At What Age Can You Start Drawing From Your 401K

At What Age Can You Start Drawing From Your 401K - Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. Some reasons for taking an early 401. It depends on your age. You can't take loans from old 401(k) accounts. And you’ll have to pay taxes on the rmd amounts in the year they are taken. Web recipients who retire at 62 but draw $1,900 a month from their 401(k)s would use up $23,000 in 401(k) savings for each year they delayed claiming social security. Web the rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401 (k)s without incurring the customary 10% penalty for early withdrawals made before age. For 2024, you can stash away up to $23,000 in your. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. This is known as the rule of 55. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Some reasons for taking an early 401. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10%. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill once they're added. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax,. Another rule is that, after age 70.5 or 72, depending on when they were born, retirees must start taking mandatory minimum distributions from their 401 (k) plans every year. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web as a general rule, if. Web at any age, retirees owe federal income taxes on distributions from regular 401 (k) accounts, although roth 401 (k) distributions escape taxation. Keep these ages in mind to boost your retirement benefits and avoid penalties. And hundreds of thousands, if not millions, of us actually have accounts. Millions of us have 401 (k) accounts, sponsored by our employers or. This is known as the rule of 55. Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: A penalty tax usually applies to. Web once you reach age 72, you have to start taking required minimum distributions (rmds). You’re not age 55 yet. Some reasons for taking an early 401. Millions of us have 401 (k) accounts, sponsored by our employers or former employers. And defined benefit plans, the first rmd is due by april 1 of the later of the year they reach age 72, or the participant is no longer employed (if allowed by the plan). Web one exception to the. 10 important ages for retirement planning. You’re not age 55 yet. In 401 (k), 403 (b) and 457 (b) plans; If you’re contemplating early retirement, you should know how the rule of 55 works. Web recipients who retire at 62 but draw $1,900 a month from their 401(k)s would use up $23,000 in 401(k) savings for each year they delayed. And you’ll have to pay taxes on the rmd amounts in the year they are taken. Web recipients who retire at 62 but draw $1,900 a month from their 401(k)s would use up $23,000 in 401(k) savings for each year they delayed claiming social security. And defined benefit plans, the first rmd is due by april 1 of the later. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill once they're added. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Web once you reach age. Note that the secure 2.0 act raised the age. Web in that scenario, let’s say your salary is $100,000 and your employer matches 50% of the first 6% you contribute to your 401(k). Web at any age, retirees owe federal income taxes on distributions from regular 401 (k) accounts, although roth 401 (k) distributions escape taxation. Web you can make. If you contribute up to the matching amount, you get the full. And defined benefit plans, the first rmd is due by april 1 of the later of the year they reach age 72, or the participant is no longer employed (if allowed by the plan). Web some of them might surprise you. Some reasons for taking an early 401. And you’ll have to pay taxes on the rmd amounts in the year they are taken. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Web the rule of 55 is an irs regulation that allows certain older americans to withdraw money from their 401 (k)s without incurring the customary 10% penalty for early withdrawals made before age. You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. Updated on october 25, 2021. Web essentially, a 401 (k) is a retirement savings plan that lets you funnel part of your paycheck into the account before taxes are taken out. Millions of us have 401 (k) accounts, sponsored by our employers or former employers. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age 73, or age 70½ if you reached that age by jan. For 2024, you can stash away up to $23,000 in your. Terminate service with the employer. Note that the secure 2.0 act raised the age.

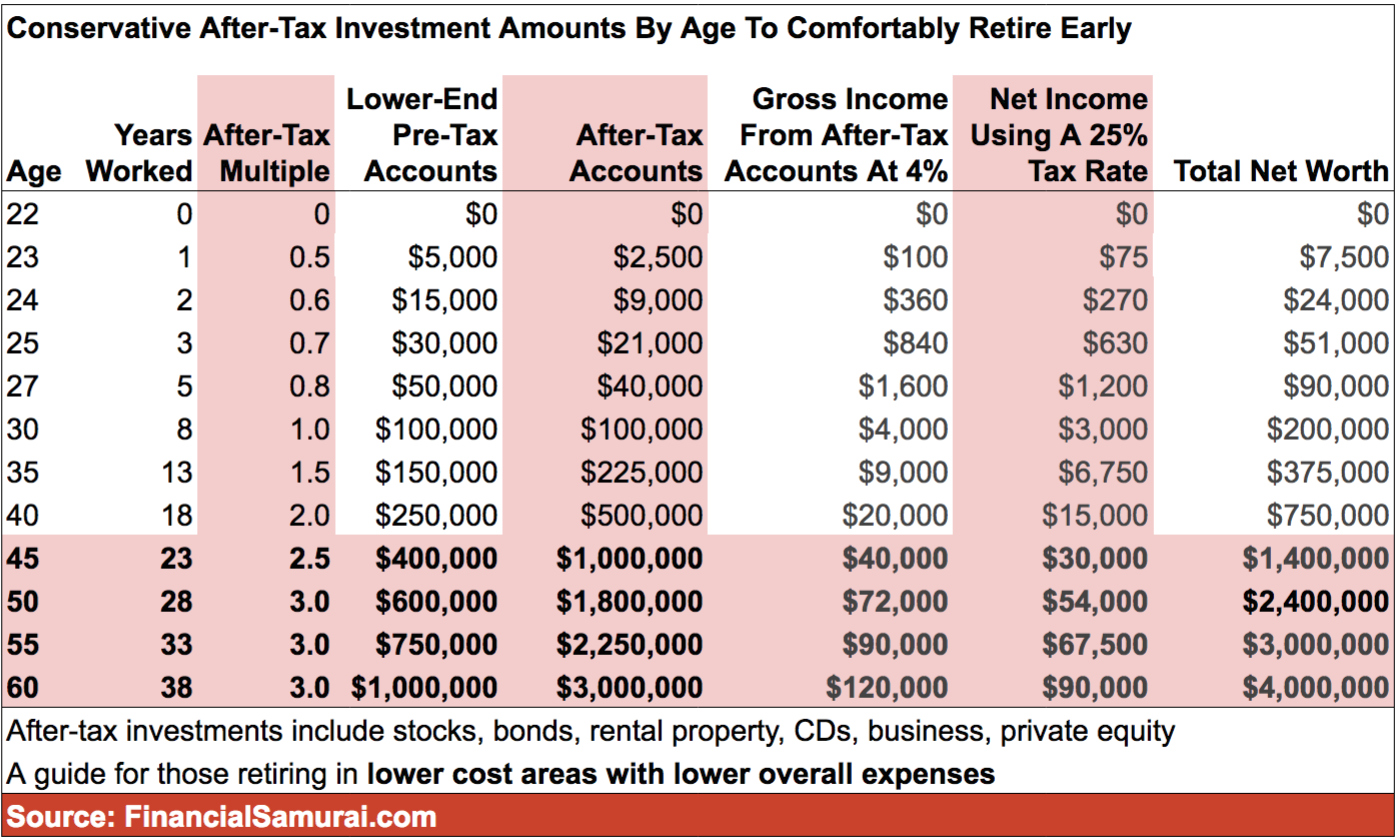

401k By Age PreTax Savings Goals For Retirement Financial Samurai

401k Savings By Age How Much Should You Save For Retirement

12 of the Most Common Employee 401(k) Questions, Answered Gusto

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is a 401(k) and How Does It Work?

Social Security Age Chart When to Start Drawing Bene... Ticker Tape

Important ages for retirement savings, benefits and withdrawals 401k

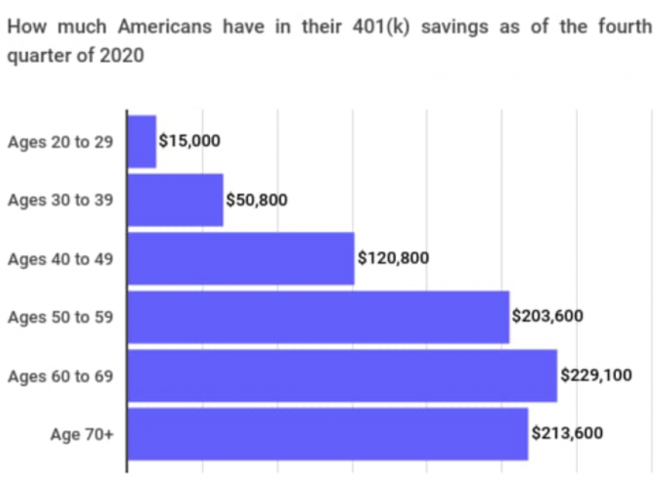

The Average And Median 401(k) Account Balance By Age

401k By Age Are You Saving Enough For Retirement?

Why The Median 401(k) Retirement Balance By Age Is So Low

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

In 401 (K), 403 (B) And 457 (B) Plans;

If You’re Contemplating Early Retirement, You Should Know How The Rule Of 55 Works.

10 Important Ages For Retirement Planning.

Since Both Accounts Have Annual Contribution Limits And Potentially Different Tax Benefits.

Related Post: