At What Age Can You Draw From Ira Without Penalty

At What Age Can You Draw From Ira Without Penalty - You can even owe an additional penalty if. Web updated april 1, 2024. Web you can take money without penalty from a traditional ira once you reach age 59 1/2, and you must begin taking money out of an ira at age 70 1/2 according to a. If you transfer your traditional or roth ira at any age and request that. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your. Web in the case of both a traditional and roth ira, you can start withdrawing funds (or in official terms, take distributions) after you reach age 59½. Web are you over age 59 ½ and want to withdraw? In other cases, you owe income tax on the money you withdraw. Web what if i withdraw money from my ira? In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your. If you transfer your traditional or roth ira at any age and request that. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or. Web. But you'll still owe the income tax if it's a traditional ira. Generally you’ll owe income taxes and a. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira,. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or. In other cases, you owe income tax on the money. Web nerdwallet advisory llc. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. Web there are certain. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web nerdwallet advisory llc. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. Wide array of investmentssave on taxeslow or no. Web you have to pay a 10% additional tax on the taxable amount you withdraw from your simple ira if you are under age 59½ when you withdraw the money unless you. Web withdraw funds before this age, and you're looking at a combination of federal income tax and a possible 10% penalty on your withdrawal. Web above all, remember. Web as with traditional iras, older individuals are allowed to contribute an extra $1,000 per person to their hsas once they reach age 55. If you're younger than 59½ and the account is less than 5 years old. If you're 59 ½ or older you're usually all clear. Web are you over age 59 ½ and want to withdraw? Web. In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your. Roth iras work in almost the exact opposite fashion of traditional iras in terms of the tax and penalty rules surrounding account withdrawals. Web above all, remember that you can divide your $25,000, perhaps maxing out your ira account first and then distributing the remainder across. Web above all, remember that you can divide your $25,000, perhaps maxing out your ira account first and then distributing the remainder across your 401(k) and. But if you're younger than that, you will get hit with a penalty for early withdrawals from traditional. Web nerdwallet advisory llc. You can even owe an additional penalty if. Web withdrawals must be. Web are you over age 59 ½ and want to withdraw? But if you're younger than that, you will get hit with a penalty for early withdrawals from traditional. Web above all, remember that you can divide your $25,000, perhaps maxing out your ira account first and then distributing the remainder across your 401(k) and. In other cases, you owe. But it's still critical to know how your withdrawal may be taxed. In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your. Web unfortunately, the u.s. There is no need to show a hardship to take a distribution. Web in the case of both a traditional and roth ira, you can start withdrawing funds (or in official terms, take distributions) after you reach age 59½. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. However, some early distributions qualify for a waiver of. Web if you're 59 ½ or older: Web nerdwallet advisory llc. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Web you can take money without penalty from a traditional ira once you reach age 59 1/2, and you must begin taking money out of an ira at age 70 1/2 according to a. But if you're younger than that, you will get hit with a penalty for early withdrawals from traditional. Web withdrawals must be taken after age 59½. Government imposes a 10 percent penalty on any withdrawals before age 59 1/2. If you're 59 ½ or older you're usually all clear. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties.

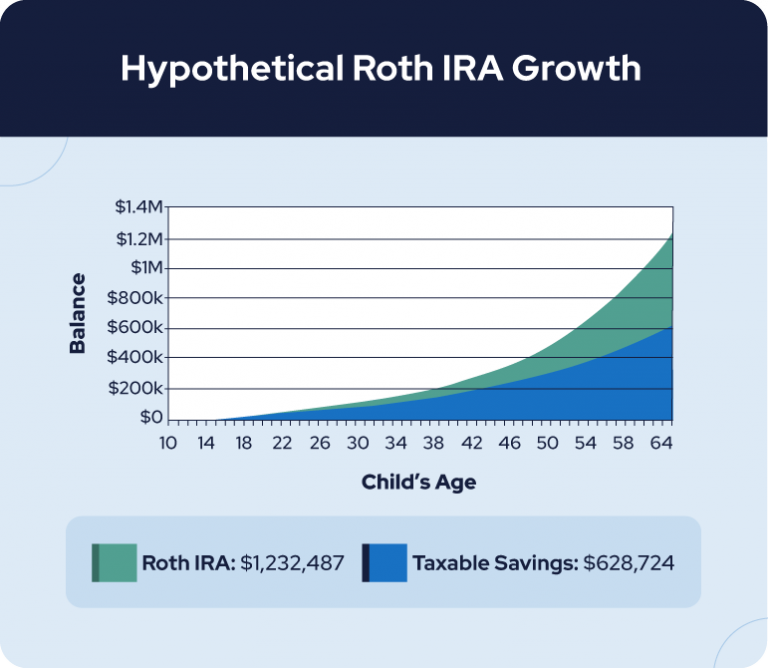

Roth IRA For Kids Make Your Grandchildren Millionaires RetireGuide

Roth IRA Withdrawal Rules and Penalties First Finance News

Important ages for retirement savings, benefits and withdrawals 401k

Roth IRA Withdrawal Rules and Penalties First Finance News

72(t) Distribution An Option to Take Early Withdrawals From an IRA

How to Make a Penalty Free IRA Withdrawal 2020 3 CARES Act Rules

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits

Retire Early AND Withdraw From Your IRA Penalty Free! YouTube

11Step Guide To IRA Distributions Ira, Step guide, Money matters

How to Move 401k to Gold IRA Without Penalty — The Complete Guide by

If You Transfer Your Traditional Or Roth Ira At Any Age And Request That.

Generally You’ll Owe Income Taxes And A.

Generally, Early Withdrawal From An Individual Retirement Account (Ira) Prior To Age 59½ Is Subject To Being Included In.

Web Are You Over Age 59 ½ And Want To Withdraw?

Related Post: