Can I Draw From My 401K

Can I Draw From My 401K - Web you can make a 401 (k) withdrawal in a lump sum, but in most cases, if you do and are younger than 59½, you'll pay a 10% early withdrawal penalty in addition to. Contributions and earnings in a. A 401(k) account alone may not help you save as much as you need for retirement.; Advice & guidanceaccess to advisors To purchase a principal residence. Web first, let’s recap: If you withdraw money from your 401(k) before you’re 59 1⁄2, the irs usually assesses a 10% tax as an early distribution penalty. Web with a roth ira, you can withdraw as much as you’ve contributed—but not any investment earnings—at any time for any reason without paying taxes or penalties. Web understanding early withdrawals. Web first, not all employers allow early 401 (k) withdrawals. Web you can withdraw money when you retire, take out a 401 (k) loan, make a hardship withdrawal, or roll over your funds to another account. Learn finance easily.learn more.free animation videos.learn at no cost. Here’s what you need to know about each. Tapping your 401 (k) early. A 401 (k) early withdrawal is any money you take out from. Learn finance easily.learn more.free animation videos.learn at no cost. Web traditional 401 (k) plans: Web the irs specifies that you can only withdraw funds from your 401 (k) with no penalty for the qualifying reasons: With traditional 401 (k) plans, employers can make contributions to all participants, match employee contributions, or both. Here’s what you need to know about each. Web the irs specifies that you can only withdraw funds from your 401 (k) with no penalty for the qualifying reasons: Here’s what you need to know about each. Web understanding early withdrawals. If you need money but are trying to. Web first, let’s recap: Between the taxes and penalty, your immediate take. Not everyone has access to a 401(k) plan at. Gili benita for the new york times. Contributions and earnings in a. If your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Web there are three main ways to withdraw money from your 401 (k) before you hit retirement age. Web with a roth ira, you can withdraw as much as you’ve contributed—but not any investment earnings—at any time for any reason without paying taxes or penalties. Web a withdrawal permanently removes money from your retirement savings for your immediate use, but. Web the irs specifies that you can only withdraw funds from your 401 (k) with no penalty for the qualifying reasons: You’ll need to speak with someone at your company’s human resources department to see if this option is. Web drawbacks of 401(k) accounts: Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends. If your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. For 2024, you can’t put more than $7,000 into a roth, plus another. Web understanding early withdrawals. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently.. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. If you need money but are trying to. Not everyone has access to a 401(k) plan at. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Web with a roth ira,. Fact checked by kirsten rohrs schmitt. Contributions and earnings in a. If your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently. Web yes, you can withdraw money. Web there are three main ways to withdraw money from your 401 (k) before you hit retirement age. If you need money but are trying to. Web traditional 401 (k) plans: Web yes, you can withdraw money from your 401 (k) before age 59½. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your. You can also make an early. Web investing extra money in your 401(k) may not make sense. Web you can make a 401 (k) withdrawal in a lump sum, but in most cases, if you do and are younger than 59½, you'll pay a 10% early withdrawal penalty in addition to. Between the taxes and penalty, your immediate take. Web you can withdraw money when you retire, take out a 401 (k) loan, make a hardship withdrawal, or roll over your funds to another account. Web understanding early withdrawals. However, early withdrawals often come with hefty penalties and tax consequences. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. Web traditional 401 (k) plans: Web understanding early withdrawals. If you withdraw money from your 401(k) before you’re 59 1⁄2, the irs usually assesses a 10% tax as an early distribution penalty. Gili benita for the new york times. For 2024, you can’t put more than $7,000 into a roth, plus another. Web yes, you can withdraw money from your 401 (k) before age 59½. With traditional 401 (k) plans, employers can make contributions to all participants, match employee contributions, or both. Low cost fundsmarket insightsretirement planningfund comparison tool:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

When Can I Draw From My 401k Men's Complete Life

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

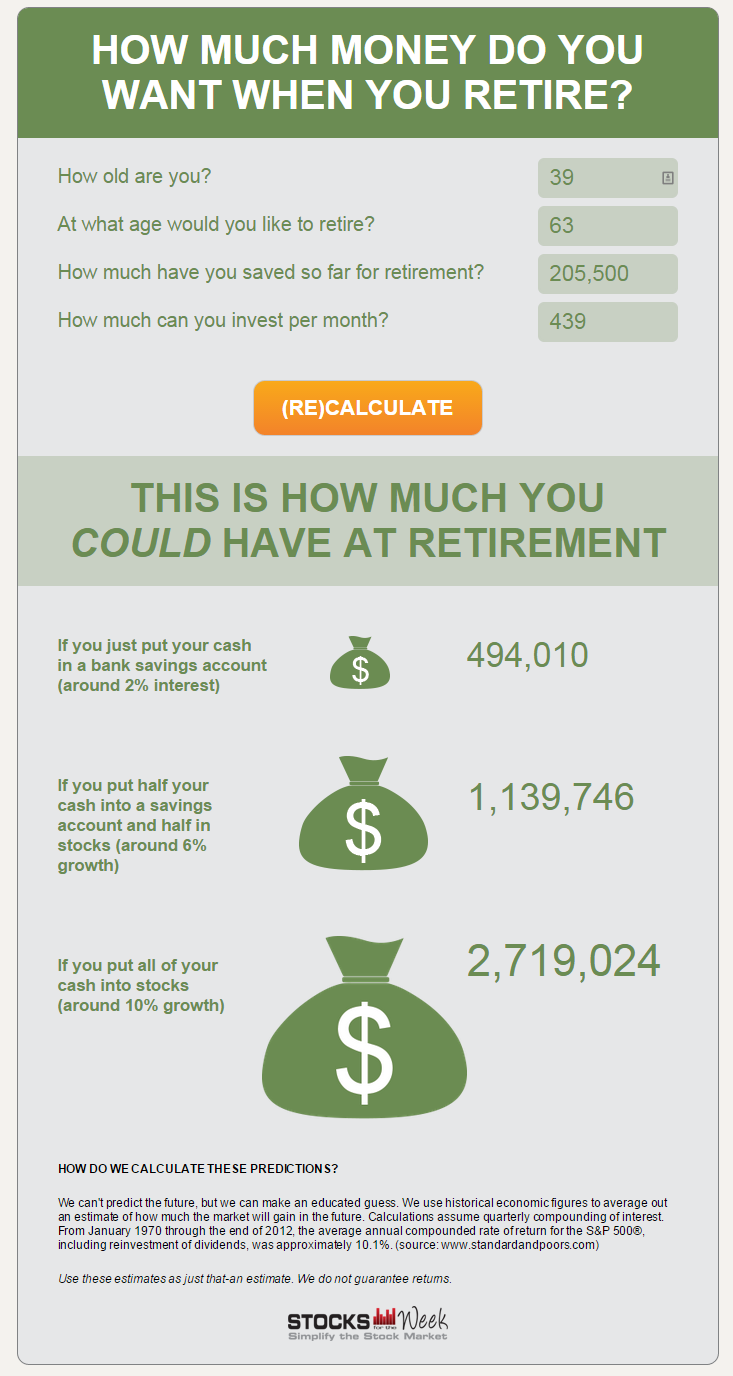

How to Estimate How Much Your 401k will be Worth at Retirement

How To Draw Money From 401k LIESSE

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

4 Reasons to Borrow From Your 401(k)

3 Ways to Withdraw from Your 401K wikiHow

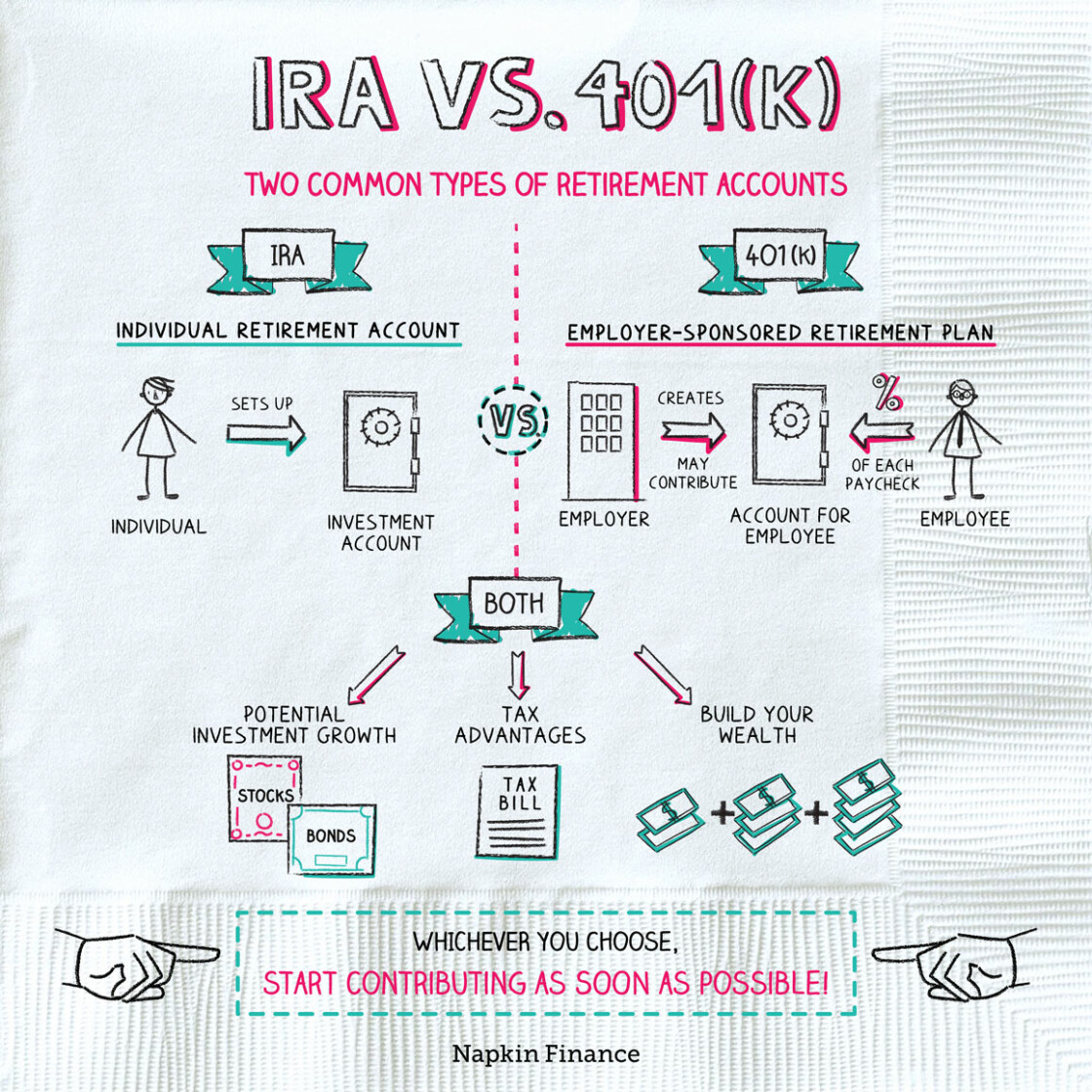

What is 401K? IRA vs 401K Retirement Answers from Napkin Finance

When Can I Draw From My 401k Men's Complete Life 401k, Canning, I can

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is a 401(k) and How Does It Work?

Web First, Not All Employers Allow Early 401 (K) Withdrawals.

Web First, Let’s Recap:

You’ll Need To Speak With Someone At Your Company’s Human Resources Department To See If This Option Is.

They Also Can Use A Vesting.

Related Post: