Compound Interest Drawing

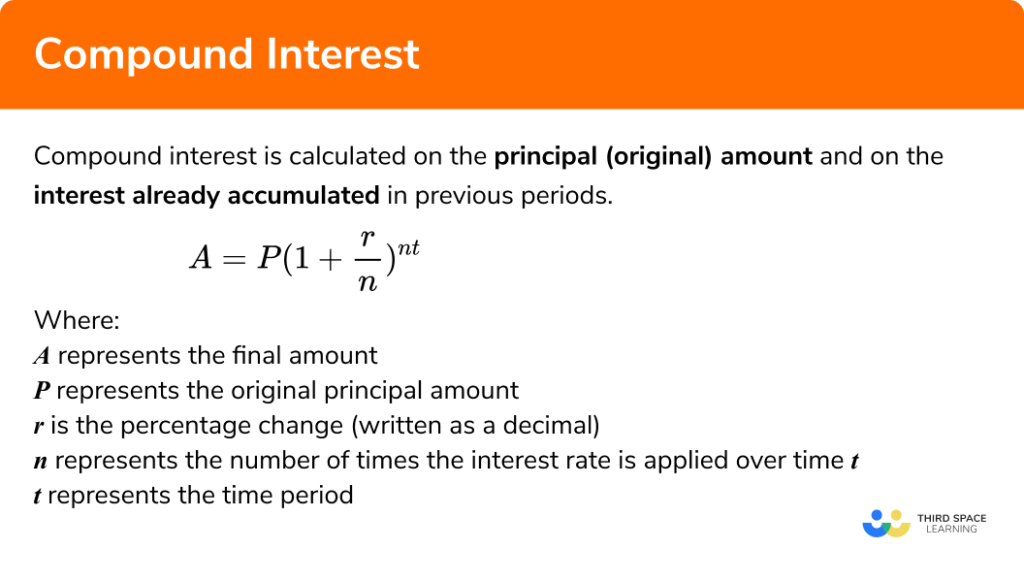

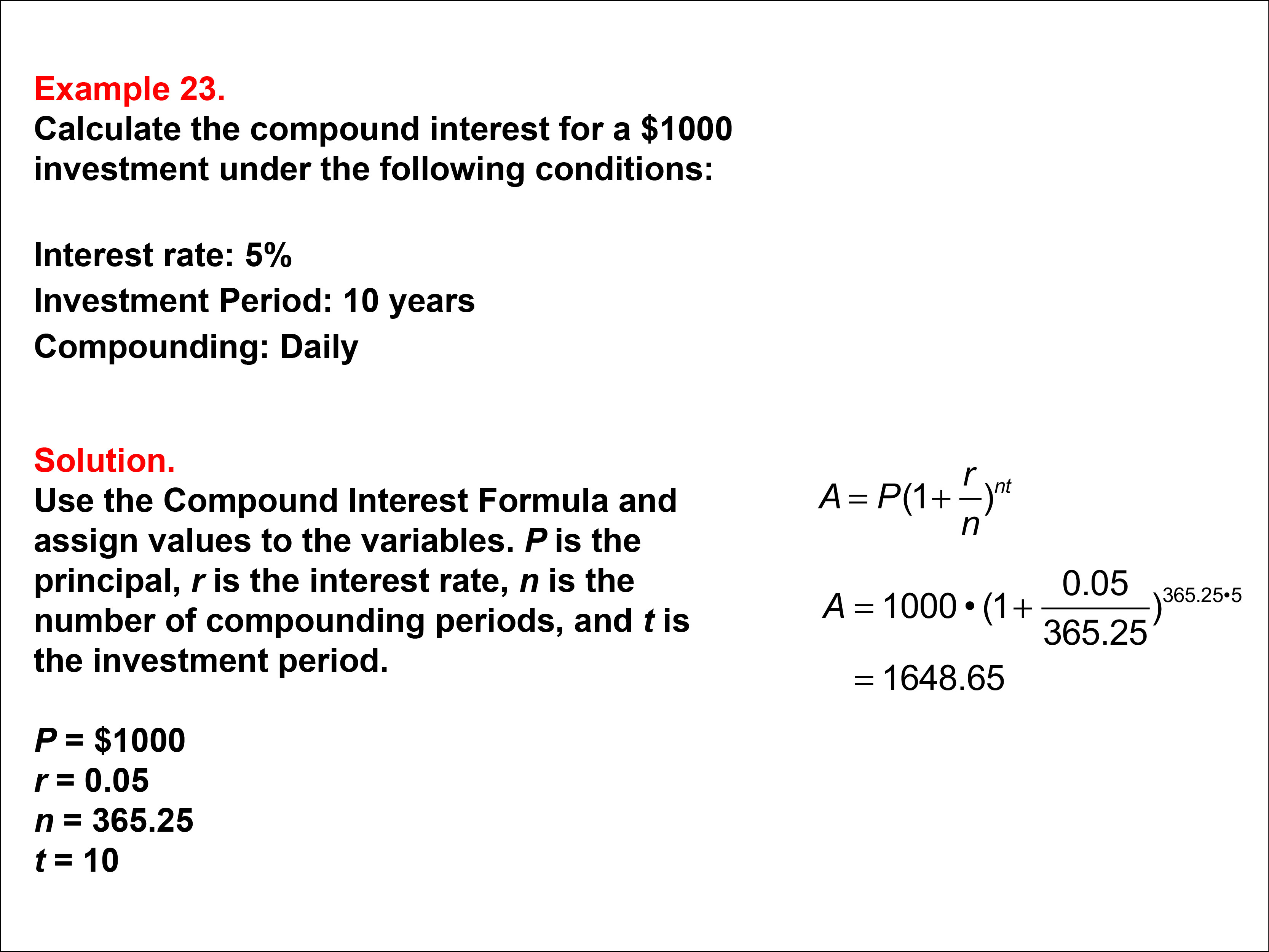

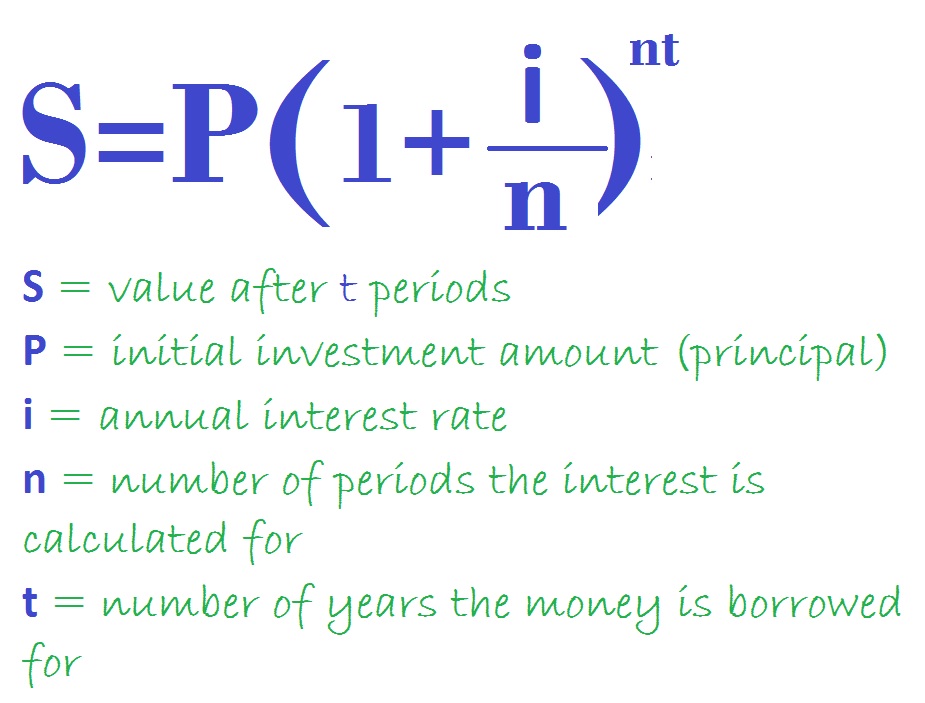

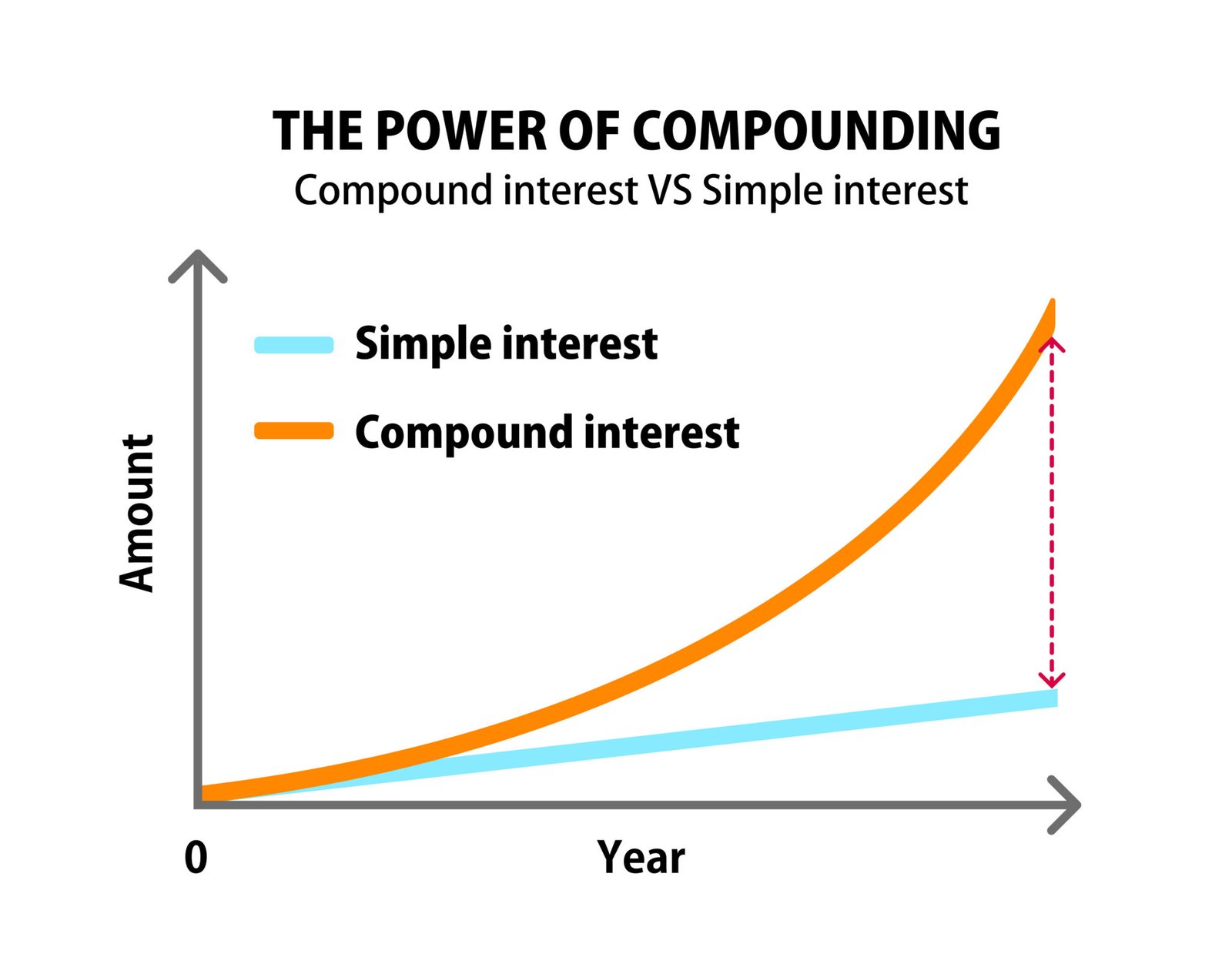

Compound Interest Drawing - P is your initial investment amount. The longer your investment stays in the account, the greater the ratio of interest to the original amount. Define compound interest in simple terms how to calculate compound interest compound annual growth rate (cagr) compound interest faqs. N is how many times your interest is compounded each year. Compound interest is the interest calculated on the principal and the interest accumulated over the previous period. % i enter average annual inflation rate: A is the total amount of money you have at the end. For annual compounding, multiply the initial balance by one plus your annual interest rate raised to the power of the number of time periods (years). Compound interest calculator finds compound interest earned on an investment or paid on a loan. Calculate the final amount of money you will be able to save. Compound interest calculator finds compound interest earned on an investment or paid on a loan. > intro to compound interest. You can also use this calculator to solve for compounded rate of return, time period and principal. Web what is the compound interest formula, with an example? $ i increase yearly contributions by: Compound interest calculator finds compound interest earned on an investment or paid on a loan. P(1 + r/n)^(n*t) = a principal: P is your initial investment amount. Web compound interest is the money your bank pays you on your balance — known as interest — plus the money that interest earns over time. For annual compounding, multiply the initial balance. Web compound interest, or 'interest on interest', is calculated using the compound interest formula a = p* (1+r/n)^ (nt) , where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years. Amount of money that you have available to. A is the total amount of money you have at the end. Doping engineering has emerged as an effective approach to address the key challenges faced by these compounds, namely, poor conducti journal of materials chemistry a. Web compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid. Amount of. Compound interest calculator finds compound interest earned on an investment or paid on a loan. P is the investment or principal balance at the start of the investment. Web compound interest is the money your bank pays you on your balance — known as interest — plus the money that interest earns over time. P is your initial investment amount.. N = number of compounding periods. Web money invested in the stock market and in savings accounts may benefit from compound interest. Understand the difference between starting to save now or later. I number of to grow: Calculate the final amount of money you will be able to save. The vertical axis is the a axis, the horizontal axis is the t axis. Web compound interest, or 'interest on interest', is calculated using the compound interest formula a = p* (1+r/n)^ (nt) , where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and. Web compound interest is the money your bank pays you on your balance — known as interest — plus the money that interest earns over time. Compounding thus can be construed as interest on. Web our compound interest calculator is a versatile tool which will help you: P is the investment or principal balance at the start of the investment.. Web here's the formula for the compound amount. I number of to grow: The longer your investment stays in the account, the greater the ratio of interest to the original amount. % i enter average annual inflation rate: Deposit amount $ increase deposits yearly with inflation? Web compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid. Use compound interest formula a=p (1 + r/n)^nt to find interest, principal, rate, time and total investment value. R is your interest rate, expressed as a decimal. Understand the difference between starting to save now or later. P is. Web compound interest, or 'interest on interest', is calculated using the compound interest formula a = p* (1+r/n)^ (nt) , where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years. Continuous compounding a = pe^rt. $ € £ ₹ ¥. % i choose your compounding interval: Compounding thus can be construed as interest on. This gives a combined figure for principal and compound interest. A is the total amount of money you have at the end. Web compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid. Web how to calculate ci. P is your initial investment amount. $ i increase yearly contributions by: You can also use this calculator to solve for compounded rate of return, time period and principal. Web let's go over the compound interest formula and define each variable. Web our compound interest calculator is a versatile tool which will help you: Our online tools will provide quick answers to your calculation and conversion needs. (daily to yearly) the basics.

Compound Interest GCSE Maths Steps, Examples & Worksheet

How Does Compound Interest Work? STEVE HARVEY

Student Tutorial Compound Interest Media4Math

Pictures of compound interest. free images that you can download and use!

![Compound Interest Calculator [Formula & How to Calculate] Mint](https://blog.mint.com/wp-content/uploads/2021/02/pasted-image-0-1-2.png?resize=1536)

Compound Interest Calculator [Formula & How to Calculate] Mint

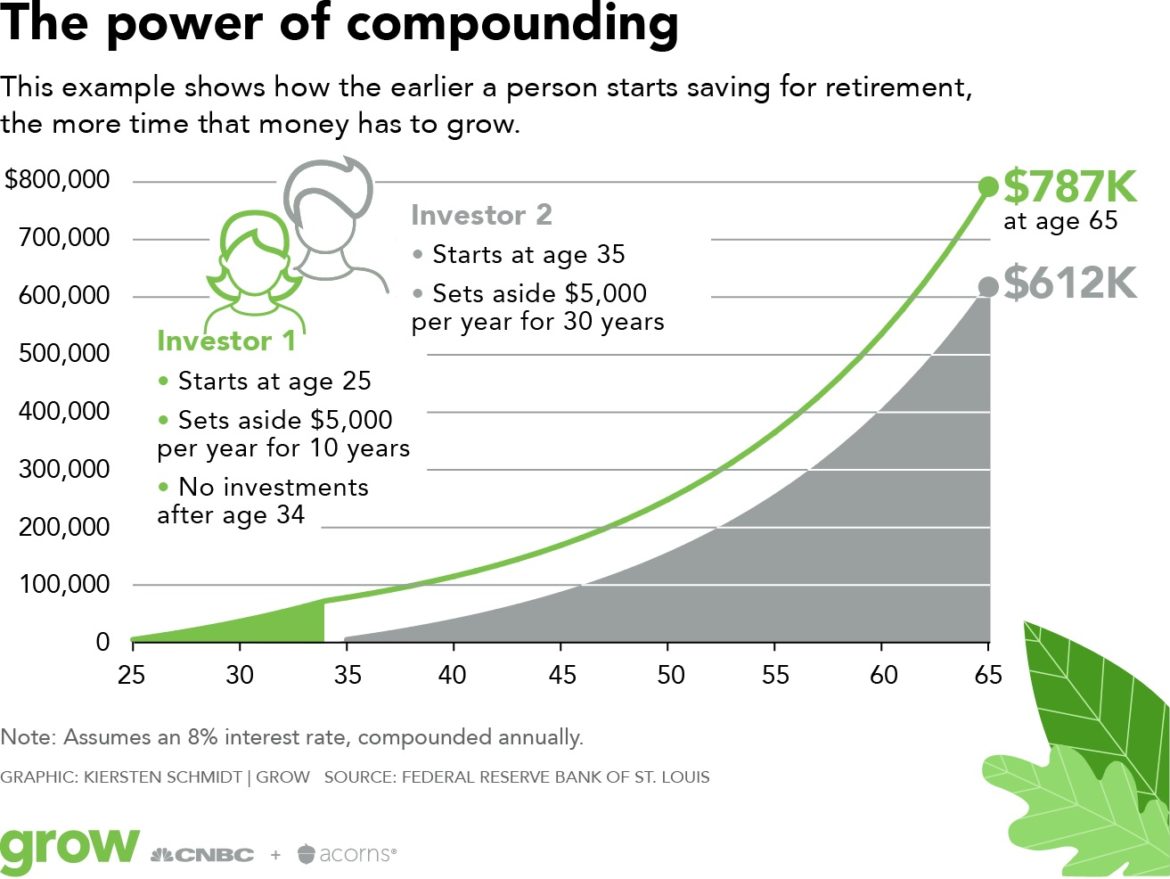

The Power of Compound Interest Explained WalletGenius

How Compound Interest Can Make You Rich

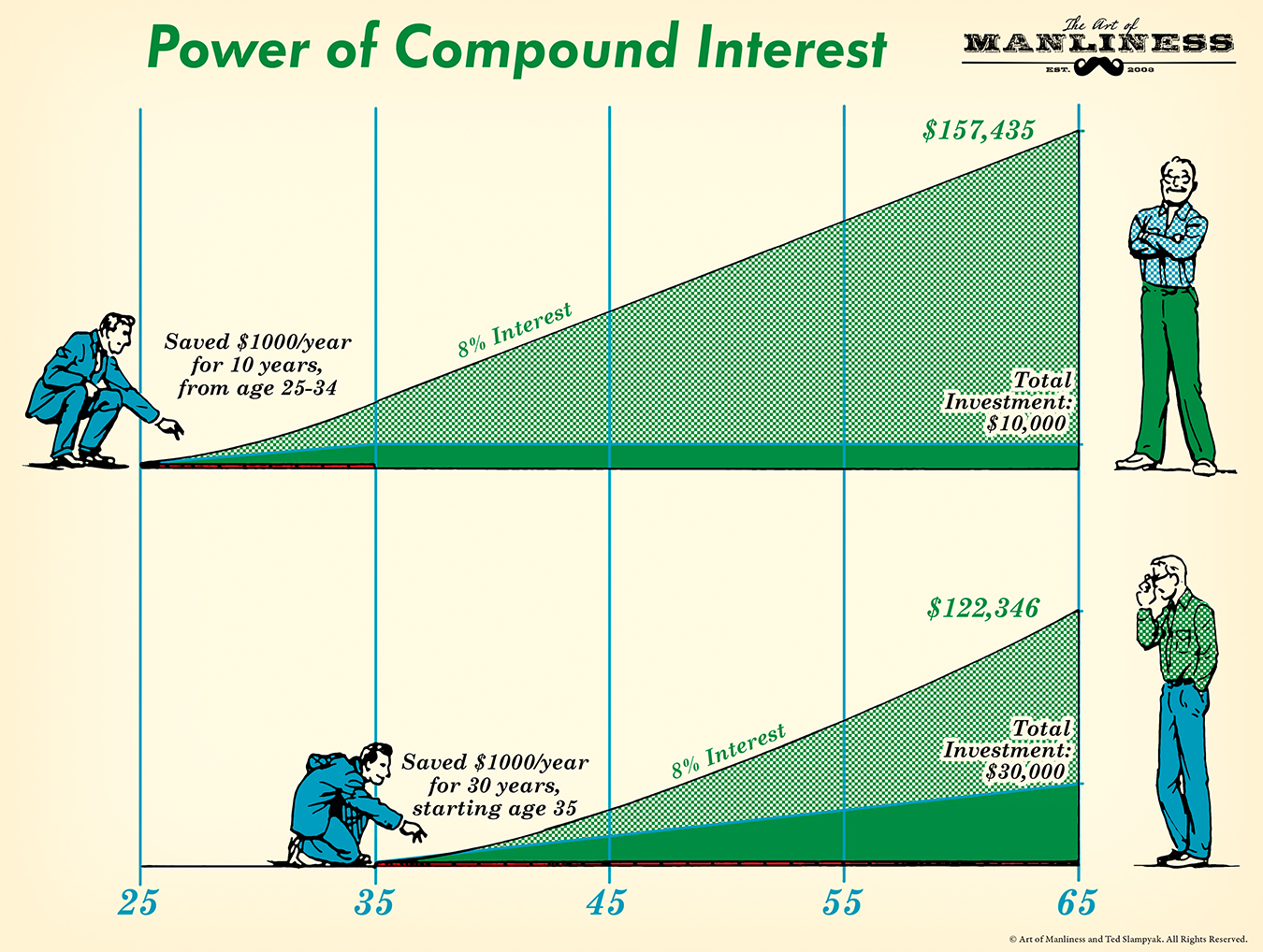

Compound Interest Formula and Benefits The Art of Manliness

What Is Compound Interest And How To Calculate It? The Compound

Compound Interest Calculator Data Driven Money

For Annual Compounding, Multiply The Initial Balance By One Plus Your Annual Interest Rate Raised To The Power Of The Number Of Time Periods (Years).

R Is The Interest Rate, Ranging From 1% (0.01) To 10% (0.1).

Understand The Difference Between Starting To Save Now Or Later.

It’s A Way To Make Your Cash Work For You.

Related Post: