At What Age Can You Start Drawing Your 401K

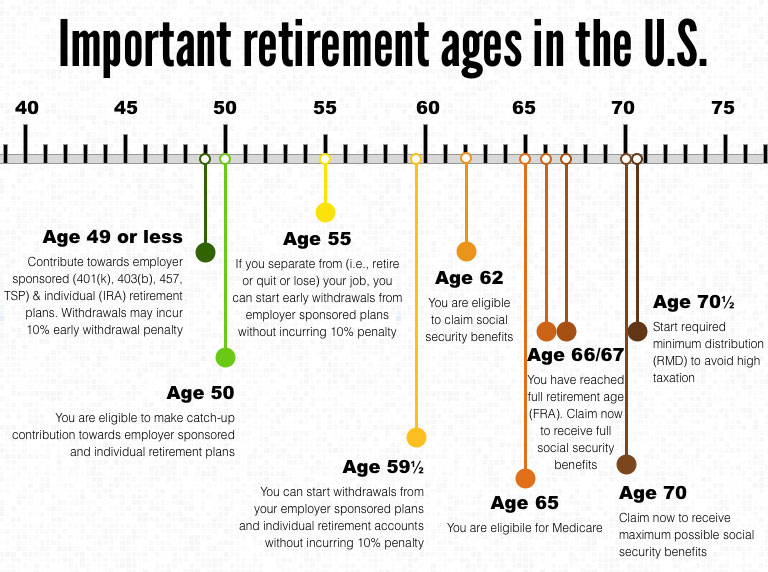

At What Age Can You Start Drawing Your 401K - 1, 2023, you do not have to start taking rmds until age 73. Web updated on october 25, 2021. Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age 73, or age 70½ if you reached that age by jan. Web updated on february 15, 2024. You generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at age 73. Terminate service with the employer. 1 if you will turn 72 after jan. You’re not age 55 yet. When can a retirement plan distribute benefits? Taking an early withdrawal from your 401 (k) should only be done as a last resort. Have left your employer voluntarily or involuntarily in the year. Web it depends on your age. The internal revenue service (irs) has set the standard retirement. Terminate service with the employer. You’re not age 55 yet. Complete 10 years of plan participation; Basics of 401 (k) distributions. Web 401 (k) accounts have very generous contribution limits, much higher than those of iras. Web you generally have to start taking withdrawals from your ira, simple ira, sep ira, or retirement plan account when you reach age 72 (73 if you reach age. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a. It’s important, though, that you plan the timing of those withdrawals effectively. But 401 (k)s also have much more limited investment options than iras and regular brokerage. Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: It’s important, though, that you plan the timing of those withdrawals effectively. A penalty tax usually applies to any withdrawals taken before age 59 ½. Web the median 401 (k) balance for americans ages 40. Web to use the rule of 55, you’ll need to: Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Web you generally have to start taking withdrawals from your ira, simple ira, sep ira, or retirement. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web generally, if you are age 73, you've reached the age where the irs mandates you start taking withdrawals from most qualified retirement accounts, such as. The internal revenue service (irs) has set the standard retirement. You’re not age 55 yet. Turn 65 (or the plan’s normal retirement age, if earlier); However, beneficiaries of a roth ira are subject to the rmd rules. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. To start taking these withdrawals, you’ll just have to prove that you qualify for the plan administrator. Terminate service with the employer. Complete 10 years of plan participation; 1, 2023, you do not have to start taking rmds until age 73. Web generally, if you are age 73, you've reached the age where the irs mandates you start taking withdrawals. Make adjustments to that percentage depending on your circumstances. Web the rule of 55 doesn't apply if you left your job at, say, age 53. Web if you meet the requirements for all of these rules then the rule of 55 might be a good fit for you to avoid paying the early withdrawal penalty. Web understanding early withdrawals. You. Make adjustments to that percentage depending on your circumstances. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. Web another rule is that, after age 70.5 or 72, depending on when they were born, retirees must start taking mandatory minimum distributions from their 401 (k) plans every year. Edited by jeff white,. Complete 10 years of plan participation; Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: Web updated on february 15, 2024. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. Taking an early withdrawal from your 401 (k) should only be done as a last resort. 1 if you will turn 72 after jan. Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at age 73. Web another rule is that, after age 70.5 or 72, depending on when they were born, retirees must start taking mandatory minimum distributions from their 401 (k) plans every year. Web it depends on your age. You can't start taking distributions from your 401 (k) and avoid the early withdrawal penalty once you reach 55. Make adjustments to that percentage depending on your circumstances. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web to use the rule of 55, you’ll need to: Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. Note that the secure 2.0 act raised the age. However, beneficiaries of a roth ira are subject to the rmd rules.:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

Social Security Age Chart When to Start Drawing Bene... Ticker Tape

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

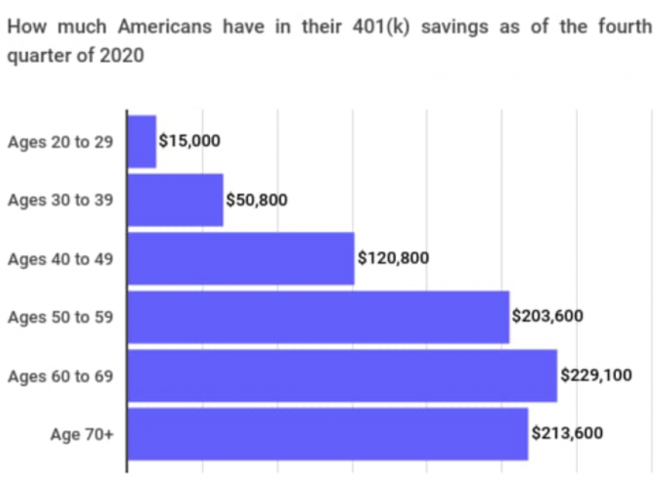

401k Savings By Age How Much Should You Save For Retirement

Important ages for retirement savings, benefits and withdrawals 401k

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

401k By Age PreTax Savings Goals For Retirement Financial Samurai

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

The Average And Median 401(k) Account Balance By Age

12 of the Most Common Employee 401(k) Questions, Answered Gusto

Terminate Service With The Employer.

Web Generally, If You Are Age 73, You've Reached The Age Where The Irs Mandates You Start Taking Withdrawals From Most Qualified Retirement Accounts, Such As Iras And 401 (K)S (But Not Roth Iras).

Web It's Important To Consider How 401 (K) Withdrawals, Which Are Required After Age 73 (Or, If You Turn 74 After December 31, 2032, It's Age 75), May Affect Your Tax Bill Once They're Added.

Roth Iras Do Not Require Withdrawals Until After The Death Of The Owner;

Related Post: