Can I Draw Money Out Of My Pension

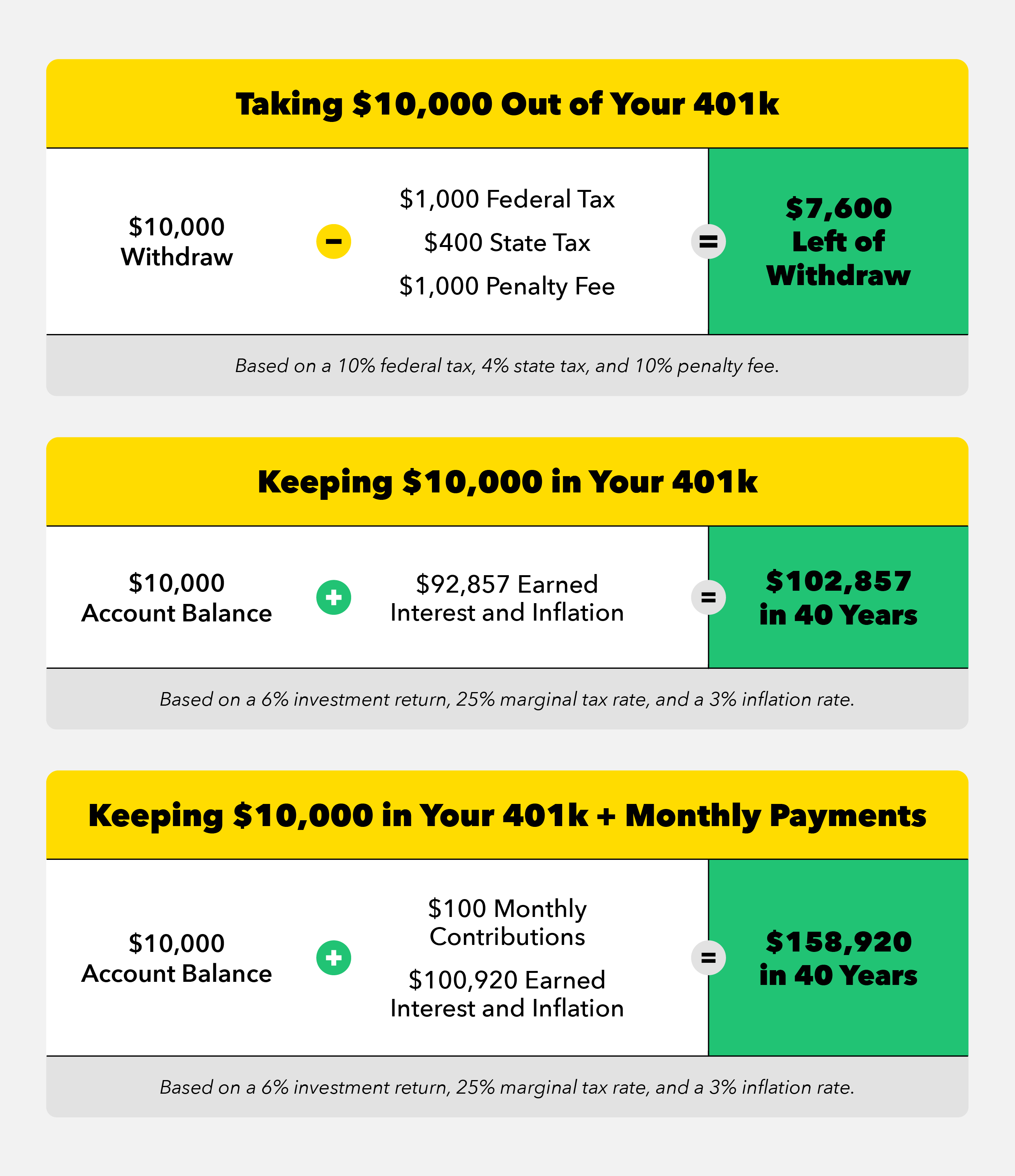

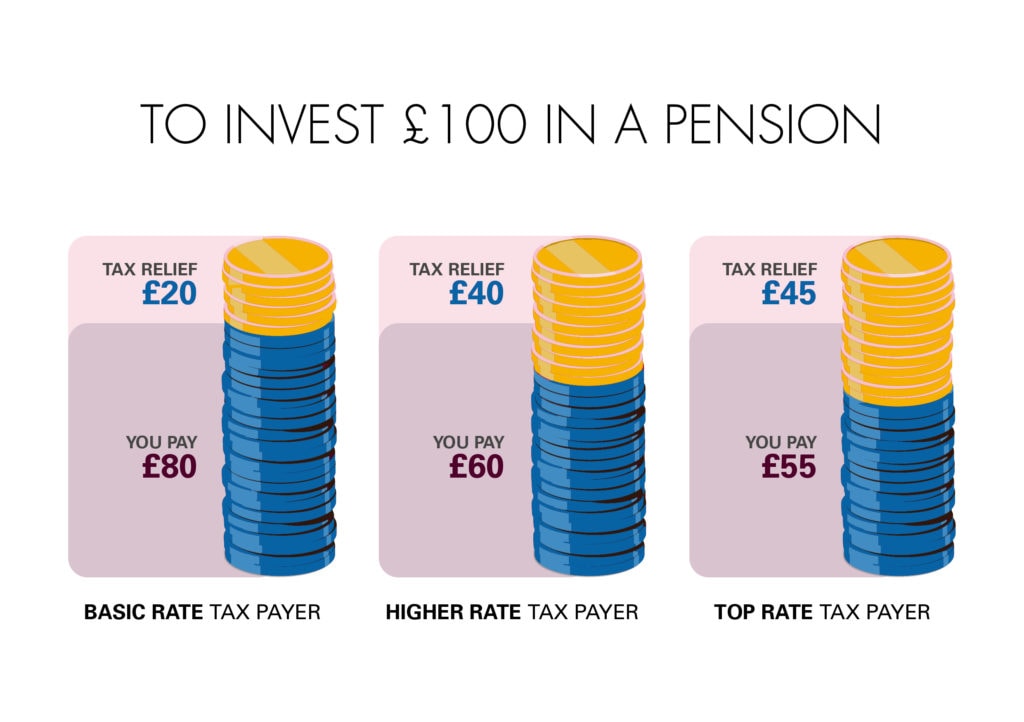

Can I Draw Money Out Of My Pension - Unless you qualify for an exception, you must still pay the 10% additional tax for taking an early distribution from your traditional ira even if you take it to satisfy a divorce court order ( internal revenue code section 72 (t) ). You may be able to take cash directly from your pension pot. Updated on may 7, 2022. But you need to know what to expect from the irs. Web the earliest you can take money from your personal or workplace pension is usually 55 (rising to 57 from 2028). Withdrawing from your pot in smaller lump sums. Web you can withdraw more than the minimum required amount. Web you can take money from your pension as and when you need to through income drawdown. Should you withdraw your pension as a lump sum? Web income includes any money you regularly draw down from your pension. Web you can withdraw more than the minimum required amount. The remaining 75% is taxable, but whether you pay tax and how much you pay depends on your specific circumstances. Web early pension release, also known as pension unlocking, refers to withdrawing money from your pension before the age of 55 (rising to 57 from 2028). Yes, you can collect. Web withdraw cash from your pension pot. Web the earliest you can take money from your personal or workplace pension is usually 55 (rising to 57 from 2028). You’ll lose out on future pension growth potential. Web fact checked by. Web you can take money from your pension as and when you need to through income drawdown. Can i take out a loan from my pension plan? Updated on may 7, 2022. To save money on future pension payouts, a company may give employees the chance to withdraw their pension as a lump sum. Your pension should only impact your benefits if you’re over 55, since that’s the earliest you can usually access your pension. If you. You’ll lose out on future pension growth potential. Vested benefits refer to the portion of a pension plan that an employee is entitled to receive even if they leave their job before retirement age. But you need to know what to expect from the irs. However, there are considerable tax implications to consider before going for this option. Withdrawing from. Web it is usually possible to withdraw all your pension when you turn 55 (57 from 2028), but there are downsides to consider: Web yes, you can withdraw money early for unexpected needs. If you take a distribution from your retirement plan early (meaning before the day you turn 59 1/2), you'll generally have to pay a 10% early distribution. However, there are considerable tax implications to consider before going for this option. Web withdrawing your full pension pot. Web retiring or taking a pension before 59 1/2. Unless you meet specific conditions, any early withdrawals made before you’re. You’ll lose out on future pension growth potential. And you don’t need to stop working to take your pension. Yes, you can collect social security benefits if you have pension, but two rules might reduce your monthly benefit. Unless you qualify for an exception, you must still pay the 10% additional tax for taking an early distribution from your traditional ira even if you take it to satisfy. But it's still critical to know how your withdrawal may be taxed. Are you over age 59 ½ and want to withdraw? Web withdrawing your full pension pot. If you take a distribution from your retirement plan early (meaning before the day you turn 59 1/2), you'll generally have to pay a 10% early distribution tax above and beyond any.. Updated on may 7, 2022. But you need to know what to expect from the irs. Web fact checked by. Web retiring or taking a pension before 59 1/2. Yes, you can collect social security benefits if you have pension, but two rules might reduce your monthly benefit. Find out more about your options for taking your pension money. Web withdraw cash from your pension pot. But it's still critical to know how your withdrawal may be taxed. Should you withdraw your pension as a lump sum? Web fact checked by. Are you over age 59 ½ and want to withdraw? But it's still critical to know how your withdrawal may be taxed. What are the advantages of taking a lump sum? Your pension should only impact your benefits if you’re over 55, since that’s the earliest you can usually access your pension. Yes, you can collect social security benefits if you have pension, but two rules might reduce your monthly benefit. Web it is usually possible to withdraw all your pension when you turn 55 (57 from 2028), but there are downsides to consider: But you need to know what to expect from the irs. To save money on future pension payouts, a company may give employees the chance to withdraw their pension as a lump sum. Find out more about your options for taking your pension money. Web when can i access my pension money? Web retiring with a pension and social security: To do this, you can close you pension pot and take your fund as cash. Updated on may 7, 2022. Web draw money from the pension fund itself to give you an income. However, you also have a ‘selected retirement age’, which is likely to be later than your normal minimum pension age. This rule is only waived when certain exceptions apply and the rule of 55 is.

Money Drawing How To Draw A Money Step by Step for Beginners YouTube

How pension drawdown works What you need to know and do

How To Make A Retirement Cash Flow Plan (That Actually Works)

How to Draw Money Cash Wad Dollars / Watercolor Drawing Tutorial YouTube

How to Draw MONEY EASY Step by Step YouTube

Should I Cash Out My 401k to Pay Off Debt?

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/B66TYOIB2FJIEZYS5A7VGLPG4M.jpg)

Can I cash in my pension early? Rules and exceptions explained The

When can I take money out of my pension on Vimeo

Can I Take My Pension at 55 and Still Work ** Find Out How

A 14 Steps Guide to Cash Balance Pension Plan Termination CareerCliff

Web Fact Checked By.

Web Withdrawing Your Full Pension Pot.

The Remaining 75% Is Taxable, But Whether You Pay Tax And How Much You Pay Depends On Your Specific Circumstances.

Web Ordinarily, You Can’t Withdraw Money From These Plans Before Age 59½ Without Facing A 10% Early Withdrawal Penalty.

Related Post: