At What Age Do You Have To Draw From 401K

At What Age Do You Have To Draw From 401K - These withdrawals are called required minimum distributions (rmds). 1 if you will turn 72 after jan. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Web first, let’s recap: For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death. This calculator has been updated for the 'secure act of 2019 and cares. Participants in a traditional 401 (k) plan are not allowed to withdraw their funds until they reach age 59½, with the exception of withdrawing funds to cover some hardships or life. You can't take loans from old 401(k) accounts. Web generally, if you are age 73, you've reached the age where the irs mandates you start taking withdrawals from most qualified retirement accounts, such as iras and 401(k)s (but not roth iras). Reach age 72 (73 if you reach age 72 after dec. When it comes to when you can withdraw 401(k) funds, age 59½ is the magic. Participants in a traditional 401 (k) plan are not allowed to withdraw their funds until they reach age 59½, with the exception of withdrawing funds to cover some hardships or life. Web with a roth 401(k), you don’t have to worry about paying taxes when. Web first, let’s recap: Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at age 73. How old will you be at the end of this year? Web with both a 401 (k) and a traditional ira, you will be. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill once they're added to. Periodic, such as annuity or installment payments. The distributions are required to start when you turn age 72 (or 70 1/2 if you were. Irs rmd comparison chart (iras vs defined contribution plans (e.g., 401 (k), profit sharing, and 403 (b) plans)) irs publication 575 (pension and annuity income) (discusses distributions from defined contribution plans) You can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income. Depending on the terms of the plan, distributions may be: Web you reach age 59½ or experience a financial hardship. Web with a roth 401(k), you don’t have to worry about paying taxes when it’s time to withdraw funds from the account. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. 401 (k) withdrawals before age 59½. Web required minimum distributions, or rmds, are minimum amounts that many retirement plan and ira account owners must generally withdraw annually after they reach age 72. Web first, let’s recap: Generally,. Web there is no way to take a distribution from a 401 (k) without owing income taxes at the rate you’re paying the year you take the distribution. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. When it comes to when you can withdraw 401(k) funds, age 59½ is the magic. Web there is no way to take a distribution from a 401 (k) without owing income taxes at the. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. You can't take loans from old 401(k) accounts. For instance, your age affects when you may: Periodic, such as annuity or. Periodic, such as annuity or installment payments. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill once they're added to. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Depending on the terms of the plan, distributions may be: 1, 2023, you do not have to start taking rmds until age 73. Web required minimum distributions, or rmds, are minimum amounts that many retirement plan and ira account owners must generally withdraw annually after they reach age 72. 401 (k) withdrawals before age 59½. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web you reach age 59½ or experience a financial hardship. This calculator has been updated for the 'secure act of 2019 and cares. Participants in a traditional 401 (k) plan are not allowed to withdraw their funds until they reach age 59½, with the exception of withdrawing funds to cover some hardships or life. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Retire (if your plan allows this).:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

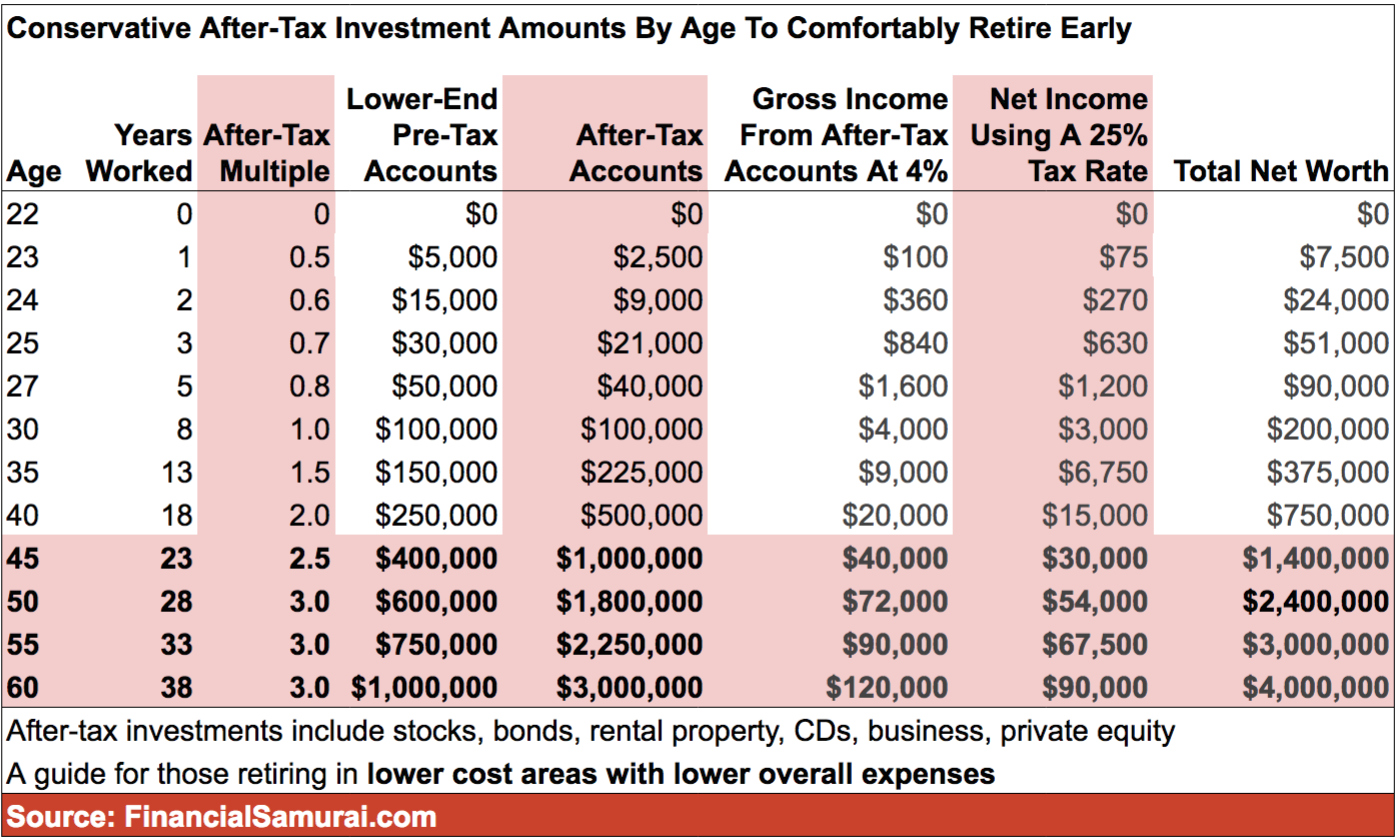

20 Best Retirement Savings By Age Chart

How Much Should I Have in My 401k During My 20's, 30's, 40's and 50's

Why The Median 401(k) Retirement Balance By Age Is So Low

The Average And Median 401(k) Account Balance By Age

Important ages for retirement savings, benefits and withdrawals 401k

401k By Age Are You Saving Enough For Retirement?

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

401k Savings By Age How Much Should You Save For Retirement

at what age do you have to take minimum distribution from a 401k Hoag

Your Plan Administrator Will Let You Know Whether They Allow An Exception To The Required Minimum Distribution Rules If You're Still Working At Age 72.

Web With A Roth 401(K), You Don’t Have To Worry About Paying Taxes When It’s Time To Withdraw Funds From The Account.

Web With Both A 401 (K) And A Traditional Ira, You Will Be Required To Take Minimum Distributions Starting At Age 73 Or 75, Depending On The Year You Were Born.

How Old Will You Be At The End Of This Year?

Related Post: