Can I Draw Social Security If I Never Worked

Can I Draw Social Security If I Never Worked - 3 ways to collect social security benefits even if you've never worked. If you were financially dependent on a person who has died, you might qualify for survivors benefits. Web no, you do not receive social security if you have never worked. Well, that’s not the case. Web the age you stop working can affect the amount of your social security retirement benefits because we base your retirement benefit on your highest 35 years of earnings and the age you start receiving benefits. If, for example, you stop working at age 60 but wait until 67 to claim social security, your benefit will not be reduced because you did not work in those seven years. Web if you are at least 66 years and 2 months old, the top threshold currently in effect for social security's full retirement age, the answer is no. Have a medical condition that meets social security's strict definition of disability. Web if you haven't worked and paid social security taxes for 10 years or more, we'll still see if you're eligible for a monthly benefit based on a current or former spouse's work. What you would lose is an opportunity to make your benefit bigger. Web the only people who can legally collect benefits without paying into social security are family members of workers who have done so. Web others never worked outside the home or paid social security tax. What you would lose is an opportunity to make your benefit bigger. Please answer a few questions to help us determine your eligibility. Web if. Social security benefits are based on the amount of income you earned during your working life. Web social security rules allow nonworking spouses to receive income based on a working spouse’s earnings record. However, there is a limit to how much you can earn and still receive full benefits. Web if you haven't worked and paid social security taxes for. If you're married to someone who is entitled to social security benefits, you could collect spousal benefits based on his or her work record. Web in order to be eligible for social security benefits, you generally need to have worked and paid payroll taxes for at least 10 years. And because the social security administration usually won't notify you if.. Web if you are at least 66 years and 2 months old, the top threshold currently in effect for social security's full retirement age, the answer is no. What you would lose is an opportunity to make your benefit bigger. If you make more than the social security administration’s earnings limit before full retirement age, you could lose benefits. How. In fact, there are several different scenarios in which a person can receive social security benefits without ever having paid into the system, or. 12mm+ questions answeredhelped over 8mm worldwide Starting with the month you reach full retirement age, we will not reduce your benefits no matter how much you earn. Well, that’s not the case. However, if you are. Web the age you stop working can affect the amount of your social security retirement benefits because we base your retirement benefit on your highest 35 years of earnings and the age you start receiving benefits. Web however, there's a chance you may still be eligible to receive social security benefits, even if you've never had a job. Web it. How much are social security benefits for nonworking spouses? The short answer is yes. Web social security rules allow nonworking spouses to receive income based on a working spouse’s earnings record. Social security calculates your retirement benefit by: Web you can get social security retirement benefits and work at the same time. If you make more than the social security administration’s earnings limit before full retirement age, you could lose benefits. Web another common way to receive social security benefits without having worked is through survivor’s benefits. Web in order to be eligible for social security benefits, you generally need to have worked and paid payroll taxes for at least 10 years.. The short answer is yes. An example of these are widows and widowers, but this can also apply to parents, children, divorced spouses and relatives. Web the age you stop working can affect the amount of your social security retirement benefits because we base your retirement benefit on your highest 35 years of earnings and the age you start receiving. However, if you are younger than full retirement age and make more than the yearly earnings limit, we will reduce your benefits. However, there are a few ways you can collect benefits. They have no benefit of their own, but thanks to the social security spousal benefit available under their spouse’s work record, they can still receive payments. A majority. If, for example, you stop working at age 60 but wait until 67 to claim social security, your benefit will not be reduced because you did not work in those seven years. If you're married to someone who is entitled to social security benefits, you could collect spousal benefits based on his or her work record. Web the answer is yes—and no. Web social security rules allow nonworking spouses to receive income based on a working spouse’s earnings record. What you would lose is an opportunity to make your benefit bigger. 3 ways to collect social security benefits even if you've never worked. Web in order to be eligible for social security benefits, you generally need to have worked and paid payroll taxes for at least 10 years. In general, we pay monthly benefits to people who are unable to work for a year or more because of a disability. To get benefits, you need to accrue 40 work credits, which hinge on. Social security benefits are based on the amount of income you earned during your working life. However, there is a limit to how much you can earn and still receive full benefits. If you make more than the social security administration’s earnings limit before full retirement age, you could lose benefits. However, there are a few ways you can collect benefits. Web others never worked outside the home or paid social security tax. Web the age you stop working can affect the amount of your social security retirement benefits because we base your retirement benefit on your highest 35 years of earnings and the age you start receiving benefits. Well, that’s not the case.

What Age Can You Collect Social Security? Retirement Plan Services

What Can I Draw Social Security When Should I Start Drawing My Social

WHEN TO DRAW SOCIAL SECURITY and Other Social Security Myths YouTube

How Old Can You Be to Draw Social Security Joseph Voinieuse

How To Draw Social Security Early? Retire Gen Z

When is it best to begin drawing Social Security Benefits?

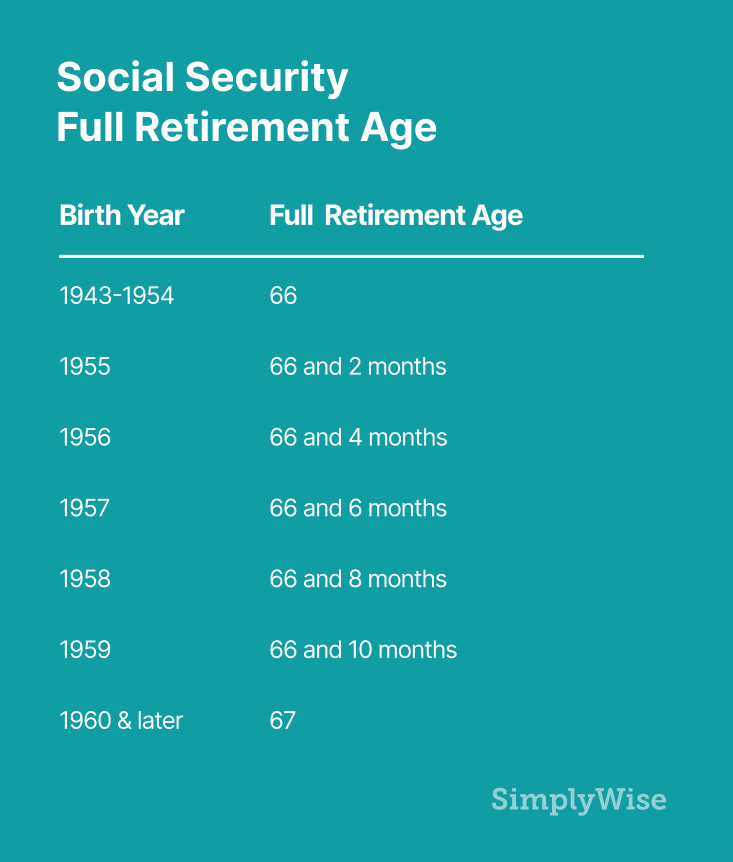

How is Social Security calculated? SimplyWise

Can You Collect Social Security If You Never Worked? SimplyWise

What’s The Right Age To Start Drawing Social Security? To Our

Can I draw Social Security at 62 and still work full time? Answered

How Much Are Social Security Benefits For Nonworking Spouses?

You Can Get Ssi Disability Without A Work History, But You Can't Get Ssdi Benefits On Your Own Work Record.

As A Result, They Won’t Be Eligible To Receive Regular Social Security Retirement Benefits.

Have A Medical Condition That Meets Social Security's Strict Definition Of Disability.

Related Post: