Draw Down A Loan

Draw Down A Loan - Web learn what a loan drawdown is and how it works for home and construction loans. Web what is a loan drawdown? Lifetime mortgages are a type of. Web a loan drawdown is the process by which you receive funds from a loan agreement. The key differences are as follows: Instead, they’ll release the funds to the. Web the mortgage switching index from online mortgage broker doddl.ie is based on the average new mortgage draw down of €308,814 in the last quarter of 2023, with. A sizable amount is set aside to replenish u.s. Web a drawdown lifetime mortgage lets you take cash from your home as and when you want it rather than taking a simple lump sum. Drawdowns usually have to do with the reception of funds from either a retirement account, bank loan, or money deposited into an individual account. There are different ways to disburse loans, such as direct deposit, wire transfer,. A sizable amount is set aside to replenish u.s. Discover the pros and cons of a drawdown mortgage, calculate your returns and compare the best deals on the whole market with equity release supermarket. Web the measure would provide the ukraine war effort with about $60 billion.. There are different ways to disburse loans, such as direct deposit, wire transfer,. Lifetime mortgages are a type of. Disbursements refer to either cash. If your home loan is approved, your lender won’t simply pay the cash straight into your bank account for a property purchase. Web draw term loans allow borrowers to access funds throughout a draw period. Web a loan drawdown refers to the process of disbursing or paying out funds from a loan. Defense stockpiles, and billions more would. Web a delayed draw term loan (ddtl) is a flexible financing solution allowing borrowers to draw funds over time, aligning cash outflows with funding needs. If your home loan is approved, your lender won’t simply pay the. Drawdown can mean the act of borrowing under a loan agreement on a particular day. Web according to business dictionary, a loan drawdown is when someone withdraws funds from a loan facility. Lifetime mortgages are a type of. Drawdowns usually have to do with the reception of funds from either a retirement account, bank loan, or money deposited into an. Web a revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower. Practical law says lenders often allow drawdowns. Web a loan drawdown is the process by which you receive funds from a loan agreement. The terms drawdown and disbursement have multiple meanings in. Disbursements refer to either cash. The term loan drawdown refers to the disbursement of funds from a lender to a borrower. Find out the benefits, drawbacks and alternatives of a drawdown facility and how. In banking, a drawdown refers to a gradual accessing of credit funds. Put simply, it's the act of. Practical law says lenders often allow drawdowns. A delayed draw term is negotiated between the borrower and the lender. Web lucy was unable to draw down on her loan to cover the cost, so she requested a payment plan to afford the special levy, but the owners corporation refused. In banking, a drawdown refers to a gradual accessing of credit. It’s when the lender releases the funds to you, either in a lump sum or in installments,. In trading, a drawdown refers to a reduction in equity. Web a loan drawdown is the process by which you receive funds from a loan agreement. The key differences are as follows: If your home loan is approved, your lender won’t simply pay. Discover the pros and cons of a drawdown mortgage, calculate your returns and compare the best deals on the whole market with equity release supermarket. Put simply, it's the act of. Web a loan disbursement is when the lender delivers the approved loan amount to you. If your home loan is approved, your lender won’t simply pay the cash straight. Disbursements refer to either cash. Web a delayed draw term loan (ddtl) is a flexible financing solution allowing borrowers to draw funds over time, aligning cash outflows with funding needs. Web the measure would provide the ukraine war effort with about $60 billion. Practical law says lenders often allow drawdowns. Web a loan drawdown refers to the process of disbursing. A sizable amount is set aside to replenish u.s. Defense stockpiles, and billions more would. “we want to ensure the right guardrails are in place to protect lps”,. Drawdowns usually have to do with the reception of funds from either a retirement account, bank loan, or money deposited into an individual account. Web a loan drawdown refers to the process of disbursing or paying out funds from a loan. Web the mortgage switching index from online mortgage broker doddl.ie is based on the average new mortgage draw down of €308,814 in the last quarter of 2023, with. Web put simply, a drawdown loan allows you to borrow 'in chunks' and repay the full amount borrowed, rather than taking out a loan for a larger amount than you need, which could. Web learn what a loan drawdown is and how it works for home and construction loans. Web lucy was unable to draw down on her loan to cover the cost, so she requested a payment plan to afford the special levy, but the owners corporation refused. Web according to business dictionary, a loan drawdown is when someone withdraws funds from a loan facility. Web a revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower. Find out the benefits, drawbacks and alternatives of a drawdown facility and how. The term loan drawdown refers to the disbursement of funds from a lender to a borrower. Discover the pros and cons of a drawdown mortgage, calculate your returns and compare the best deals on the whole market with equity release supermarket. Practical law says lenders often allow drawdowns. There are different ways to disburse loans, such as direct deposit, wire transfer,.

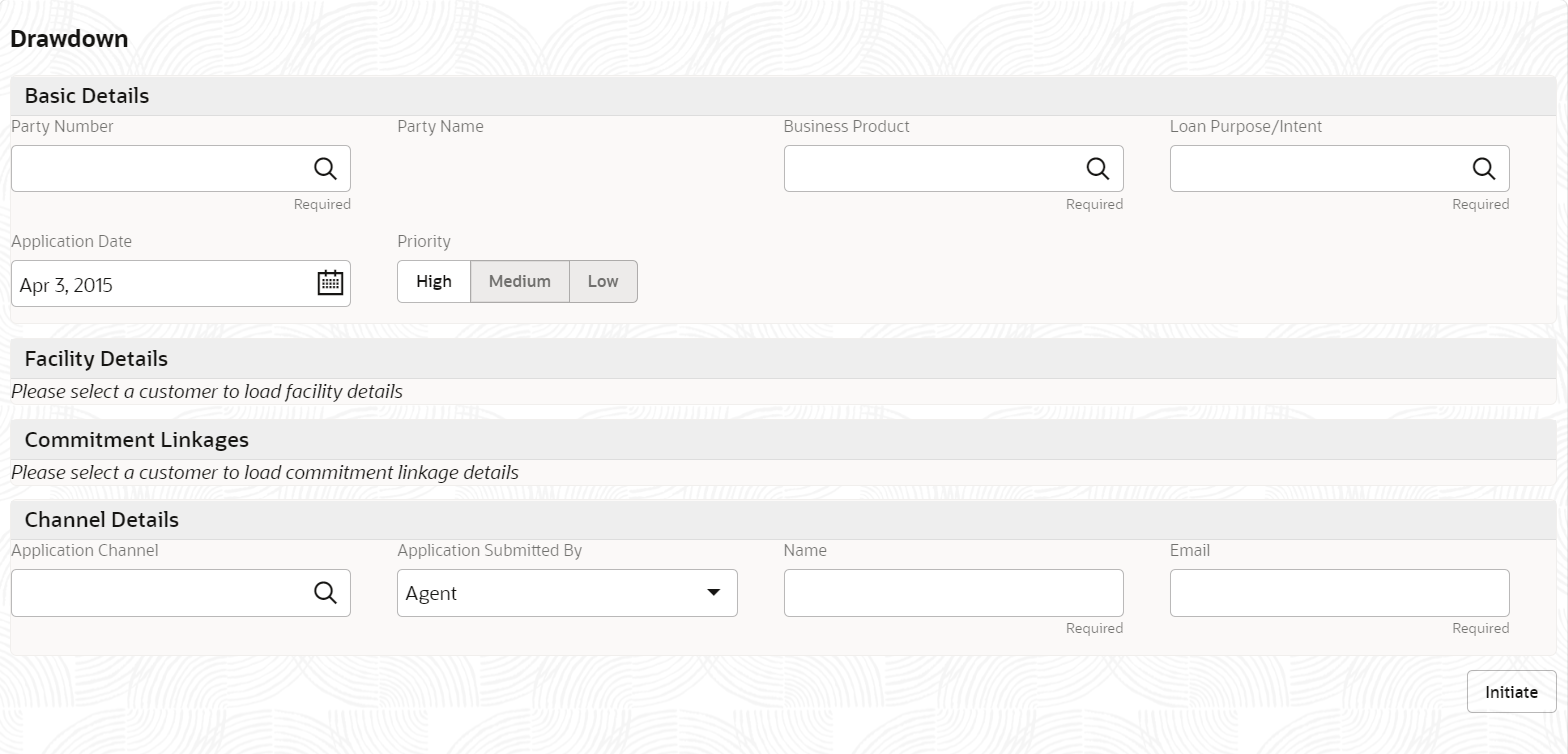

Request loan drawdown Templates & Legal Help

Loan Drawdown

What should be in a loan agreement? Catalyst Law

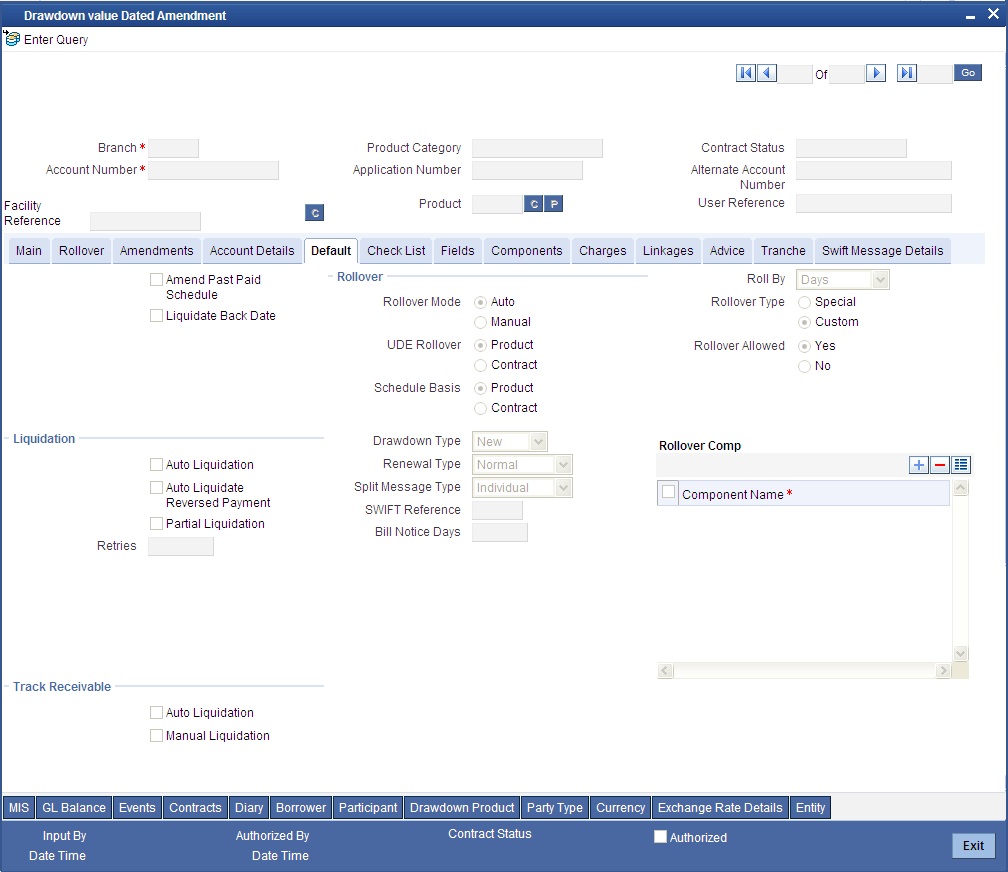

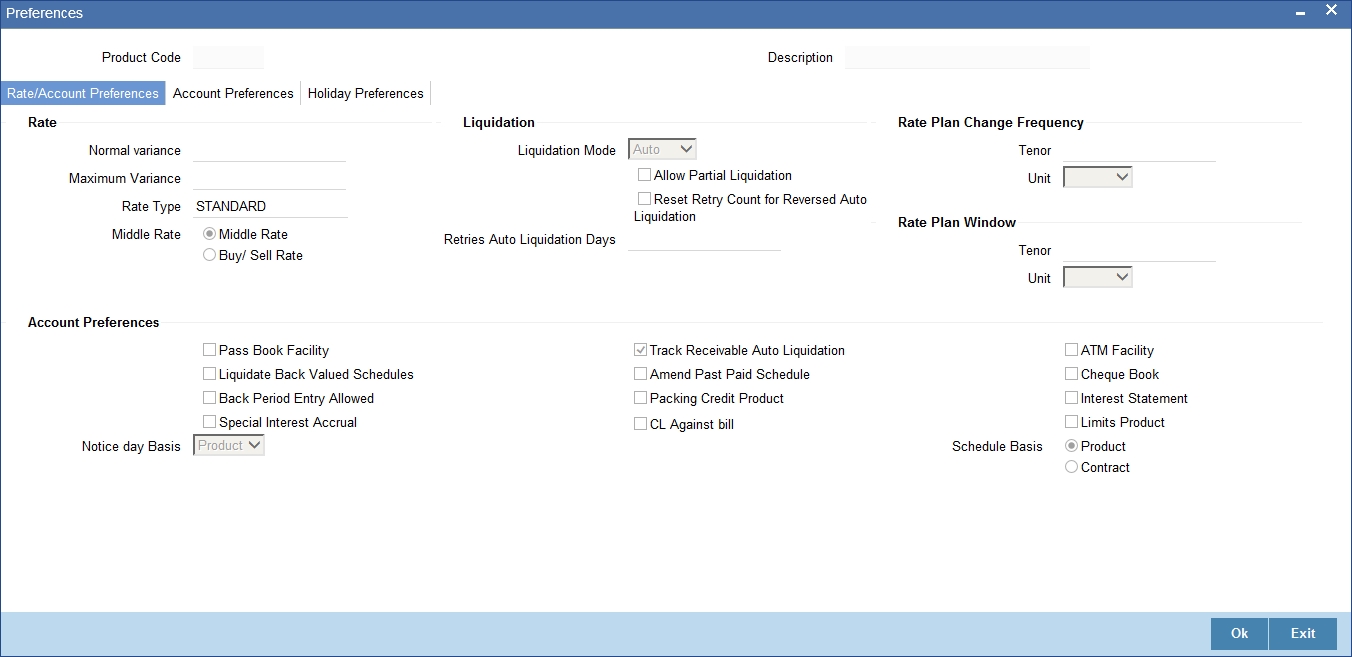

8. Rollingover a Drawdown Loan

8. Rollingover a Drawdown Loan

What Doese Draw Down Loan Mean

Draw Vs. Loan What's The Difference? Inspire Accountants Small

8. Rollingover a Drawdown Loan

Your Guide to the Home Loan Drawdown Process in Malaysia

What Doese Draw Down Loan Mean

Web A Delayed Draw Term Loan (Ddtl) Is A Flexible Financing Solution Allowing Borrowers To Draw Funds Over Time, Aligning Cash Outflows With Funding Needs.

Web What Is A Loan Drawdown?

It’s When The Lender Releases The Funds To You, Either In A Lump Sum Or In Installments,.

Instead, They’ll Release The Funds To The.

Related Post: