At What Age Can I Draw My 401K

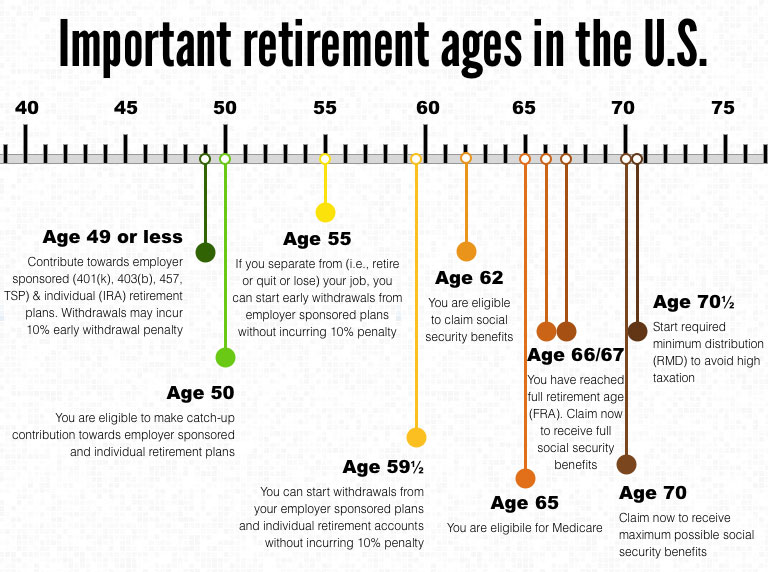

At What Age Can I Draw My 401K - There is a 10% penalty for pulling money from your 401(k) before age 59½ (with some exceptions. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. You can access funds from an old 401(k) plan after you reach age 59½ even if you haven't yet retired. Written by javier simon, cepf®. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. In most, but not all, circumstances, this triggers an early withdrawal penalty of. Web be at least age 55 or older. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web those limits are up from tax year 2023. Web first, let’s recap: If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). The best idea for 401(k) accounts from a previous employer is to roll them over when you leave a job. You can. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. This is where the rule of 55 comes in. If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider. Web the median 401 (k) balance for americans. Web you can start receiving your social security retirement benefits as early as age 62. Taking an early withdrawal from your 401 (k) should only be done as a last resort. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. A 401 (k) early withdrawal is any money you take out from your. Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age 73, or age 70½ if you reached that age by jan. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web it expects to. This is where the rule of 55 comes in. However, early withdrawals often come with hefty penalties and tax consequences. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. Web for most people, full retirement age — the age at which they’re entitled to 100% of their social security retirement benefits — is. The best idea for 401(k) accounts from a previous employer is to roll them over when you leave a job. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a severance from employment, your 401(k) plan is terminated or you experience financial hardship. If you find yourself needing to tap into your retirement. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. This is known as the rule of 55. Web first, let’s recap: If you delay taking your benefits from your full retirement age. Web to qualify for the rule of 55, withdrawals must be made in the year that an employee turns 55 (or older) and leaves their employer, either to retire early or for any other reason. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. The best idea for 401(k). Web you can start receiving your social security retirement benefits as early as age 62. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider. Note that the secure 2.0 act raised. Written by javier simon, cepf®. Note that the secure 2.0 act raised the age. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. If you’re contemplating early retirement, you should know how the rule of 55 works. However, you are entitled to full benefits when you. There is a 10% penalty for pulling money from your 401(k) before age 59½ (with some exceptions. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. Researchers found that although it's the least popular time to file (with only 4% of retirees filing at that age), around 57% of the study participants could have earned more over a. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Web understanding early withdrawals. Web if you retire or are laid off in the calendar year you turn 55 or later—or the year you turn 50 if you’re a public service employee—you can withdraw funds from your current 403 (b) or 401 (k). But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. Note that the secure 2.0 act raised the age. Edited by jeff white, cepf®. This is where the rule of 55 comes in. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Web updated on february 15, 2024. Web it expects to report to congress with recommendations by the end of 2025, ms. Web whether you use the 4% rule or not, the less you withdraw, the longer your retirement will last. Taking an early withdrawal from your 401 (k) should only be done as a last resort. You can access funds from an old 401(k) plan after you reach age 59½ even if you haven't yet retired.

at what age do you have to take minimum distribution from a 401k Hoag

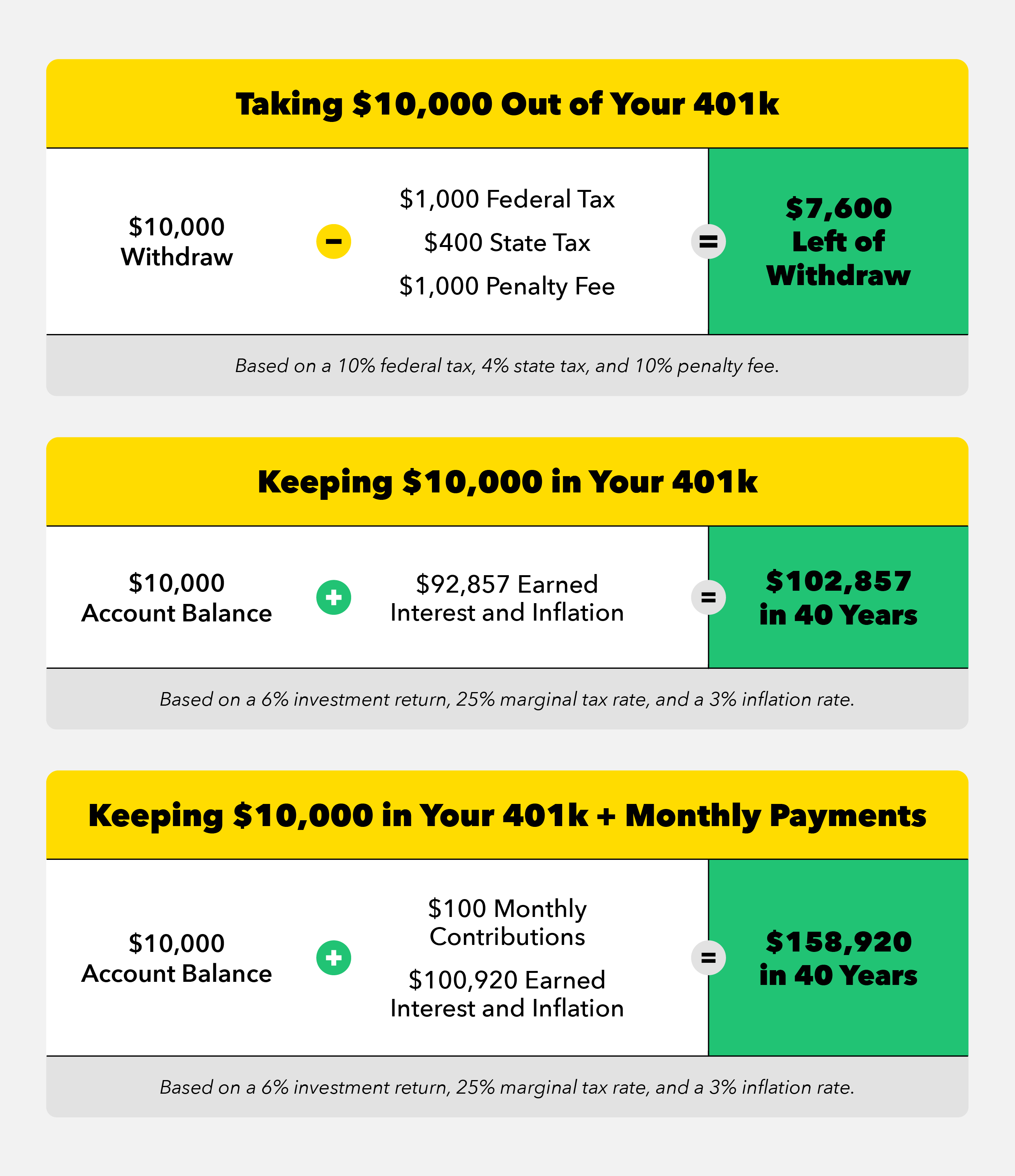

Should I Cash Out My 401k to Pay Off Debt?

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

Roth 401k calculator with match ChienSelasi

How Much Should I Have Saved In My 401k By Age?

Important ages for retirement savings, benefits and withdrawals 401k

Why The Median 401(k) Retirement Balance By Age Is So Low

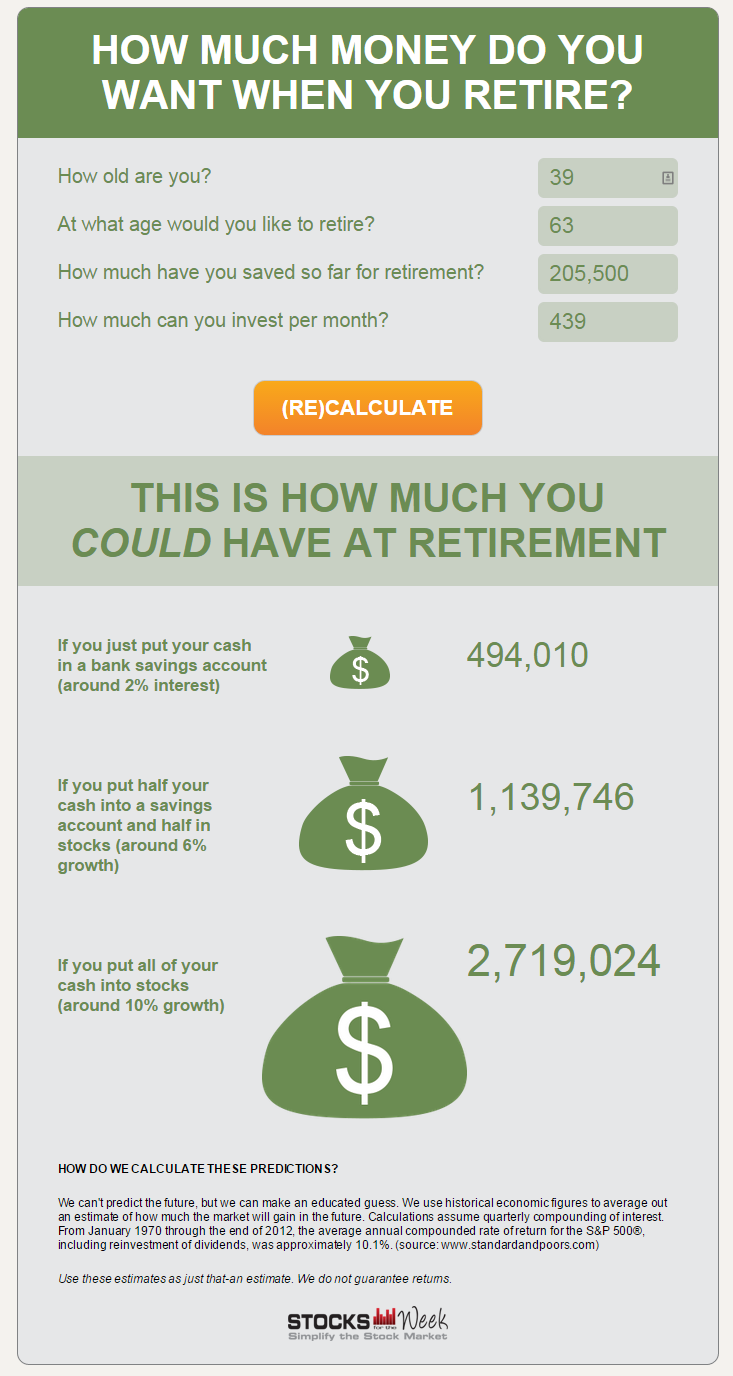

How to Estimate How Much Your 401k will be Worth at Retirement

What is the Average 401k Balance by Age? (See How You Compare) Dollar

401k Savings By Age How Much Should You Save For Retirement

Web Yes, You Can Withdraw Money From Your 401 (K) Before Age 59½.

Have A 401 (K) Or 403 (B) That Allows Rule Of 55 Withdrawals.

Web Age 59½ Is The Earliest You Can Withdraw Funds From An Ira Account And Pay No Penalty.

Web Those Limits Are Up From Tax Year 2023.

Related Post: