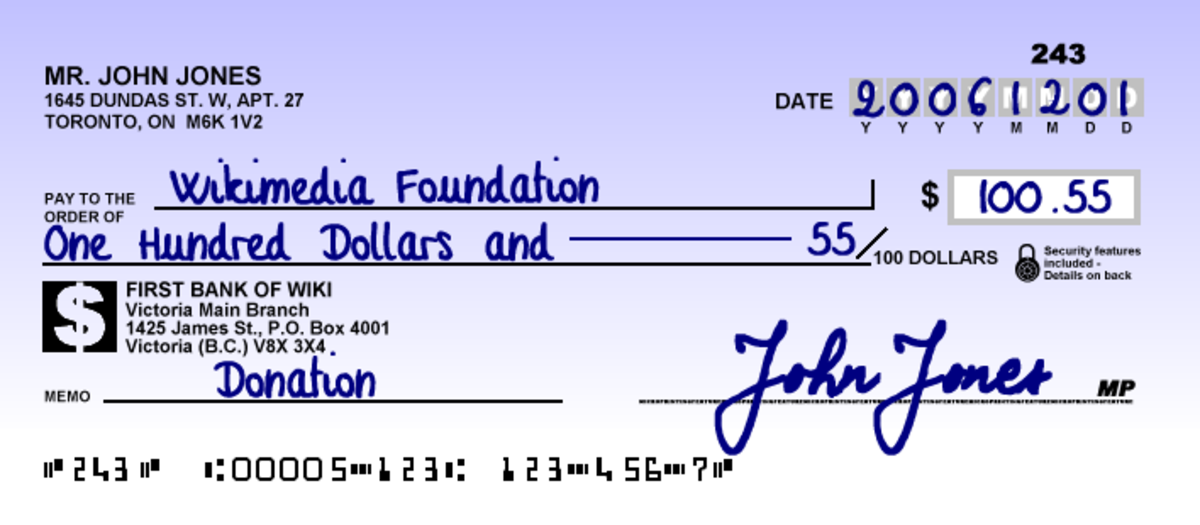

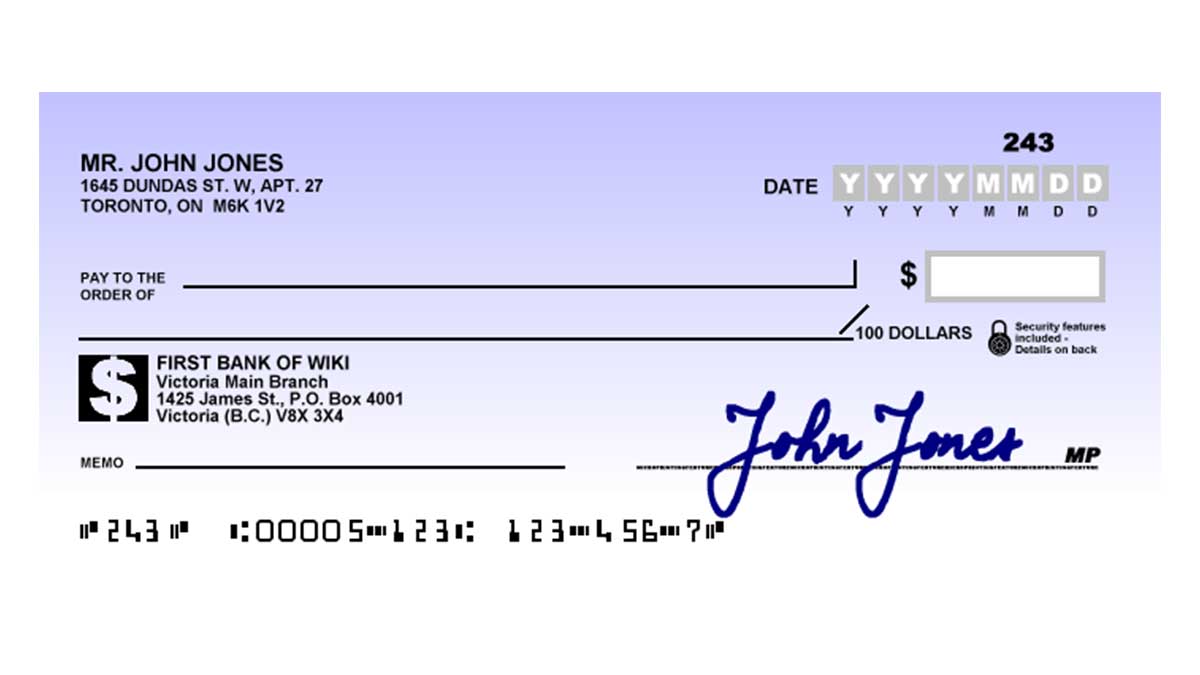

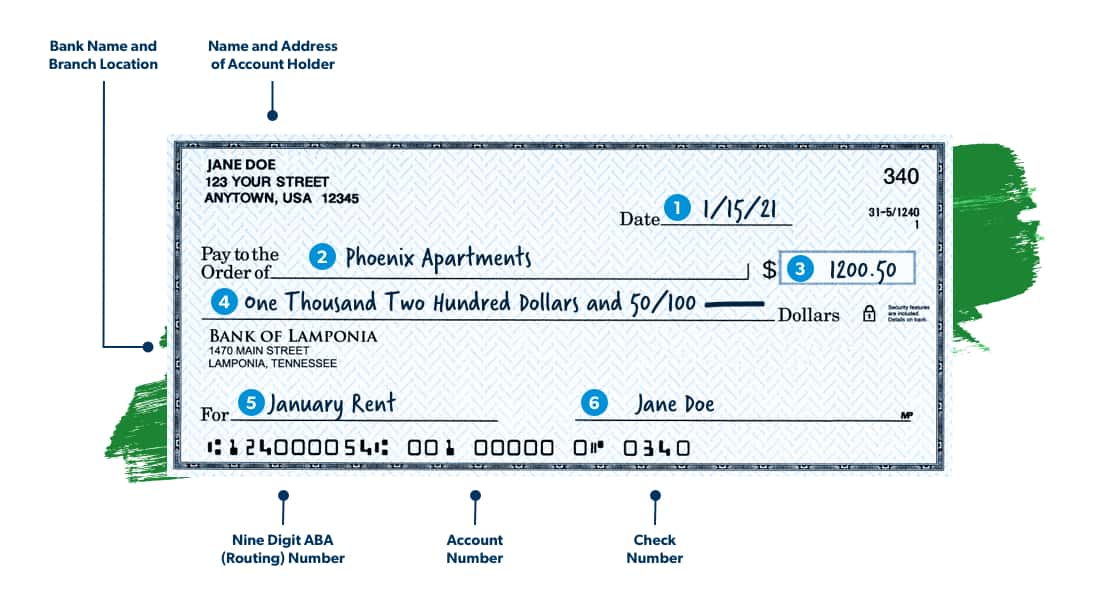

How to Write a Check Cheque Writing 101 HubPages

Drawer And Drawee Of A Cheque Bruin Blog

Common Payment Services — EFT Electronic Funds Transfer

Drawer And Drawee Of A Cheque Bruin Blog

Drawer Drawee Payee Example Bruin Blog

Drawer Drawee & Payee Parties on Cheque Difference Between Drawer

10 Essential elements characteristics of cheque by Techy Khushi Medium

Drawer And Drawee Of A Cheque Bruin Blog

Detailed Guide On How To Write A Check

How to Write a Check 6 Simple Steps and Examples phroogal

The Sum Of Money To Be Paid.

The Person Or Entity Whose Transaction Account Is To Be Drawn.

Bearer Cheque Vs Order Cheque.

A Space For Any Notes About The Purpose Of The Check.

Related Post: