Can Husband And Wife Draw Social Security

Can Husband And Wife Draw Social Security - Web it is likely that both you and your spouse have earned enough social security credits to be eligible for your own benefits after retirement. The maximum amount is between 150 percent and 188 percent of the worker’s monthly. Web social security will not pay the sum of your retirement and spousal benefits; If you don’t have enough social security credits to qualify for benefits on your own record, you may be able to. Web your spousal retirement benefit would be $1,000 (50% of $2,000). Web technically, yes, you can receive both benefits on your spouse's earnings record and your own retirement payment. Can my children get benefits on my social security when i retire? If the number of months exceeds 36, then the benefit is further reduced 5/12. Web when a social security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. A retired worker’s spouse qualifies for social security spousal benefits once that spouse turns 62, or if they (the spouse) are. Determining when to start your social security benefits is a personal decision. Anyone who is married can apply for social security benefits on their own, or they can take the option to get up to 50 percent of their spouse’s benefit amount at full retirement age. As a practical matter, however, you'll get the higher of the two amounts, and. If your benefit amount as a spouse is higher than your own retirement benefit, you will get a combination of the. Web it is technically possible for both spouses to receive ssi. Web technically, yes, you can receive both benefits on your spouse's earnings record and your own retirement payment. A retired worker’s spouse qualifies for social security spousal benefits. Any age and caring for a child who is under age 16 or who has a disability that began before age 22. Social security benefits are a crucial part of millions of americans’ retirement income. Can a grandchild get social security? Web can i collect social security spousal benefits? However, your spouse’s earnings could affect the overall amount you get. If your spouse’s full retirement age benefit amounts to $2,000 per month, your spousal benefit at your full retirement age could amount to $1,000 per month. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. Web a spouse can choose to retire. Web technically, yes, you can receive both benefits on your spouse's earnings record and your own retirement payment. Under this provision, you don’t have a choice whether to wait and switch. Web march 28, 2024, at 2:35 p.m. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. Any age. If your spouse’s full retirement age benefit amounts to $2,000 per month, your spousal benefit at your full retirement age could amount to $1,000 per month. Web what are the marriage requirements to receive social security spouse’s benefits? If my spouse dies, can i collect their social security benefits? Web social security will not pay the sum of your retirement. Web technically, yes, you can receive both benefits on your spouse's earnings record and your own retirement payment. The maximum amount is between 150 percent and 188 percent of the worker’s monthly. Web married couples may have some advantages when deciding how and when to claim social security. Determining when to start your social security benefits is a personal decision.. If i claim early retirement benefits, do my spouse's benefits get penalized. Web social security will not pay the sum of your retirement and spousal benefits; Even though the basic rules apply to everyone, a couple has more options than a single person because each member of a couple 1 can claim at different dates and may be eligible for. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. You’ll get a payment equal to the higher of the two benefits. Web social security will not pay the sum of your retirement and spousal benefits; Web it is likely that both you and your spouse have earned enough social. Web can i collect social security spousal benefits? Web the maximum monthly social security retirement benefit for a married couple is $9,110 in 2023 and $9,746 in 2024 if each spouse waits until age 70 to receive benefits and paid the maximum. In some cases, it makes sense for both spouses to claim on the same spouse's earnings record. If. If i claim early retirement benefits, do my spouse's benefits get penalized. Yes, you can collect social security's on a spouse's earnings record. Can children still collect survivor benefits in college? A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. The math can be a little bit complex. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. Web technically, yes, you can receive both benefits on your spouse's earnings record and your own retirement payment. If your spouse is already getting social security when you claim benefits, you are subject to the “deemed filing” rule. Web the maximum monthly social security retirement benefit for a married couple is $9,110 in 2023 and $9,746 in 2024 if each spouse waits until age 70 to receive benefits and paid the maximum. Web one payment does not offset or affect the other. Web march 28, 2024, at 2:35 p.m. If your spouse’s full retirement age benefit amounts to $2,000 per month, your spousal benefit at your full retirement age could amount to $1,000 per month. Web when can my spouse get social security benefits on my record? Web a spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. Even though the basic rules apply to everyone, a couple has more options than a single person because each member of a couple 1 can claim at different dates and may be eligible for spousal benefits. Web the bipartisan budget act of 2015 made some changes to social security’s laws about filing for retirement and spousal benefits.Social Security Benefits For Spouses

When is it best to begin drawing Social Security Benefits?

Collecting Social Security Benefits As A Spouse

Social Security Spousal Benefits The Complete Guide Social Security

What’s The Right Age To Start Drawing Social Security? To Our

How To Apply For Social Security Spousal Death Benefits

3 Most Important Things to Know About the Social Security Surviving

Can My Wife Draw Her Social Security While I Work for the Railroad

How is Social Security calculated? SimplyWise

Can I Draw Social Security from My Husband's Social Security Disability?

Web With Just A Little Planning, You And Your Spouse Can Make The Most Of Your Social Security Benefits.

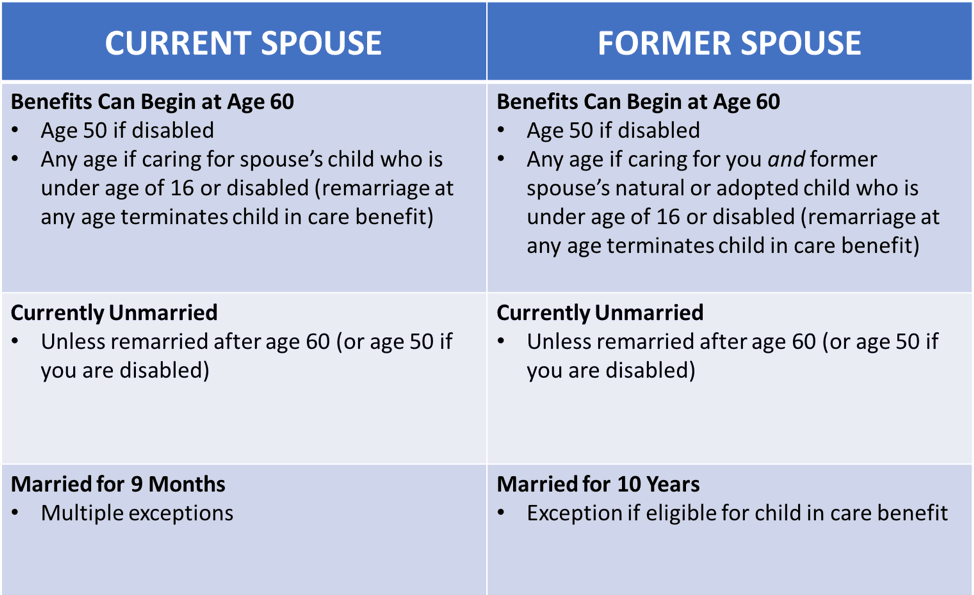

Second, Her Marriage To The Ex Must.

If The Number Of Months Exceeds 36, Then The Benefit Is Further Reduced 5/12.

Web It Is Likely That Both You And Your Spouse Have Earned Enough Social Security Credits To Be Eligible For Your Own Benefits After Retirement.

Related Post: